ANALYST DAY PRESENTATION

Published on March 21, 2023

Exhibit 99.1

NET Power Analyst Day March 2023

Disclaimer (1/2) This presentation is being delivered by Rice Acquisition Corp . II ("RONI") and NET Power, LLC ("NET Power") for informational purposes only . This presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination between RONI and NET Power or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any securities of RONI, NET Power or any of their respective affiliates . Cautionary Note Regarding Forward - Looking Statements and Projections . Certain statements in this presentation may constitute “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , Section 21 E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 , each as amended . Forward - looking statements provide current expectations of future events and include any statement that does not directly relate to any historical or current fact . Words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “projects,” or other similar expressions may identify such forward - looking statements . Actual results may differ materially from those discussed in forward - looking statements as a result of factors, risks and uncertainties over which RONI and NET Power have no control . These factors, risks and uncertainties include, but are not limited to, the following : (i) conditions to the completion of the proposed business combination and PIPE investment, including stockholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule ; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement between the parties or the termination of any PIPE investor’s subscription agreement ; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally ; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations and potential difficulties in NET Power’s employee retention as a result of the proposed business combination ; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations ; (vi) potential litigation that may be instituted against RONI or NET Power or their respective directors or officers related to the proposed acquisition or the merger agreement or in relation to NET Power’s business ; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment ; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power ; (ix) NET Power’s history of significant losses ; (x) NET Power’s ability to manage future growth effectively ; (xi) NET Power’s ability to utilize its net operating loss and tax credit carryforwards effectively ; (xii) NET Power’s ability to continue as a going concern if the transactions contemplated herein are not completed ; (xiii) the capital - intensive nature of NET Power’s business model, which may require NET Power to raise additional capital in the future ; (xiv) barriers NET Power may face in its attempts to deploy and commercialize its technology ; (xv) the complexity of the machinery NET Power relies on for its operations and development ; (xvi) NET Power’s ability to establish and maintain supply relationships ; (xvii) risks related to NET Power’s joint development arrangements with Baker Hughes and reliance on Baker Hughes to commercialize and deploy its technology ; (xviii) risks related to NET Power’s other strategic investors and partners ; (xix) NET Power’s ability to successfully commercialize its operations ; (xx) the availability and cost of raw materials ; (xxi) the ability of NET Power’s supply base to scale to meet NET Power’s anticipated growth ; (xxii) risks related to NET Power’s ability to meet its projections ; (xxiii) NET Power’s ability to expand internationally ; (xxiv) NET Power’s ability to update the design, construction and operations of its NET Power Process (as defined herein) ; (xxv) the impact of potential delays in discovering manufacturing and construction issues ; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters ; (xxvii) the ability of commercial plants using the NET Power Process to efficiently provide net power output ; (xxviii) NET Power’s ability to obtain and retain licenses ; (xxix) NET Power’s ability to establish an initial commercial scale plant ; (xxx) NET Power’s ability to license to large customers ; (xxxi) NET Power’s ability to accurately estimate future commercial demand ; (xxxii) NET Power’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry ; (xxxiii) NET Power’s ability to comply with all applicable laws and regulations ; (xxxiv) the impact of public perception of fossil fuel derived energy on NET Power’s business ; (xxxv) any political or other disruptions in gas producing nations ; (xxxvi) NET Power’s ability to protect its intellectual property and the intellectual property it licenses ; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination ; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the SEC or as a condition to obtaining regulatory approval of the proposed business combination ; (xxxix) the impact of the global COVID - 19 pandemic on any of the foregoing risks ; and (xl) such other factors as are set forth in RONI’s periodic public filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in its Annual Report on Form 10 - K for the fiscal year ended December 31 , 2022 , its subsequent quarterly reports on Form 10 - Q, and in its other filings made with the SEC from time to time, which are available via the SEC’s website at www . sec . gov . Neither RONI nor NET Power undertake any duty to update these forward - looking statements or the other information contained in this presentation . This presentation contains projected financial information with respect to the combined company, namely NET Power’s projected EBITDA and enterprise value for future years . Such projected financial information constitutes forward - looking information and is for illustrative purposes only, and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information . Actual results may differ materially from the results contemplated by the projected financial information contained in this presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved . 2

