425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on May 19, 2023

Filed by Rice Acquisition Corp. II pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Rice Acquisition Corp. II (File No. 001-40503)

On May 19, 2023, Rice Acquisition Corp. II (“RONI”) and NET Power, LLC (“NET Power”) issued the press release set forth below, and RONI posted the presentation set forth below on its website at https://ricespac.com/rac-ii, both of which relate to the proposed business combination involving RONI and NET Power (the “Business Combination”).

* * * * *

|

|

NET Power and Rice Acquisition Corp. II Secure $50 Million PIPE

Commitment from SK Group and Announce Intent to Form Joint

Venture to Accelerate Deployment of NET Power Plants in Asia

| ● | NET Power adds another strategic investor in SK and increases total committed capital to $560 million for the proposed business combination with RONI |

| ● | NET Power-SK proposed Joint Venture expected to leverage SK’s regional expertise to catalyze development of NET Power plants in Asia |

May 19, 2023 – NET Power, LLC (“NET Power”) and Rice Acquisition Corp. II (NYSE: RONI) (“RONI”) today announced a $50 million PIPE commitment from SK Group (“SK”) in connection with NET Power’s and RONI’s proposed business combination. The groups also announced their intent to establish a NET Power-SK Joint Venture to pursue the origination and development of utility-scale NET Power plants across Asia.

The proposed NET Power-SK Joint Venture is expected to utilize NET Power’s patented oxy-combustion supercritical CO2 power cycle with SK's regional footprint and project development expertise to deploy clean, reliable and low-cost power across key Asian markets. Project origination and development work are expected to include activities such as site selection, supply and offtake contracting, financing and permitting.

Danny Rice, the incoming CEO of NET Power, emphasized the importance of decarbonizing Asian power generation to achieve global emissions goals. "Asian power generation, which is primarily fueled by coal, accounts for nearly 25% of global emissions," he said. "We believe that NET Power possesses the most cost-effective technology for decarbonizing fossil fuel-based power generation, and we are thrilled to partner with SK to deploy our NET Power plants on a large scale throughout Asia. SK is one of the largest and most respected conglomerates globally, and combining our expertise with their resources could accelerate our deployment in one of the largest markets for NET Power, and undoubtedly the most critical market for the planet."

“NET Power’s technology is expected to help SK accomplish our pledge to achieve carbon net-zero across all businesses by 2050. Deploying NET Power plants throughout Asia is an important step forward in decarbonizing the region and ending a prevailing dependence on high-carbon intensity baseload power generation,” said SK Inc. Materials President Young-wook Lee.

The new investment from SK brings the expected investment in NET Power to $895 million, consisting of approximately $345 million from RONI’s trust account (assuming no redemptions), approximately $540 million from the PIPE raised entirely at $10.00 per share of common stock and $10 million from interim financing from an existing owner of NET Power to support its operations through the closing of the business combination. Assuming no RONI shareholders exercise their redemption rights, the combined company is expected to have a market capitalization in excess of $2.0 billion.

NET Power and SK expect to each own a 50% stake in the common equity of the NET Power-SK Joint Venture, which is subject to negotiation and execution of definitive documentation.

As previously disclosed, NET Power expects to need only $200 million of net proceeds from the business combination and the PIPE to fully fund corporate operations through commercialization of SN1, which is expected to be operational in 2026. The anticipated net proceeds above $200 million are expected to support SN1 capital needs and future commercial origination efforts.

