425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on December 20, 2022

Filed by Rice Acquisition Corp. II pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Rice Acquisition Corp. II (File No. 001-40503)

On December 20, 2022, Rice Acquisition Corp. II (“RONI”) posted the following articles on its corporate website.

Rice Acquisition Corp. II sees future of natural gas in $1.4B deal

Daniel Rice IV.

Stew Milne

By Paul J. Gough – Reporter, Pittsburgh Business Times

Dec 14, 2022

Listen to this article 4 min

Rice Acquisition II’s $1.4 billion special acquisition corporation acquisition of NET Power technology is a bet on the smaller firm’s technology to find a lower-cost place in the energy transition for natural gas as well as another use case for carbon capture and storage.

Natural gas is plentiful in the Marcellus and Utica shales, among other parts of the United States. But it’s also emissions intensive and the current solutions in the power industry — where natural gas is a major contributor to the electricity grid — doesn’t have an easy or cheap solution to capturing the carbon emissions that result from creating electricity.

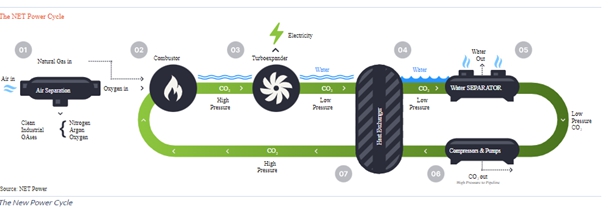

Enter NET Power, which was formed in 2010 with a technology that would create electricity at utility scale while at the same time capturing the carbon dioxide created during the power generation process. The technology, known as oxy-combustion, would create 300 megawatts of electricity from 50 million cubic feet of natural gas as well as water and, according to NET Power, 820,000 tons of carbon dioxide that could be used for other industries or, more than likely, permanently stored underground. It’s funded by a number of heavy hitters in the energy industry, including power generator Constellation and shale companies Occidental and Baker Hughes.

NET Power caught the eye of Rice Acquisition II (NYSE: RONI), the Rice family’s second energy-transition and natural gas-focused SPAC in a little more than two years, leading to Wednesday’s deal. It’s expected to close in the second quarter of 2023.

Daniel J. Rice IV, the former Rice Energy CEO, said NET Power’s technology combined with plentiful natural gas — and the impact of the Inflation Reduction Act’s tax breaks — makes for a lower cost of electricity moving forward than either coal-fired power plants or traditional natural gas-fueled power plants.

“Net Power’s technology enables the U.S. energy industry to take a leading role in reducing global emissions by expanding domestic and global access to low-cost, reliable, and clean energy,” Rice said during an investor presentation Wednesday after the deal was announced.

NET Power’s outgoing CEO, Ron DeGregorio, a former president of Constellation predecessor Exelon, agrees.

“If you can use natural gas to reliably generate electricity, while capturing all emissions, you can change the world,” he said. “I believe NET Power is on the cusp of achieving this vision.”

NET Power, which will be led by Rice as CEO after the deal is done, foresees commercial operations in either 2026 or 2027. It has a demonstration project, known as La Porte, in Texas. It also has other projects in the works. The future won’t be building its own plants but instead licensing at other plants that will be built in the future that use NET Power’s technology, with about $65 million in licensing fees per utility-scale plant, according to the investor presentation. There could be as many as 1,000 plants built with NET Power technology over the course of the next decades as older coal-fired and natural-gas power plants are retired; they make about 25% of all global emissions of carbon dioxide.

“This is one of the many reasons why we’re really excited about NET Power,” Rice said. “It has the potential to be the single most impactful solution to curbing global emissions.”

Rice is in a choice position to lead the organization. He and his brothers, including EQT CEO Toby Rice, founded Marcellus Shale pioneer driller Rice Energy in the Pittsburgh region before it was acquired by EQT in 2017. Rice also sold off Archaea Energy, which was acquired in a SPAC merger with Rice Acquisition Corp. I, in October for a $4 billion price tag to BP.

“We know natural gas and all parts of the value chain, but most importantly, we understand the critical role that U.S. gas serves domestically and abroad; we believe NET Power could be the world’s most important clean energy solution and I have a deep sense of responsibility to help in any way possible to deliver it to the world,” Rice said.

And the Rice family also announced a $100 million investment in NET Power, which will be matched by a $100 million investment by Occidental as well, and NET Power’s other owners including Baker Hughes and Constellation will also be working to commercialize.

© 2022 American City Business Journals. All rights reserved. Use of and/or registration on any portion of this site constitutes acceptance of our User Agreement (updated January 1, 2021) and Privacy Policy and Cookie Statement (updated July 1, 2022). The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of American City Business Journals.