Disclaimer (2/2) Non - GAAP Financial Measures . The independent auditors of NET Power have not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this presentation . Some of the financial information and data contained in this presentation, such as EBITDA, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”) . EBITDA is defined as net earnings (loss) before interest expense, income tax expense (benefit), depreciation and amortization . NET Power believes these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to NET Power’s financial condition and results of operations . NET Power believes that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends . NET Power's method of determining these non - GAAP measures may be different from other companies' methods and, therefore, may not be comparable to those used by other companies and NET Power does not recommend the sole use of these non - GAAP measures to assess its financial performance . Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP . The principal limitation of these non - GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in NET Power’s financial statements . In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures . In order to compensate for these limitations, management presents non - GAAP financial measures in connection with GAAP results . NET Power is not providing a reconciliation of projected EBITDA for future years to the most directly comparable measure prepared in accordance with GAAP because NET Power is unable to provide this reconciliation without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence, the financial impact, and the periods in which the adjustments may be recognized . For the same reasons, NET Power is unable to address the probable significance of the unavailable information, which could be material to future results . No Representations or Warranties . Neither RONI nor NET Power makes any representation or warranty, express or implied, as to the accuracy or completeness of this document or any other information (whether written or oral) that has been or will be provided to you . Nothing contained herein or in any other oral or written information provided to you is, nor shall be relied upon as, a promise or representation of any kind by RONI or NET Power . Without limitation of the foregoing, RONI and NET Power expressly disclaim any representation regarding any projections concerning future operating results or any other forward - looking statement contained herein or that otherwise has been or will be provided to you . Neither RONI nor NET Power shall be liable to you or any prospective investor or any other person for any information contained herein or that otherwise has been or will be provided to you . Important Information about the Business Combination and Where to Find It . This presentation is being made in respect of the proposed business combination transaction involving RONI and NET Power . RONI has filed a registration statement on Form S - 4 (as may be amended from time to time, the “registration statement”) with the U . S . Securities and Exchange Commission (the “SEC”) on December 23 , 2022 , which includes a preliminary proxy statement/prospectus, and RONI may file other documents with the SEC regarding the proposed transaction . The information in the preliminary proxy statement/prospectus is not complete and may be changed . After the registration statement is declared effective by the SEC, a definitive proxy statement/prospectus will be sent to the shareholders of RONI . Before making any voting or investment decision, investors and security holders of RONI are urged to carefully read the entire registration statement and definitive proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction . The documents filed by RONI with the SEC may be obtained free of charge at the SEC’s website at www . sec . gov . In addition, the documents filed by RONI may be obtained free of charge from RONI at www . ricespac . com/rac - ii . Participants in Solicitation . RONI and NET Power and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of RONI, in favor of the approval of the proposed transaction . For information regarding RONI’s directors and executive officers, please see RONI’s Annual Report on Form 10 - K for the year ended December 31 , 2022 filed with the SEC on March 2 , 2023 . Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus, as they may be amended, and other relevant documents filed with the SEC when they become available . Free copies of these documents may be obtained as described in the preceding section . No Offer or Solicitation . This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination transaction . This communication shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, or an exemption therefrom . 3