|

|

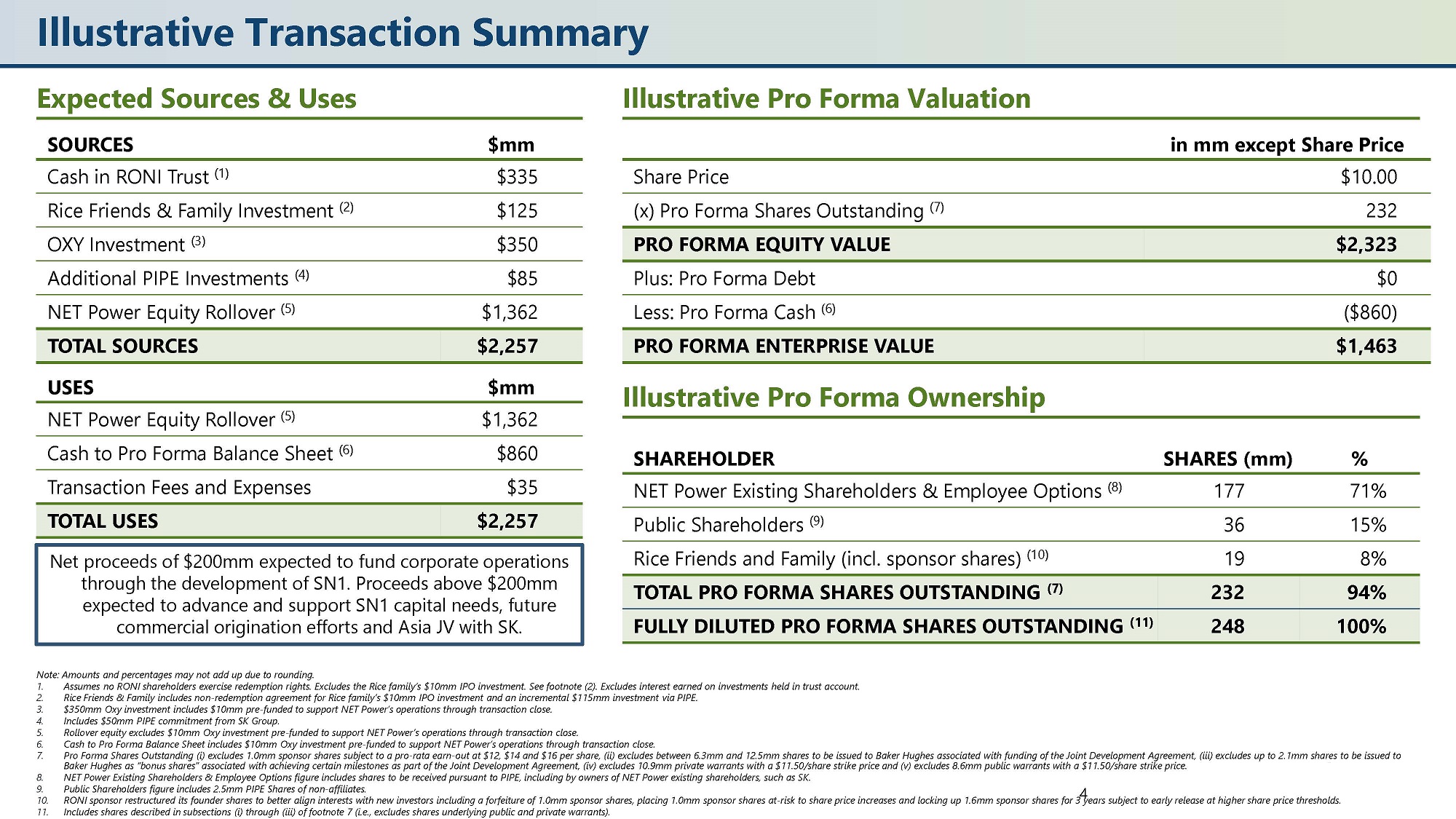

Expected Sources & Uses

| SOURCES | $mm | |||

| Cash in RONI Trust (1) | $ | 335 | ||

| Rice Friends & Family Investment (2) | $ | 125 | ||

| OXY Investment (3) | $ | 350 | ||

| Additional PIPE Investments (4) | $ | 85 | ||

| NET Power Equity Rollover (5) | $ | 1,362 | ||

| TOTAL SOURCES | $ | 2,257 | ||

| USES | $mm | |||

| NET Power Equity Rollover (5) | $ | 1,362 | ||

| Cash to Pro Forma Balance Sheet (6) | $ | 860 | ||

| Transaction Fees and Expenses | $ | 35 | ||

| TOTAL USES | $ | 2,257 |

Illustrative Pro Forma Valuation

| in

mm except Share Price |

||||

| Share Price | $ | 10.00 | ||

| (x) Pro Forma Shares Outstanding (7) | 232 | |||

| PRO FORMA EQUITY VALUE | $ | 2,323 | ||

| Plus: Pro Forma Debt | $ | 0 | ||

| Less: Pro Forma Cash (6) | $ | (860 | ) | |

| PRO FORMA ENTERPRISE VALUE | $ | 1,463 | ||

Illustrative Pro Forma Ownership

| SHAREHOLDER | SHARES (mm) | % | |||||

| NET Power Existing Shareholders & Employee Options (8) | 177 | 71 | % | ||||

| Public Shareholders (9) | 36 | 15 | % | ||||

| Rice Friends and Family (incl. sponsor shares) (10) | 19 | 8 | % | ||||

| TOTAL PRO FORMA SHARES OUTSTANDING (7) | 232 | 94 | % | ||||

| FULLY DILUTED PRO FORMA SHARES OUTSTANDING (11) | 248 | 100 | % | ||||

Note: Amounts and percentages may not add up due to rounding.

| (1) | Assumes no RONI shareholders exercise redemption rights. Excludes the Rice family’s $10mm IPO investment. See footnote (2). Excludes interest earned on investments held in trust account. |

| (2) | Rice Friends & Family includes non-redemption agreement for the Rice family’s $10mm IPO investment and an incremental $115mm investment via PIPE. |

| (3) | $350mm Oxy investment includes $10mm pre-funded to support NET Power’s operations through transaction close. |

| (4) | Includes $50mm PIPE commitment from SK Group. |

| (5) | Rollover equity excludes $10mm Oxy investment pre-funded to support NET Power’s operations through transaction close. |

