425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on January 27, 2023

Filed by Rice Acquisition Corp. II pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Rice Acquisition Corp. II (File No. 001-40503)

On January 26, 2023, an interview with Ron DeGregorio, current Chief Executive Officer of NET Power, LLC (“NET Power”), was published on Carbon Herald. During such interview, Mr. DeGregorio discussed, among other things, Rice Acquisition Corp. II (“RONI”) and the proposed business combination involving RONI and NET Power. Below is the article stemming from the interview.

“Net Power Brings The World Clean, Cost Effective, Reliable, And Dispatchable Utility-Scale Energy” – CEO Ron DeGregorio

We sat down with one of the most advanced and innovative energy companies in the world that can present us today with a real working solution to the energy crisis. Net Power LLC is a company that transforms the natural gas energy generation process into clean and reliable power.

The company has been developing its patented oxy-combustion technology for more than a decade to offer the market a clean energy solution that the world is desperately in the need of.

Ron DeGregorio, CEO of NET Power walked us through the story of the company and shared the amazing journey of bringing the novel, revolutionary technology to the commercialization stage.

https://youtu.be/vFcbev1TkoU

Let’s start with the most important question – what is Net Power?

Net Power is a company that’s bringing to market a new kind of power generation system, a new kind of engine, if you will. This new power generation system was born a little over a decade ago, by a couple of very smart, bright individuals who took two very novel concepts, put them together and patented the system, the idea.

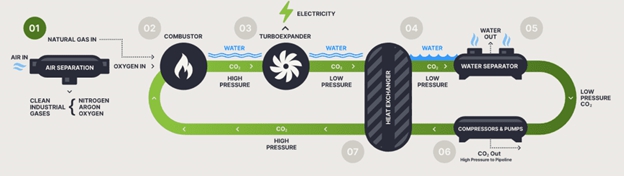

One of those two novel concepts is that when you burn pure oxygen, with natural gas, the only by-products are CO2 and water. That’s called oxy-combustion. It’s not a breakthrough, but it’s a novel concept. And the second one was that we could use pure CO2, as the actual working fluid in a closed-loop – turbo expansion system.

Most people who are familiar with turbo machinery and power generation understand the water steam cycle where we burn a fuel, and we boil water. We use steam to turn a turbine to turn a generator to create electricity. Then we condense the steam back to water and we put it back to the boiler – that’s a closed loop boiling water system.

This second novel concept uses pure CO2 as the working fluid. We burn fossil fuel and generate energy in a working fluid, and we put the CO2 through a turbo expander that turns a generator and gets the power out of it. After that, the CO2 goes right back in the front of the machine.

Net Power process. Credit: Net Power

Putting these two novel concepts together essentially means we burn natural gas, generate electricity and capture all the emissions. The emissions are not in a tailpipe that goes out to the atmosphere but rather they’re captured in a closed loop.

We built and demonstrated the capability of doing this in a big demonstration to show we could sustain combustion of natural gas and pure oxygen in a pure CO2 system. As many know CO2 is used as a fire suppression agent and here we are sustaining combustion in that CO2.

We built a demonstration plant with a couple of hundred million dollars in LaPorte, Texas. And over a decade of demonstration, we went and actually developed the technology Net Power is using now to partner with one of our owners, Baker Hughes. We are now going to market and developing two systems – a commercial scale, 300 MW power plant, and an industrial scale nominally 100 MW power generation system.

2

And how was the company created?

About a decade ago, the company was incorporated by a small technology development group called 8 Rivers Capital. It had the intellectual property and came to two big companies – an engineering procurement construction company called The Shaw Group, and a US-based power generation utility company called Exelon.

I happened to work at Exelon at the time. 8 Rivers Capital came to us and The Shaw Group and said they would like to take our idea and help to commercialize it. The first step was to demonstrate it can work and the second was to commercialize it. Those are two very distinct steps, right? We’ve proven the technology at La Porte, and bringing it to market and commercializing it, is the step we’re in right now.

What do you do with the CO2 that you collect from the process? Do you plan to work with Occidental for the CO2 sequestration for all future plants or just for the 300 MW utility-scale facility that you mentioned?

Occidental, invested in the company along the way, they are part owners and they also happen to be interested in hosting our first commercial utility-scale, 300 MW plant in their operations in West Texas. So OXY has interest in the continued deployment of Net Power plants to power their direct air capture systems.

We also believe that the Net Power’s total addressable market is all power generation equipment. We believe that there is no power generation technology that exists today that can satisfy all three of the important criteria – reliable, I would include the word dispatchable, cost-effective and clean.