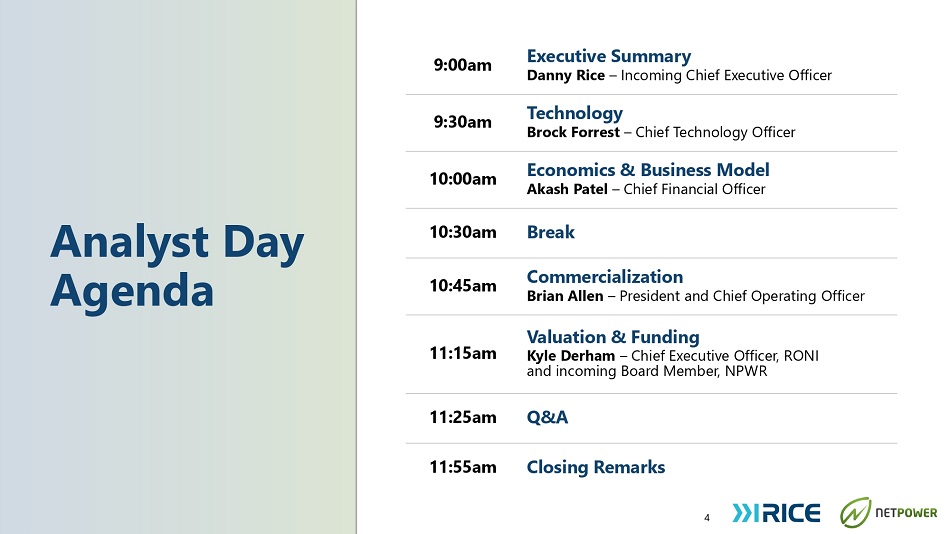

Analyst Day Agenda 4 9:00am Executive Summary Danny Rice – Incoming Chief Executive Officer 9:30am Technology Brock Forrest – Chief Technology Officer 10:00am Economics & Business Model Akash Patel – Chief Financial Officer 10:30am Break 10:45am Commercialization Brian Allen – President and Chief Operating Officer 11:15am Valuation & Funding Kyle Derham – Chief Executive Officer, RONI and incoming Board Member, NPWR 11:25am Q&A 11:55am Closing Remarks