| (6) | Cash to Pro Forma Balance Sheet includes $10mm Oxy investment pre-funded to support NET Power’s operations through transaction close. |

| (7) | Pro Forma Shares Outstanding (i) excludes 1.0mm sponsor shares subject to a pro-rata earn-out at $12, $14 and $16 per share, (ii) excludes between 6.3mm and 12.5mm shares to be issued to Baker Hughes associated with funding of the Joint Development Agreement, (iii) excludes up to 2.1mm shares to be issued to Baker Hughes as “bonus shares” associated with achieving certain milestones as part of the Joint Development Agreement, (iv) excludes 10.9mm private warrants with a $11.50/share strike price and (v) excludes 8.6mm public warrants with a $11.50/share strike price. |

| (8) | NET Power Existing Shareholders & Employee Options figure includes shares to be received pursuant to PIPE, including by owners of NET Power existing shareholders, such as SK. |

| (9) | Public Shareholders figure includes 2.5mm PIPE shares of non-affiliates. |

| (10) | RONI sponsor restructured its founder shares to better align interests with new investors including a forfeiture of 1.0mm sponsor shares, placing 1.0mm sponsor shares at-risk to share price increases and locking up 1.6mm sponsor shares for 3-years subject to early release at higher share price thresholds. |

| (11) | Includes shares described in subsections (i) through (iii) of footnote 7 (i.e., excludes shares underlying public and private warrants). |

About NET Power

NET Power is a clean energy technology company whose mission is to globally deploy affordable and reliable zero-emissions energy. The Company invents, develops, and licenses clean power generation technology. Founded in 2010 and headquartered in Durham, North Carolina, NET Power has received strategic investments from key industry partners including 8 Rivers, Constellation, Occidental, and Baker Hughes. For more information, please visit https://netpower.com/.