Wind and solar on their own, aren’t necessarily reliable. If they were coupled with utility-scale, energy storage systems, they could check the box of reliable but today, just wind and solar on their own don’t do that.

We believe Net Power checks the boxes of what we call the energy trifecta – clean, affordable, reliable and dispatchable and there isn’t any utility-scale energy system that can power the world that checks all three boxes.

3

That’s why we’re very excited about Net Power. I was also wondering, can the technology be integrated in existing natural gas plants?

No, it’s a new engine and a new power generation system. We don’t believe that you can take existing natural gas fired machines and convert them to our system. That being said, like any new power generation technology, there are advantages to deploying it at sites that are existing – we’ll call them utility power generation sites.

Because you already had the existing natural gas supply maybe you have the existing interconnect to the power grid. So we believe some of the deployment will happen there. However, for Net Power plants an important part of siting is to sequester the CO2 safely. We can put it into an existing CO2 infrastructure pipeline system and sell the CO2 as a product just like we sell electricity as a product.

The siting for the plants will initially be strategic with considerations related to CO2 offtake. And thereby, we think of early deployments with our partner OXY, and other carbon sequestration hubs that are being developed right now.

We really believe that long term we need fossil fuels, and we need CCUS. And we think our technology helps to catalyze that and helps fund it.

How do you plan to scale the technology? The company has previously stated that it has a vision of replacing all current natural gas plants – how do you plan to achieve a global scale?

We’ve been working on the development of this technology, and the commercialization plans for a decade. People ask me, why haven’t we heard of you yet? The reason is, we really wanted to prove that this technology works. And that we can scale it so that it can change the world.

4

We have a technology that burns natural gas, generates electricity, and captures all emissions. If you ask anybody who works in the big power generation utility business and tell them you have a technology that burns natural gas, generates electricity, and captures all emissions, they would be falling out of their chair. They understand how the world works with power generation today.

So we needed to take our time and prove the technology works credibly. Once we did that, we sat down and thought about what we need to do to commercialize it on a global scale.

We had to go find one of the premier turbo machinery, experienced manufacturers, people that build and operate manufacturing facilities and make compression equipment for CO2 as a working fluid.

Baker Hughes has a Genesis company that probably has the best engineers and technicians that have been building, making and designing these kinds of pieces of equipment for decades now.

So we needed to get that strategic partnership with Baker Hughes. A year or so ago we finalized it. Baker Hughes not only can design, build and deliver them to clients, they also said, they are interested in the technology, and want to own part of Net Power itself.

Baker Hughes is now our fourth owner and they have some level of exclusivity with us. So now we bring the power generation technology and our partners, and we are really ready for prime time.

How fast can you actually bring these power plants to operation?

We’re building the first serial number one plant, that will be operational by the end of 2026. We have a pipeline of more interest than we can satisfy so it’s about making sure we’re good and strategic, working in projects that are part of larger carbon sequestration hubs.

5

We are going to ramp up our deployment of 30 utility-scale 300 MW plants a year by around 2030. We believe that once the first utility-scale system gets online and runs for a year or two reliably, we won’t be able to close the floodgates.

The world needs power generation that’s reliable, cost-effective and clean and when that happens, you won’t be able to satisfy the market. Given the credibility that Baker Hughes brings now to our story, we already have clients that want to get on board and do this with us.

Could you share some more details about your partnerships?

Yes, Net Power was developed with strategic intent by three new partners who brought not only investment and capital, but also interest, wisdom and help. So it started with an EPC company and a big power generating utility.

Then Oxy came along as a big oil energy company, with an interest in the CO2 sequestration advantages and experiences. Then subsequently, as I described, Baker Hughes came along, giving us the leg up on how you actually bring those plants to market, sell performance, guarantee them, commercialize them.

And then, of course, the last of those strategic partnerships comes along in the form of the Rice acquisition, helping with the financing, how we grow and capitalize with customers.

Our La Porte facility is operated with some help from one of our owners Constellation with the O&M services. Exelon changed its corporate identity and split into two companies and Constellation is the company that kept the interest in Net Power, so we continue to use them for help in project management growth.

6

What is the cost of the electricity produced from Net Power? How does it compare to that of conventional natural gas plants?

Our modeling shows that Net Power plants can be competitive, with the most cost-effective combined cycle plants today that have back-end carbon control systems. And we believe we can modularize our systems and actually get our costs down on capital installation, such that we will compete with combined cycle plants that don’t even have back-end controlling capture.