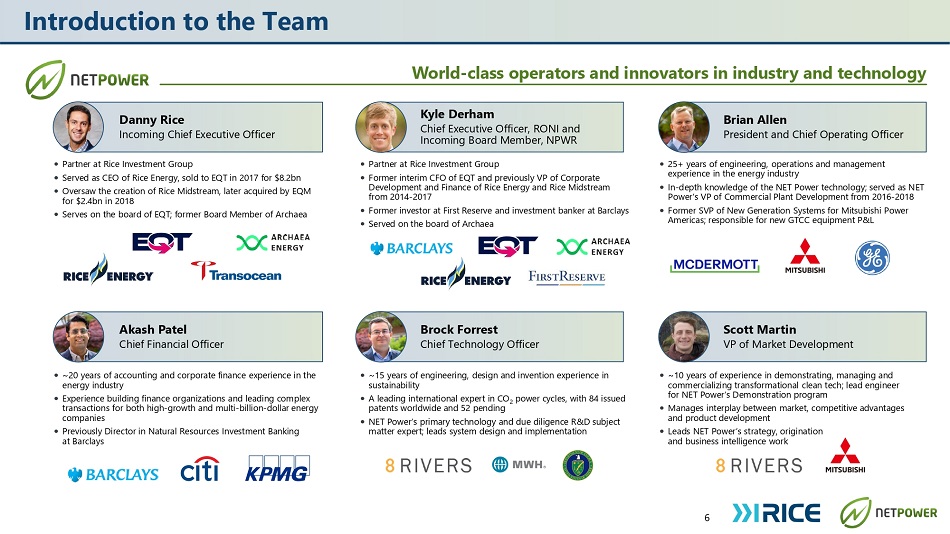

Introduction

Introduction to the Team 6 Partner at Rice Investment Group Served as CEO of Rice Energy, sold to EQT in 2017 for $8.2bn Oversaw the creation of Rice Midstream, later acquired by EQM for $2.4bn in 2018 Serves on the board of EQT; former Board Member of Archaea Partner at Rice Investment Group Former interim CFO of EQT and previously VP of Corporate Development and Finance of Rice Energy and Rice Midstream from 2014 - 2017 Former investor at First Reserve and investment banker at Barclays Served on the board of Archaea Danny Rice Incoming Chief Executive Officer ~10 years of experience in demonstrating, managing and commercializing transformational clean tech; lead engineer for NET Power’s Demonstration program Manages interplay between market, competitive advantages and product development Leads NET Power’s strategy, origination and business intelligence work World - class operators and innovators in industry and technology Brian Allen President and Chief Operating Officer Brock Forrest Chief Technology Officer Akash Patel Chief Financial Officer ~15 years of engineering, design and invention experience in sustainability A leading international expert in CO 2 power cycles, with 84 issued patents worldwide and 52 pending NET Power’s primary technology and due diligence R&D subject matter expert; leads system design and implementation 25+ years of engineering, operations and management experience in the energy industry In - depth knowledge of the NET Power technology; served as NET Power’s VP of Commercial Plant Development from 2016 - 2018 Former SVP of New Generation Systems for Mitsubishi Power Americas; responsible for new GTCC equipment P&L ~20 years of accounting and corporate finance experience in the energy industry Experience building finance organizations and leading complex transactions for both high - growth and multi - billion - dollar energy companies Previously Director in Natural Resources Investment Banking at Barclays Kyle Derham Chief Executive Officer, RONI and Incoming Board Member, NPWR Scott Martin VP of Market Development