|

|

About Rice Acquisition Corp. II

RONI is led by Daniel Rice IV and Kyle Derham, former executives of Rice Energy, Inc. (“RICE”) and Rice Midstream Partners (“RMP”). In 2018 and 2019, RICE and RMP merged with EQT Corporation (NYSE: EQT) and EQT’s midstream affiliates for over $10 billion to become the largest U.S. natural gas producer. Rice Acquisition Corp. led a 2021 business combination with Archaea Energy LLC and Aria Energy LLC to create Archaea Energy, Inc. (formerly NYSE: LFG), an industry-leading renewable natural gas platform that BP p.l.c. (NYSE: BP) acquired for a cash consideration of $4.1 billion in December 2022, generating a 2.6x return on investment for LFG PIPE investors in approximately one year. Daniel Rice currently serves on the board of EQT. The RONI website is https://ricespac.com/rac-ii/.

About SK

SK Group, South Korea's second-largest conglomerate, is a collection of global industry-leading companies driving innovations in semiconductors, sustainable energy, telecommunications and life sciences. Based in Seoul, SK invests in building businesses around the world with a shared commitment to reducing global greenhouse gas emissions and increasing the use of renewable energy.

SK companies combined have $139 billion in global annual revenue and employ more than 100,000 people worldwide. SK companies are investing billions of dollars in expanding their U.S. presence with business operations or partnerships in hydrogen energy and fuel cells, EV battery manufacturing and technology, energy storage solutions, pharmaceutical manufacturing and development, semiconductors, and advanced materials. For more information, visit sk.com

Important Information about the Transaction and Where to Find It

This press release relates to, among other matters, a proposed business combination transaction involving NET Power and RONI. In connection with the transaction, RONI has filed with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 (File No. 333-268975), including a proxy statement and prospectus (the “Proxy Statement/Prospectus”). This document is not a substitute for the Proxy Statement/Prospectus. The definitive Proxy Statement/Prospectus was filed with the SEC on May 10, 2023 and has been or will be sent to all RONI shareholders as of April 18, 2023 (the record date for voting on the proposed transaction). RONI may also file other relevant documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SECURITY HOLDERS OF RONI AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RONI, NET POWER, THE TRANSACTION AND RELATED MATTERS.

Investors and security holders of RONI may obtain free copies of the Proxy Statement/Prospectus and other documents that are filed or will be filed with the SEC by RONI through the website maintained by the SEC at www.sec.gov or at RONI’s website at www.ricespac.com/rac-ii.

Participants in the Solicitation

RONI and NET Power and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from RONI’s shareholders in connection with the transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction between RONI and NET Power are contained in the Proxy Statement/Prospectus. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination. This press release shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