* * * * *

2

Q&A

Gas Industry Vet Touts NET Power's Decarbonization Potential

Copyright © 2022 Energy Intelligence Group

Rice Acquisition II, a blank-check firm formed last year by natural gas veteran Danny Rice and his family, said this week it would acquire and take public technology player NET Power. Rice has considerable experience in growing start-ups, including with his own company, the Marcellus-focused Rice Energy, which went public in 2014 and was acquired by EQT in 2017. He also led Rice Acquisition I’s purchase last year of renewable natural gas (RNG) player Archaea Energy, which was recently acquired by BP. Rice, who will serve as NET Power’s CEO, spoke with Energy Intelligence about the acquisition, decarbonizing the gas grid, and the market for low-carbon gas.

Q: Last year, when you were talking about potential targets for Rice Acquisition II, you said something along the lines of ‘there are great technologies out there that don’t involve EVs or batteries, but they do involve decarbonizing the grid.’ Which really describes what NET Power is doing. So was that a target for a while?

A: We’ve been following the NET Power story for almost the entirety of its existence. So we were up in Appalachia in the mid-2000s, late 2000s, doing Rice Energy, and we went public in 2014. And that was around the time that the 8 Rivers team spun NET Power off into its own standalone company. And so from afar, we were saying, ‘All right, we've been able to really unlock a massive amount of low-cost, reliable natural gas.’ And I think in the back of our heads, we were always thinking, wouldn't it be nice if somebody could figure out a way to, in a really cost-effective way, totally decarbonize it and really make natural gas the no brainer solution for the planet, for consumers, for everybody.

And so I think it was more of just the stars sort of aligned with us being in the market with Rice Acquisition Corp II.

With NET Power, we have this massive appreciation of how low-cost and reliable natural gas is as a feedstock to power generation. The big question mark with natural gas is, how do you make it clean? And the NET Power guys, to their credit, a long time ago said we need to figure out a way to make natural gas low-to no-emissions in the power generation cycle. And so the coming together of the two companies, from my perspective, has kind of been 10 years in the making, even though we only reached out to them to possibly inquire about taking them public within the last 12 months.

Q: In the US alone, you've targeted about 1,000 plants in the total addressable market. So are those going to be new plants? Are those coal replacements? Are they both?

A: It'll be both. In the United States, we'll definitely be looking to replace these aging coal and gas plants. A lot of those plants aren't baseload power anymore. They've been relegated to peaker status. So those become fantastic candidates to replace with NET Power and then get back to 90%-100% baseload. So they're running all the time, as they should be if there's zero carbon emission, and it's 24/7 reliable power, and it's low cost. But that's just kind of meeting current demand. I think if you look at electrification trends here in the United States, I think there's a 50% increase in electricity growth, just demand growth over the next 30 years. So there's the massive growth in new electricity demand coming. And so it's really important that we have a very reliable, low cost and clean grid to meet that new demand as it moves from petroleum to power.

3

Q: So how do you actually go about addressing that market? How do you expect to capture that?

A: I think it's a couple of ways because I think if you look at potential builders and owners of a NET Power plant, it varies. It could be a traditional utility that wants to build a NET Power plant into their rate base. It could be an independent power producer that sees attractive power prices in certain markets that are really, really close to sequestration sites, that say this is a no-brainer to put this plant here and just dispatch power into this power market. And then there's also going to be folks with behind-the-meter solutions that have really large industrial complexes that say, ‘I need baseload power, but I also have an obligation to reduce my carbon intensity in my base business.’ And so when those companies take a look around and say, ‘show me a clean, reliable, low-cost source of power for my business right now,’ there's no one single solution to be able to do that. And so we see a tremendous amount of opportunity there as well. And I think in those sorts of applications, Baker Hughes is going to be really helpful in being able to penetrate those markets. But I think a lot of it is going to be folks reaching out to us. And I think that's been like the most incredible thing is the company really hasn't spent any time on the commercialization, they've really just been head down focusing on proving the technology for the last decade. And us taking the company public is really this inflection point of going from proving the technology to now commercializing the technology.

Q: Looking at your background with Archaea Energy, can we expect at some point to see a renewable natural gas (RNG) NET Power plant?