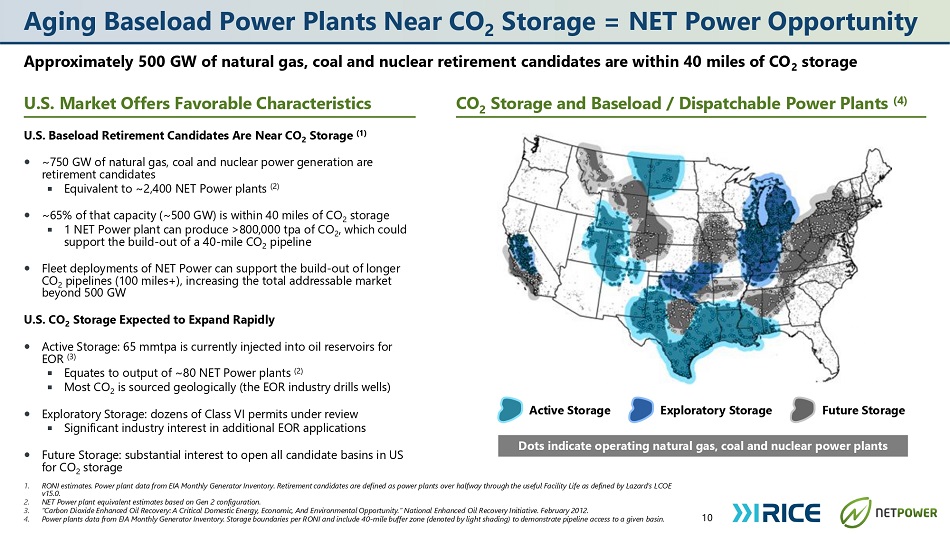

7 Executive Summary Danny Rice Incoming Chief Executive Officer

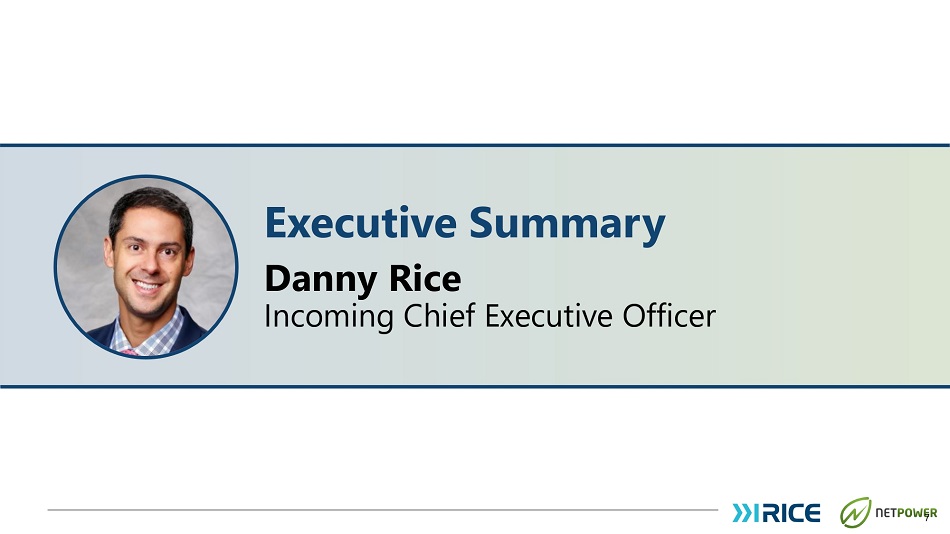

40% 45% 60% 156% (50%) Peers Peers Peers Source: Company filings and press releases, FactSet as of 3/17/23. 1. Peers include AR, CNX, COG, EQT, GPOR and RRC. Performance period measured from 1/24/14 (RICE IPO) to 11/13/17 (closing of RICE/EQT acquisition). 2. Peers include AM, CNXM and EQM. Performance period measured from 12/17/14 (RMP IPO) to 11/13/17 (closing of RICE/EQT acquisition). 3. Peers include AR, CNX, CTRA, RRC and SWN. Performance period measured from 12/7/18 (trading date prior to the Rice Team sending its first public letter to EQT’s board) to 3/17/23. 4. Peers include AMTX, CLNE and MNTK. Performance period measured from 4/6/21 (trading date prior to announcement of de - SPAC transaction) to 12/27/22. 12% 29% (50%) Peers The Rice Team Has Consistently Created Value in Natural Gas Through multiple cycles, as Founders, Operators and Investors, the Rice Team has generated top returns across four dominant public companies spanning the natural gas value chain 8 Natural Gas Producer Founded 2007, Exited 2017 ~$8.0 billion sale to EQT Natural Gas Midstream Founded 2007, Exited 2017 ~$2.0 billion sale to EQT Largest Natural Gas Producer in U.S. Operated 2018 - Present ~$15.5 billion enterprise value Largest Public RNG Producer in U.S. Invested 2018, SPAC 2021, Exit 2022 ~$4.1 billion sale to bp Public shareholder returns (1) 1/24/14 to 11/13/17 Public shareholder returns (2) 12/17/14 to 11/13/17 Public shareholder returns (3) 12/7/18 to 3/17/23 Public shareholder returns (4) 4/6/21 to 12/27/22

An Innovative Technology to Decarbonize Natural Gas Power Generation NET Power’s power plant transforms natural gas into clean, emission - free power NET Power Overview Who we are: NET Power is a US - based clean energy technology company that has developed a gas - fired power plant that generates clean power with no emissions Innovative Design: NET Power’s patented technology employs oxy - combustion and utilizes super - critical CO 2 as the turbine’s working fluid to efficiently produce clean, low - cost power and deliver a pure stream of CO 2 for sequestration or utilization Proven technology: Demonstration plant in La Porte, TX (50 MWth) was commissioned in 2018 and has achieved over 1,500 operational hours and synchronized to the Texas grid in 2021 Preparing for global deployment: Agreement with Baker Hughes to design and manufacture key plant equipment; expect first deliveries in 2026 - 2027; standardized 300MWe design enables cost economies of scale and rapid deployment Several projects in various stages of development, first 300MW plant expected online in 2026 - 2027 Positioning for long - term success: In December 2022, NET Power announced transaction to go public ; successful energy entrepreneur Danny Rice to become NET Power’s CEO upon closing of transaction (expected Spring 2023) 9 (NPWR Cycle Inventor) (Power Expertise) (CO 2 Expertise) (Plant OEM & CO 2 chain expertise) Better pic - website NET Power’s Demonstration Facility in La Porte, Texas Existing Strategic Shareholders ($143bn total EV) NET Power’s Demonstration Facility in La Porte, Texas