Other carbon capture controls only get to maybe 80-85% of carbon capture. So we’re competing against technology that can’t even be as clean as ours and they still have NOx and SOx emissions to deal with. Our technology doesn’t even create NOx and SOx. All we do is burn pure oxygen with natural gas and there’s only CO2 and water.

What are the main barriers and challenges that you face today?

Our technology meaningfully moves the needle on carbon capture. We look at numbers relative to what direct air capture systems are doing in terms of how much CO2 they capture and at what cost. The results show the technology meaningfully moves the needle.

7

It has some constraints to global expansion. Some of the constraints are CO2 offtake infrastructure that needs to be expanded in our world, but I think many involved in the energy industry are coming to that. There are constraints in some regions with CO2 infrastructure that needs to be invested in, as well as transmission infrastructure that needs to be developed.

elieve the global demand for a system that can do what I’m saying this does – which is burn natural gas to generate electricity and capture all emissions – will just overwhelm our existing supply stream.

It will take some time for those supply systems to manufacture equipment parts like turbo expanders, generators, heat exchangers, transformers, etc. And because this technology will change the world, the demand for it will be significant.

We’re working strategically with some suppliers today to help them, so we’re already trying to get ahead of the supply constraint.

And you mentioned you basically have no competition or other companies that are doing similar systems.

Only 30% of the fossil fuels in the world are used to generate power, so it’s not just power generation that needs to be cleaned up. I do believe that we can clear power generation and then electrify a lot more things that decarbonize more difficult systems.

I think no one has got to the point where they can say they produce electricity that checks off the energy trifecta. No one, for now, can follow it.

8

Can you build larger than 300 MW plants? Or is it limited to that capacity?

Experienced engineers would be able to answer the question better but I think the sizing of the unit comes down to finding the sweet spot of multiple things. Typically, the bigger you make a unit, the more overall system efficiency and capital cost reductions you can make.

So the bigger the power generation system, normally the lower the costs for installed kilowatt. So we tried to upsize when we came up with designs for power plants.

But then what’s your limit on that? On turbo machinery, we did not want to go into unchartered territory more than what people today are experienced making in manufacturing. So we found the sweet spot around 500 MW for thermal and 300 MW for electric.

https://youtu.be/1zDZmIDbDO0

As 1.5 degrees of global warming is near, the world would need efficient design, so if someone wants a 600 MW or a 900 MW size plant, we would give them two or three 300 MW plants.

There are also some synergies when you put a few of them together – you can have a common control room, a common system, a transformer, and a common interconnect with the grid. So if you want to size up, the best, most effective way is to just do multiples of 300 MW plants as opposed to us designing and building an enormous machine.

I know you’re going public soon in 2023, so is that the next phase of the company?

Yes, this company is at a point that it’s ready to have the creditworthiness of a publicly traded company. Danny Rice, who will join NET Power as its new CEO, has grown a couple of companies, taking them public so he has the experience.

Danny and the existing Net Power team will continue to rely on the strategic partnerships that have been developed with Baker Hughes, Oxy and Constellation. So I think in 2023, you’ll see a second quarter close on this transaction, and Net Power will become a publicly traded company on the New York Stock Exchange.

You’ll also see some announcements on new projects and some strategic relationships that we’re developing.

So what’s next for Net Power going on a global scale with Baker Hughes. And the big vision is replacing all of the natural gas facilities globally, is that correct?

Yes, there are so many new fossil-burning power plants put in service every year. Being a new player in a new plant market will be a huge amount of revenue for us and I think we will be the technology that people are going to, to replace a coal plant when it’s being shut down.

There’s so much new gigawatt of power generation getting installed every year, that this is going to be our first market. And it’s going to be very strategic with players that have an interest in CO2.

9

The aspirational goal is that no one ever burns fossil fuel again unless they’re doing so in a system that can capture all the emissions.

For now, we’re not going to try to displace existing generation because there’s so much new generation and in itself it is an overwhelming market. Net Power will also use intellectual property licensing to satisfy the market demand. If you want to build a power plant that uses this cycle, Net Power has patented it so we are effectively a licensing company.

Our model is similar to McDonald’s – many different people own and build McDonald’s restaurants around the world but McDonald’s specifies what the French fries are going to taste like, how they’re made and built. This is how it will work and we will get a licensing fee.

You might see Danny growing the business and enabling project origination and partnerships with people. But I think you’ll also see strengthening of the supply chain, such that we multiply our licensing revenues globally. I think what’s next is you’ll see us developing strategic partnerships in various regions of the globe.

Yes, the licensing strategy makes the most sense if you want to reach a global scale quicker. And how about you Mr DeGregorio, you announced you are retiring next, right?