A: Yeah, I mean, that’s the beauty of natural gas. We have this intricate pipeline network that we have here in the United States. You can deliver gas from the Marcellus to a power plant in California, and it can be a NET Power plant in California to use that gas. So you can take responsibly sourced gas and ship it by pipeline anywhere. The same goes with RNG. You put that gas into the pipeline, it's fungible. And so you're really taking it by displacement at the final location where it's going to be converted into power. And so I think, as you look at the carbon intensity of that power generation, yes, sticking RNG into a NET Power plant is probably the most environmentally beneficial source of power we have on this planet. So that's part of the appeal of NET Power; you can put these plants anywhere there's a grid and you really just need a sequestration site, and you just need access to natural gas. And fortunately, this country is blessed with both of those. We have lots of natural gas pipelines connected everywhere in the country. And we also have an abundance of downhole pore space capacity to permanently sequester the CO2. That's the other part that’s so exciting, the sequestration opportunity here.

* * * * *

4

Important Information about the Business Combination and Where to Find It

This communication relates to a proposed business combination transaction (the “Business Combination”) involving NET Power, LLC (“NET Power”) and RONI. In connection with the Business Combination, RONI intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a proxy statement and prospectus (the “Proxy Statement/Prospectus”). This communication is not a substitute for the Proxy Statement/Prospectus. The definitive Proxy Statement/Prospectus (if and when available) will be delivered to RONI’s shareholders. RONI may also file other relevant documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SECURITY HOLDERS OF RONI AND OTHER INTERESTED PARTIES ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RONI, NET POWER, THE BUSINESS COMBINATION AND RELATED MATTERS.

Investors and security holders of RONI may obtain free copies of the Proxy Statement/Prospectus, when available, and other documents that are filed or will be filed with the SEC by RONI through the website maintained by the SEC at www.sec.gov or at RONI’s website at www.ricespac.com/rac-ii.

Forward-Looking Statements

This communication may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the combined company and the proposed transaction between NET Power and RONI. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties.

5

Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) conditions to the completion of the proposed business combination and PIPE investment, including shareholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement between the parties or the termination of any PIPE investor’s subscription agreement; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations; (vi) potential litigation that may be instituted against RONI or NET Power or their respective directors or officers related to the proposed transaction or the business combination agreement or in relation to NET Power’s business; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power or the combined company; (ix) NET Power’s history of significant losses; (x) the combined company’s ability to manage future growth effectively; (xi) the combined company’s ability to utilize its net operating loss and tax credit carryforwards effectively; (xii) NET Power’s ability to continue as a going concern if the transactions contemplated herein are not completed; (xiii) the capital-intensive nature of NET Power’s business model, which may require the combined company to raise additional capital in the future; (xiv) barriers the combined company may face in its attempts to deploy and commercialize its technology; (xv) the complexity of the machinery NET Power relies on for its operations and development; (xvi) the combined company’s ability to establish and maintain supply relationships; (xvii) risks related to NET Power’s arrangements with third parties for the development, commercialization and deployment of technology associated with NET Power’s technology; (xviii) risks related to NET Power’s other strategic investors and partners; (xix) the combined company’s ability to successfully commercialize its operations; (xx) the availability and cost of raw materials; (xxi) the ability of NET Power’s supply base to scale to meet the combined company’s anticipated growth; (xxii) risks related to NET Power’s or the combined company’s ability to meet its projections; (xxiii) the combined company’s ability to expand internationally; (xxiv) the combined company’s ability to update the design, construction and operations of the NET Power technology; (xxv) the impact of potential delays in discovering manufacturing and construction issues; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters; (xxvii) the ability of commercial plants using NET Power’s technology to efficiently provide net power output; (xxviii) the combined company’s ability to obtain and retain licenses; (xxix) the combined company’s ability to establish an initial commercial scale plant; (xxx) the combined company’s ability to license to large customers; (xxxi) the combined company’s or NET Power’s ability to accurately estimate future commercial demand; (xxxii) the combined company’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry; (xxxiii) the combined company’s ability to comply with all applicable laws and regulations; (xxxiv) the impact of public perception of fossil fuel derived energy on the combined company’s business; (xxxv) any political or other disruptions in gas producing nations; (xxxvi) the combined company’s ability to protect its intellectual property and the intellectual property it licenses; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the SEC or as a condition to obtaining regulatory approval of the proposed business combination; (xxxix) the impact of the global COVID-19 pandemic on any of the foregoing risks; and (xl) such other factors as are set forth in RONI’s periodic public filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, its subsequent quarterly reports on Form 10-Q, and in its other filings made with the SEC from time to time, which are available via the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and NET Power and RONI assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither NET Power nor RONI gives any assurance that either NET Power or RONI, or the combined company, will achieve its expectations.

Participants in the Solicitation

RONI and NET Power and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from RONI’s shareholders in connection with the transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction between RONI and NET Power will be contained in the Proxy Statement/Prospectus, when available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This communication will not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This communication will also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

6