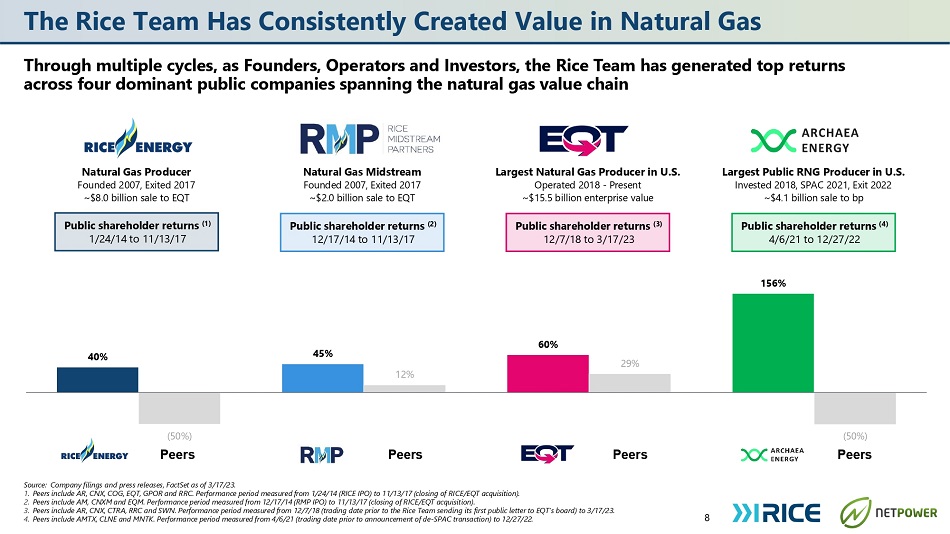

Aging Baseload Power Plants Near CO 2 Storage = NET Power Opportunity 10 Approximately 500 GW of natural gas, coal and nuclear retirement candidates are within 40 miles of CO 2 storage U.S. Market Offers Favorable Characteristics CO 2 Storage and Baseload / Dispatchable Power Plants (4) U.S. Baseload Retirement Candidates Are Near CO 2 Storage (1) ~750 GW of natural gas, coal and nuclear power generation are retirement candidates Equivalent to ~2,400 NET Power plants (2) ~65% of that capacity (~500 GW) is within 40 miles of CO 2 storage 1 NET Power plant can produce >800,000 tpa of CO 2 , which could support the build - out of a 40 - mile CO 2 pipeline Fleet deployments of NET Power can support the build - out of longer CO 2 pipelines (100 miles+), increasing the total addressable market beyond 500 GW U.S. CO 2 Storage Expected to Expand Rapidly Active Storage: 65 mmtpa is currently injected into oil reservoirs for EOR (3) Equates to output of ~80 NET Power plants (2) Most CO 2 is sourced geologically (the EOR industry drills wells) Exploratory Storage: dozens of Class VI permits under review Significant industry interest in additional EOR applications Future Storage: substantial interest to open all candidate basins in US for CO 2 storage Active Storage Exploratory Storage Future Storage Dots indicate operating natural gas, coal and nuclear power plants 1. RONI estimates. Power plant data from EIA Monthly Generator Inventory. Retirement candidates are defined as power plants over halfway through the useful Facility Life as defined by Lazard’s LCOE v15.0. 2. NET Power plant equivalent estimates based on Gen 2 configuration. 3. “Carbon Dioxide Enhanced Oil Recovery: A Critical Domestic Energy, Economic, And Environmental Opportunity.” National Enhanced Oil Recovery Initiative. February 2012. 4. Power plants data from EIA Monthly Generator Inventory. Storage boundaries per RONI and include 40 - mile buffer zone (denoted by light shading) to demonstrate pipeline access to a given basin.