|

|

Forward-Looking Statements

This communication may contain certain forward-looking statements within the meaning of the federal securities laws with respect to (i) the PIPE, including commitments to the PIPE, and (ii) the proposed transaction between NET Power and RONI and the combined company. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “seek,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) conditions to the completion of the proposed business combination and PIPE investment, including shareholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement between the parties or the termination of any PIPE investor’s subscription agreement; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations; (vi) potential litigation that may be instituted against RONI or NET Power or their respective directors or officers related to the proposed transaction or the business combination agreement or in relation to NET Power’s business; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power or the combined company; (ix) NET Power’s history of significant losses; (x) the combined company’s ability to manage future growth effectively; (xi) the combined company’s ability to utilize its net operating loss and tax credit carryforwards effectively; (xii) NET Power’s ability to continue as a going concern if the transactions contemplated herein are not completed; (xiii) the capital-intensive nature of NET Power’s business model, which may require the combined company to raise additional capital in the future; (xiv) barriers the combined company may face in its attempts to deploy and commercialize its technology; (xv) the complexity of the machinery NET Power relies on for its operations and development; (xvi) the combined company’s ability to establish and maintain supply relationships; (xvii) risks related to NET Power’s arrangements with third parties for the development, commercialization and deployment of technology associated with NET Power’s technology; (xviii) risks related to NET Power’s other strategic investors and partners; (xix) the combined company’s ability to successfully commercialize its operations; (xx) the availability and cost of raw materials; (xxi) the ability of NET Power’s supply base to scale to meet the combined company’s anticipated growth; (xxii) risks related to NET Power’s or the combined company’s ability to meet its projections; (xxiii) the combined company’s ability to expand internationally; (xxiv) the combined company’s ability to update the design, construction and operations of the NET Power technology; (xxv) the impact of potential delays in discovering manufacturing and construction issues; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters; (xxvii) the ability of commercial plants using NET Power’s technology to efficiently provide net power output; (xxviii) the combined company’s ability to obtain and retain licenses; (xxix) the combined company’s ability to establish an initial commercial scale plant; (xxx) the combined company’s ability to license to large customers; (xxxi) the combined company’s or NET Power’s ability to accurately estimate future commercial demand; (xxxii) the combined company’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry; (xxxiii) the combined company’s ability to comply with all applicable laws and regulations; (xxxiv) the impact of public perception of fossil fuel derived energy on the combined company’s business; (xxxv) any political or other disruptions in gas producing nations; (xxxvi) the combined company’s ability to protect its intellectual property and the intellectual property it licenses; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the SEC or as a condition to obtaining regulatory approval of the proposed business combination; (xxxix) the impact of the global COVID-19 pandemic on any of the foregoing risks; and (xl) such other factors as are set forth in RONI’s filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the definitive Proxy Statement/Prospectus filed on May 10, 2023, and in its other filings made with the SEC from time to time, which are available via the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and NET Power and RONI assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither NET Power nor RONI gives any assurance that either NET Power or RONI, or the combined company, will achieve its expectations.

NET Power Investor Contact:

Bryce Mendes

bryce.mendes@netpower.com

NET Power Media Contact:

Sam Fabens

sfabens@voxglobal.com

* * * * *

Updated Illustrative Transaction Summary May 2023

Disclaimer (1/2) This presentation of Rice Acquisition Corp . II ("RONI") and NET Power, LLC ("NET Power") is for informational purposes only . This presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination between RONI and NET Power or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any securities of RONI, NET Power or any of their respective affiliates . Cautionary Note Regarding Forward - Looking Statements and Projections . Certain statements in this presentation may constitute “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , Section 21 E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 , each as amended . Forward - looking statements provide current expectations of future events and include any statement that does not directly relate to any historical or current fact . Words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “projects,” or other similar expressions may identify such forward - looking statements . Actual results may differ materially from those discussed in forward - looking statements as a result of factors, risks and uncertainties over which RONI and NET Power have no control . These factors, risks and uncertainties include, but are not limited to, the following : (i) conditions to the completion of the proposed business combination and PIPE investment, including stockholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule ; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement between the parties or the termination of any PIPE investor’s subscription agreement ; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally ; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations and potential difficulties in NET Power’s employee retention as a result of the proposed business combination ; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations ; (vi) potential litigation that may be instituted against RONI or NET Power or their respective directors or officers related to the proposed acquisition or the merger agreement or in relation to NET Power’s business ; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment ; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power ; (ix) NET Power’s history of significant losses ; (x) NET Power’s ability to manage future growth effectively ; (xi) NET Power’s ability to utilize its net operating loss and tax credit carryforwards effectively ; (xii) NET Power’s ability to continue as a going concern if the transactions contemplated herein are not completed ; (xiii) the capital - intensive nature of NET Power’s business model, which may require NET Power to raise additional capital in the future ; (xiv) barriers NET Power may face in its attempts to deploy and commercialize its technology ; (xv) the complexity of the machinery NET Power relies on for its operations and development ; (xvi) NET Power’s ability to establish and maintain supply relationships ; (xvii) risks related to NET Power’s joint development arrangements with Baker Hughes and reliance on Baker Hughes to commercialize and deploy its technology ; (xviii) risks related to NET Power’s other strategic investors and partners ; (xix) NET Power’s ability to successfully commercialize its operations ; (xx) the availability and cost of raw materials ; (xxi) the ability of NET Power’s supply base to scale to meet NET Power’s anticipated growth ; (xxii) risks related to NET Power’s ability to meet its projections ; (xxiii) NET Power’s ability to expand internationally ; (xxiv) NET Power’s ability to update the design, construction and operations of its NET Power Process (as defined herein) ; (xxv) the impact of potential delays in discovering manufacturing and construction issues ; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters ; (xxvii) the ability of commercial plants using the NET Power Process to efficiently provide net power output ; (xxviii) NET Power’s ability to obtain and retain licenses ; (xxix) NET Power’s ability to establish an initial commercial scale plant ; (xxx) NET Power’s ability to license to large customers ; (xxxi) NET Power’s ability to accurately estimate future commercial demand ; (xxxii) NET Power’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry ; (xxxiii) NET Power’s ability to comply with all applicable laws and regulations ; (xxxiv) the impact of public perception of fossil fuel derived energy on NET Power’s business ; (xxxv) any political or other disruptions in gas producing nations ; (xxxvi) NET Power’s ability to protect its intellectual property and the intellectual property it licenses ; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination ; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the Securities and Exchange Commission (the “SEC”) or as a condition to obtaining regulatory approval of the proposed business combination ; (xxxix) the impact of the global COVID - 19 pandemic on any of the foregoing risks ; and (xl) such other factors as are set forth in RONI’s filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in the definitive proxy statement/prospectus (as defined below) filed on May 10 , 2023 and in its other filings made with the SEC from time to time, which are available via the SEC’s website at www . sec . gov . Neither RONI nor NET Power undertake any duty to update these forward - looking statements or the other information contained in this presentation . 2

Disclaimer (2/2) No Representations or Warranties . Neither RONI nor NET Power makes any representation or warranty, express or implied, as to the accuracy or completeness of this document or any other information (whether written or oral) that has been or will be provided to you . Nothing contained herein or in any other oral or written information provided to you is, nor shall be relied upon as, a promise or representation of any kind by RONI or NET Power . Without limitation of the foregoing, RONI and NET Power expressly disclaim any representation regarding any projections concerning future operating results or any other forward - looking statement contained herein or that otherwise has been or will be provided to you . Neither RONI nor NET Power shall be liable to you or any prospective investor or any other person for any information contained herein or that otherwise has been or will be provided to you . Important Information about the Business Combination and Where to Find It . This presentation is being made in respect of the proposed business combination transaction involving RONI and NET Power . RONI has filed with the SEC a registration statement on Form S - 4 (File No . 333 - 268975 ), including a proxy statement and prospectus (the “proxy statement/prospectus”) . This presentation is not a substitute for the proxy statement/prospectus . The definitive proxy statement/prospectus was filed with the SEC on May 10 , 2023 and has been or will be sent to all RONI shareholders as of April 18 , 2023 (the record date for voting on the proposed transaction) . RONI may also file other documents with the SEC regarding the proposed transaction . Before making any voting or investment decision, investors and security holders of RONI are urged to carefully read the entire registration statement and definitive proxy statement/prospectus and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction . The documents filed by RONI with the SEC may be obtained free of charge at the SEC’s website at www . sec . gov . In addition, the documents filed by RONI may be obtained free of charge from RONI at www . ricespac . com/rac - ii . Participants in Solicitation . RONI and NET Power and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of RONI, in favor of the approval of the proposed transaction . For information regarding RONI’s directors and executive officers, please see the proxy statement/prospectus . Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus, as they may be amended, and other relevant documents filed with the SEC when they become available . Free copies of these documents may be obtained as described in the preceding section . No Offer or Solicitation . This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination transaction . This communication shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, or an exemption therefrom . 3