Yes, I’m going to retire. My passion has been in power generation and in clean power generation. I’ll remain connected to this company in any way they need me. I’m also very proud of the entire team I helped shepherd. I’m really excited about Danny coming in. I believe he’s a great leader.

I also believe Net Power is a great team and they deserve a great leader. He brings a lot of experience that we really do need now. Especially in the United States with a great emphasis on what we call the 45Q tax credit or the carbon capture and sequestration tax credit. I think the company will benefit from Danny’s strategic relationships. I plan to walk around the industry a little bit but I’m going to retire.

* * * * *

10

Important Information about the Business Combination and Where to Find It

This communication is being made in respect of the proposed business combination transaction involving RONI and NET Power. RONI has filed a registration statement on Form S-4 (the “registration statement”) with the U.S. Securities and Exchange Commission (the “SEC”) on December 23, 2022, which includes a preliminary proxy statement/prospectus, and RONI may file other documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement/prospectus is not complete and may be changed. After the registration statement is declared effective by the SEC, a definitive proxy statement/prospectus will be sent to the shareholders of RONI. Before making any voting or investment decision, investors and security holders of RONI are urged to carefully read the entire registration statement and definitive proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by RONI with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by RONI may be obtained free of charge from RONI at www.ricespac.com/rac-ii.

Forward-Looking Statements

This communication may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the combined company and the proposed transaction between NET Power and RONI. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties.

Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) conditions to the completion of the proposed business combination and PIPE investment, including shareholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement between the parties or the termination of any PIPE investor’s subscription agreement; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations; (vi) potential litigation that may be instituted against RONI or NET Power or their respective directors or officers related to the proposed transaction or the business combination agreement or in relation to NET Power’s business; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power or the combined company; (ix) NET Power’s history of significant losses; (x) the combined company’s ability to manage future growth effectively; (xi) the combined company’s ability to utilize its net operating loss and tax credit carryforwards effectively; (xii) NET Power’s ability to continue as a going concern if the transactions contemplated herein are not completed; (xiii) the capital-intensive nature of NET Power’s business model, which may require the combined company to raise additional capital in the future; (xiv) barriers the combined company may face in its attempts to deploy and commercialize its technology; (xv) the complexity of the machinery NET Power relies on for its operations and development; (xvi) the combined company’s ability to establish and maintain supply relationships; (xvii) risks related to NET Power’s arrangements with third parties for the development, commercialization and deployment of technology associated with NET Power’s technology; (xviii) risks related to NET Power’s other strategic investors and partners; (xix) the combined company’s ability to successfully commercialize its operations; (xx) the availability and cost of raw materials; (xxi) the ability of NET Power’s supply base to scale to meet the combined company’s anticipated growth; (xxii) risks related to NET Power’s or the combined company’s ability to meet its projections; (xxiii) the combined company’s ability to expand internationally; (xxiv) the combined company’s ability to update the design, construction and operations of the NET Power technology; (xxv) the impact of potential delays in discovering manufacturing and construction issues; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters; (xxvii) the ability of commercial plants using NET Power’s technology to efficiently provide net power output; (xxviii) the combined company’s ability to obtain and retain licenses; (xxix) the combined company’s ability to establish an initial commercial scale plant; (xxx) the combined company’s ability to license to large customers; (xxxi) the combined company’s or NET Power’s ability to accurately estimate future commercial demand; (xxxii) the combined company’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry; (xxxiii) the combined company’s ability to comply with all applicable laws and regulations; (xxxiv) the impact of public perception of fossil fuel derived energy on the combined company’s business; (xxxv) any political or other disruptions in gas producing nations; (xxxvi) the combined company’s ability to protect its intellectual property and the intellectual property it licenses; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the SEC or as a condition to obtaining regulatory approval of the proposed business combination; (xxxix) the impact of the global COVID-19 pandemic on any of the foregoing risks; and (xl) such other factors as are set forth in RONI’s periodic public filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, its subsequent quarterly reports on Form 10-Q, and in its other filings made with the SEC from time to time, including the registration statement, which are available via the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

11

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and NET Power and RONI assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither NET Power nor RONI gives any assurance that either NET Power or RONI, or the combined company, will achieve its expectations.

Participants in Solicitation

RONI and NET Power and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of RONI, in favor of the approval of the proposed transaction. For information regarding RONI’s directors and executive officers, please see RONI’s Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 30, 2022. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus, as they may be amended, and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding section.

No Offer or Solicitation

This communication shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination transaction. This communication shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

12