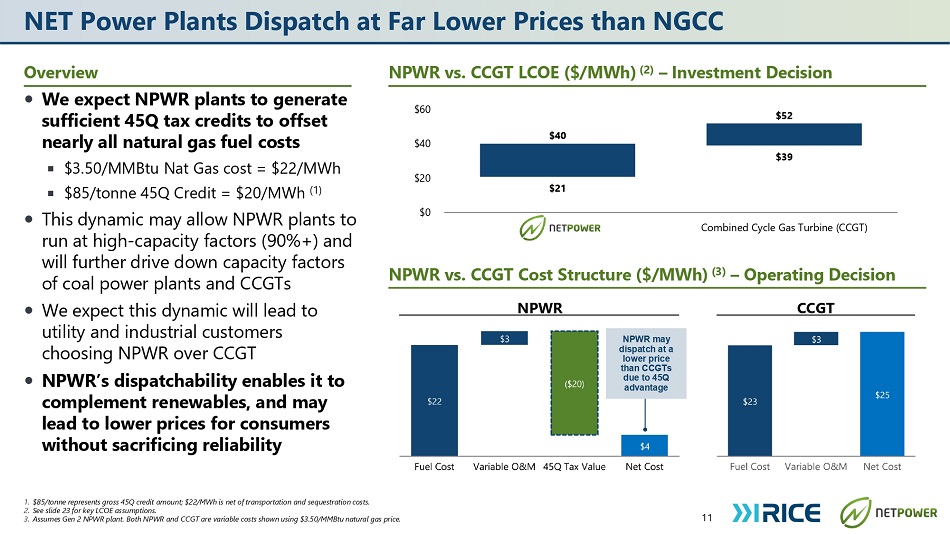

NET Power Plants Dispatch at Far Lower Prices than NGCC 11 1. $85/tonne represents gross 45Q credit amount; $22/MWh is net of transportation and sequestration costs. 2. See slide 23 for key LCOE assumptions. 3. Assumes Gen 2 NPWR plant. Both NPWR and CCGT are variable costs shown using $3.50/MMBtu natural gas price. Overview NPWR vs. CCGT LCOE ($/MWh) (2) – Investment Decision We expect NPWR plants to generate sufficient 45Q tax credits to offset nearly all natural gas fuel costs $3.50/MMBtu Nat Gas cost = $22/MWh $85/tonne 45Q Credit = $20/MWh (1) This dynamic may allow NPWR plants to run at high - capacity factors (90%+) and will further drive down capacity factors of coal power plants and CCGTs We expect this dynamic will lead to utility and industrial customers choosing NPWR over CCGT NPWR’s dispatchability enables it to complement renewables, and may lead to lower prices for consumers without sacrificing reliability $21 $39 $40 $52 $0 $20 $40 $60 NET Power Gen 2 Combined Cycle Gas Turbine (CCGT) NPWR may dispatch at a lower price than CCGTs due to 45Q advantage NPWR vs. CCGT Cost Structure ($/MWh) (3) – Operating Decision NPWR CCGT