Illustrative Transaction Summary 4 Expected Sources & Uses $mm SOURCES $335 Cash in RONI Trust (1) $125 Rice Friends & Family Investment (2) $350 OXY Investment (3) $85 Additional PIPE Investments (4) $1,362 NET Power Equity Rollover (5) $2,257 TOTAL SOURCES $mm USES $1,362 NET Power Equity Rollover (5) $860 Cash to Pro Forma Balance Sheet (6) $35 Transaction Fees and Expenses $2,257 TOTAL USES Illustrative Pro Forma Valuation in mm except Share Price $10.00 Share Price 232 (x) Pro Forma Shares Outstanding (7) $2,323 PRO FORMA EQUITY VALUE $0 Plus: Pro Forma Debt ($860) Less: Pro Forma Cash (6) $1,463 PRO FORMA ENTERPRISE VALUE Illustrative Pro Forma Ownership % SHARES (mm) SHAREHOLDER 71% 177 NET Power Existing Shareholders & Employee Options (8) 15% 36 Public Shareholders (9) 8% 19 Rice Friends and Family (incl. sponsor shares) (10) 94% 232 TOTAL PRO FORMA SHARES OUTSTANDING (7) 100% 248 FULLY DILUTED PRO FORMA SHARES OUTSTANDING (11) Net proceeds of $200mm expected to fund corporate operations through the development of SN1. Proceeds above $200mm expected to advance and support SN1 capital needs, future commercial origination efforts and Asia JV with SK. Note: Amounts and percentages may not add up due to rounding. 1. Assumes no RONI shareholders exercise redemption rights. Excludes the Rice family’s $10mm IPO investment. See footnote (2). E xcl udes interest earned on investments held in trust account. 2. Rice Friends & Family includes non - redemption agreement for Rice family’s $10mm IPO investment and an incremental $115mm investm ent via PIPE. 3. $350mm Oxy investment includes $10mm pre - funded to support NET Power’s operations through transaction close. 4. Includes $50mm PIPE commitment from SK Group. 5. Rollover equity excludes $10mm Oxy investment pre - funded to support NET Power’s operations through transaction close. 6. Cash to Pro Forma Balance Sheet includes $10mm Oxy investment pre - funded to support NET Power’s operations through transaction c lose. 7. Pro Forma Shares Outstanding (i) excludes 1.0mm sponsor shares subject to a pro - rata earn - out at $12, $14 and $16 per share, (ii ) excludes between 6.3mm and 12.5mm shares to be issued to Baker Hughes associated with funding of the Joint Development Agre eme nt, (iii) excludes up to 2.1mm shares to be issued to Baker Hughes as “bonus shares” associated with achieving certain milestones as part of the Joint Development Agreement, (iv) exc ludes 10.9mm private warrants with a $11.50/share strike price and (v) excludes 8.6mm public warrants with a $11.50/share str ike price. 8. NET Power Existing Shareholders & Employee Options figure includes shares to be received pursuant to PIPE, including by owner s o f NET Power existing shareholders, such as SK. 9. Public Shareholders figure includes 2.5mm PIPE Shares of non - affiliates. 10. RONI sponsor restructured its founder shares to better align interests with new investors including a forfeiture of 1.0mm spo nso r shares, placing 1.0mm sponsor shares at - risk to share price increases and locking up 1.6mm sponsor shares for 3 years subject to early release at higher share price thresholds. 11. Includes shares described in subsections (i) through (iii) of footnote 7 (i.e., excludes shares underlying public and private wa rrants).

