425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on January 17, 2023

Filed by Rice Acquisition Corp. II pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Rice Acquisition Corp. II (File No. 001-40503)

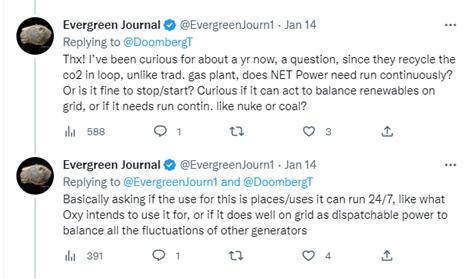

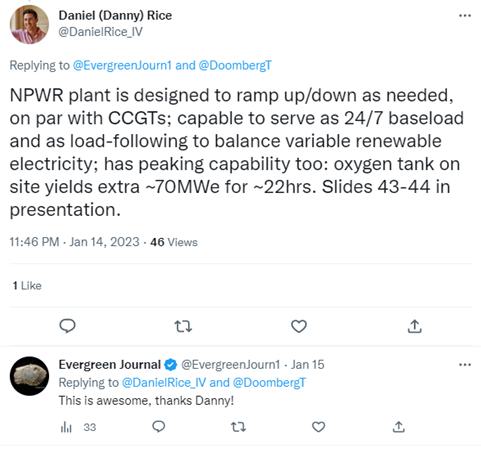

In connection with the proposed business combination involving Rice Acquisition Corp. II (“RONI”) and NET Power, LLC (“NET Power”), on January 14, 2023, Daniel Joseph Rice, IV (@DanielRice_IV), a current director of RONI, posted the following reply to Tweets from @EvergreenJourn1. Below is a copy of the original Tweet from @DoombertT, the Tweets from @EvergreenJourn1, and @DanielRice_IV’s reply.

****

Important Information about the Business Combination and Where to Find It

This communication is being made in respect of the proposed business combination transaction involving RONI and NET Power. RONI has filed a registration statement on Form S-4 (the “registration statement”) with the U.S. Securities and Exchange Commission (the “SEC”) on December 23, 2022, which includes a preliminary proxy statement/prospectus, and RONI may file other documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement/prospectus is not complete and may be changed. After the registration statement is declared effective by the SEC, a definitive proxy statement/prospectus will be sent to the shareholders of RONI. Before making any voting or investment decision, investors and security holders of RONI are urged to carefully read the entire registration statement and definitive proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by RONI with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by RONI may be obtained free of charge from RONI at www.ricespac.com/rac-ii.

2

Forward-Looking Statements

This communication may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the combined company and the proposed transaction between NET Power and RONI. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties.

Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) conditions to the completion of the proposed business combination and PIPE investment, including shareholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement between the parties or the termination of any PIPE investor’s subscription agreement; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations; (vi) potential litigation that may be instituted against RONI or NET Power or their respective directors or officers related to the proposed transaction or the business combination agreement or in relation to NET Power’s business; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power or the combined company; (ix) NET Power’s history of significant losses; (x) the combined company’s ability to manage future growth effectively; (xi) the combined company’s ability to utilize its net operating loss and tax credit carryforwards effectively; (xii) NET Power’s ability to continue as a going concern if the transactions contemplated herein are not completed; (xiii) the capital-intensive nature of NET Power’s business model, which may require the combined company to raise additional capital in the future; (xiv) barriers the combined company may face in its attempts to deploy and commercialize its technology; (xv) the complexity of the machinery NET Power relies on for its operations and development; (xvi) the combined company’s ability to establish and maintain supply relationships; (xvii) risks related to NET Power’s arrangements with third parties for the development, commercialization and deployment of technology associated with NET Power’s technology; (xviii) risks related to NET Power’s other strategic investors and partners; (xix) the combined company’s ability to successfully commercialize its operations; (xx) the availability and cost of raw materials; (xxi) the ability of NET Power’s supply base to scale to meet the combined company’s anticipated growth; (xxii) risks related to NET Power’s or the combined company’s ability to meet its projections; (xxiii) the combined company’s ability to expand internationally; (xxiv) the combined company’s ability to update the design, construction and operations of the NET Power technology; (xxv) the impact of potential delays in discovering manufacturing and construction issues; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters; (xxvii) the ability of commercial plants using NET Power’s technology to efficiently provide net power output; (xxviii) the combined company’s ability to obtain and retain licenses; (xxix) the combined company’s ability to establish an initial commercial scale plant; (xxx) the combined company’s ability to license to large customers; (xxxi) the combined company’s or NET Power’s ability to accurately estimate future commercial demand; (xxxii) the combined company’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry; (xxxiii) the combined company’s ability to comply with all applicable laws and regulations; (xxxiv) the impact of public perception of fossil fuel derived energy on the combined company’s business; (xxxv) any political or other disruptions in gas producing nations; (xxxvi) the combined company’s ability to protect its intellectual property and the intellectual property it licenses; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the SEC or as a condition to obtaining regulatory approval of the proposed business combination; (xxxix) the impact of the global COVID-19 pandemic on any of the foregoing risks; and (xl) such other factors as are set forth in RONI’s periodic public filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, its subsequent quarterly reports on Form 10-Q, and in its other filings made with the SEC from time to time, including the registration statement, which are available via the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and NET Power and RONI assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither NET Power nor RONI gives any assurance that either NET Power or RONI, or the combined company, will achieve its expectations.

Participants in Solicitation

RONI and NET Power and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of RONI, in favor of the approval of the proposed transaction. For information regarding RONI’s directors and executive officers, please see RONI’s Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 30, 2022. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus, as they may be amended, and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding section.

No Offer or Solicitation

This communication shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination transaction. This communication shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

3