* * * * *

Important Information about the Business Combination and Where to Find It

This communication relates to, among other matters, a proposed business combination involving RONI and NET Power. In connection with the Business Combination, RONI has filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (File No. 333-268975), including a proxy statement and prospectus (the “Proxy Statement/Prospectus”). This document is not a substitute for the Proxy Statement/Prospectus. The definitive Proxy Statement/Prospectus was filed with the SEC on May 10, 2023 and has been or will be sent to all RONI shareholders as of April 18, 2023 (the record date for voting on the proposed Business Combination). RONI may also file other relevant documents regarding the proposed Business Combination with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SECURITY HOLDERS OF RONI AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE BUSINESS COMBINATION, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RONI, NET POWER, THE BUSINESS COMBINATION AND RELATED MATTERS.

Investors and security holders of RONI may obtain free copies of the Proxy Statement/Prospectus and other documents that are filed or will be filed with the SEC by RONI through the website maintained by the SEC at www.sec.gov or at RONI’s website at www.ricespac.com/rac-ii.

Forward-Looking Statements

This communication may contain certain forward-looking statements within the meaning of the federal securities laws with respect to (i) the PIPE, including commitments to the PIPE, and (ii) the proposed Business Combination and the combined company. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “seek,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) conditions to the completion of the proposed business combination and PIPE investment, including shareholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement between the parties or the termination of any PIPE investor’s subscription agreement; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations; (vi) potential litigation that may be instituted against RONI or NET Power or their respective directors or officers related to the proposed Business Combination or the business combination agreement or in relation to NET Power’s business; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power or the combined company; (ix) NET Power’s history of significant losses; (x) the combined company’s ability to manage future growth effectively; (xi) the combined company’s ability to utilize its net operating loss and tax credit carryforwards effectively; (xii) NET Power’s ability to continue as a going concern if the Business Combination is not completed; (xiii) the capital-intensive nature of NET Power’s business model, which may require the combined company to raise additional capital in the future; (xiv) barriers the combined company may face in its attempts to deploy and commercialize its technology; (xv) the complexity of the machinery NET Power relies on for its operations and development; (xvi) the combined company’s ability to establish and maintain supply relationships; (xvii) risks related to NET Power’s arrangements with third parties for the development, commercialization and deployment of technology associated with NET Power’s technology; (xviii) risks related to NET Power’s other strategic investors and partners; (xix) the combined company’s ability to successfully commercialize its operations; (xx) the availability and cost of raw materials; (xxi) the ability of NET Power’s supply base to scale to meet the combined company’s anticipated growth; (xxii) risks related to NET Power’s or the combined company’s ability to meet its projections; (xxiii) the combined company’s ability to expand internationally; (xxiv) the combined company’s ability to update the design, construction and operations of the NET Power technology; (xxv) the impact of potential delays in discovering manufacturing and construction issues; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters; (xxvii) the ability of commercial plants using NET Power’s technology to efficiently provide net power output; (xxviii) the combined company’s ability to obtain and retain licenses; (xxix) the combined company’s ability to establish an initial commercial scale plant; (xxx) the combined company’s ability to license to large customers; (xxxi) the combined company’s or NET Power’s ability to accurately estimate future commercial demand; (xxxii) the combined company’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry; (xxxiii) the combined company’s ability to comply with all applicable laws and regulations; (xxxiv) the impact of public perception of fossil fuel derived energy on the combined company’s business; (xxxv) any political or other disruptions in gas producing nations; (xxxvi) the combined company’s ability to protect its intellectual property and the intellectual property it licenses; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the SEC or as a condition to obtaining regulatory approval of the proposed business combination; (xxxix) the impact of the global COVID-19 pandemic on any of the foregoing risks; and (xl) such other factors as are set forth in RONI’s filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the definitive Proxy Statement/Prospectus filed on May 10, 2023, and in its other filings made with the SEC from time to time, which are available via the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and NET Power and RONI assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither NET Power nor RONI gives any assurance that either NET Power or RONI, or the combined company, will achieve its expectations.

Participants in the Solicitation

RONI and NET Power and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from RONI’s shareholders in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination are contained in the Proxy Statement/Prospectus. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This communication shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This communication shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.