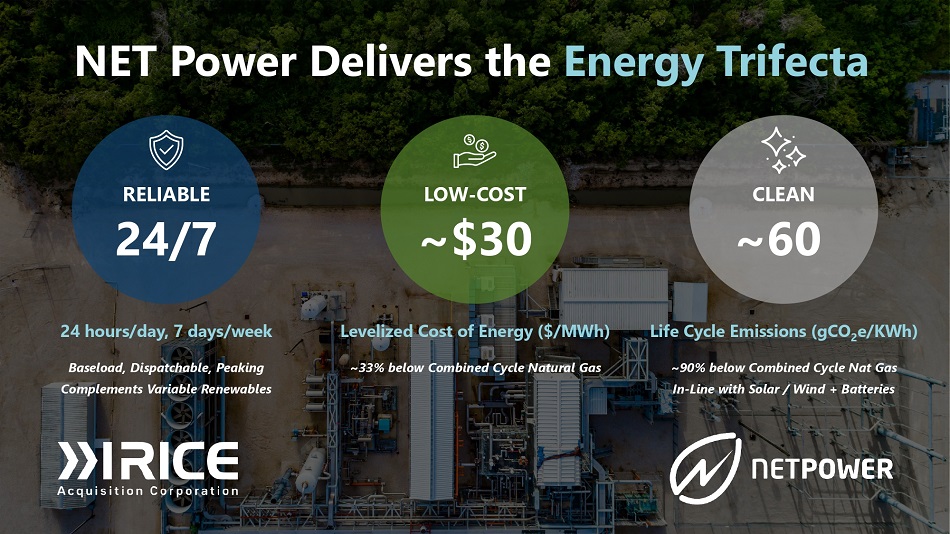

RELIABLE 24/7 24 hours/day, 7 days/week Baseload, Dispatchable, Peaking Complements Variable Renewables LOW - COST ~$30 Levelized Cost of Energy ($/MWh) ~33% below Combined Cycle Natural Gas CLEAN ~60 Life Cycle Emissions (gCO 2 e/KWh) ~90% below Combined Cycle Nat Gas In - Line with Solar / Wind + Batteries NET Power Delivers the Energy Trifecta

13 Technology Brock Forrest Chief Technology Officer

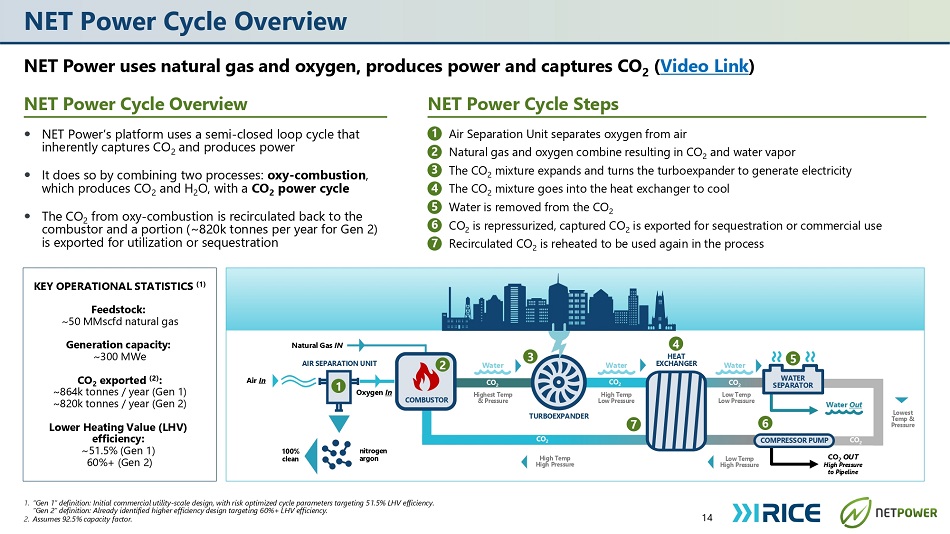

NET Power Cycle Overview NET Power uses natural gas and oxygen, produces power and captures CO 2 ( Video Link ) NET Power Cycle Overview NET Power Cycle Steps 14 1. “Gen 1” definition: Initial commercial utility - scale design, with risk optimized cycle parameters targeting 51.5% LHV efficiency. “Gen 2” definition: Already identified higher efficiency design targeting 60%+ LHV efficiency. 2. Assumes 92.5% capacity factor. NET Power’s platform uses a semi - closed loop cycle that inherently captures CO 2 and produces power It does so by combining two processes: oxy - combustion , which produces CO 2 and H 2 O, with a CO 2 power cycle The CO from oxy - combustion is recirculated back to the combus 2 tor and a portion (~820k tonnes per year for Gen 2) is exported for utilization or sequestration 1 Air Separation Unit separates oxygen from air 2 Natural gas and oxygen combine resulting in CO 2 and water vapor 3 The CO 2 mixture expands and turns the turboexpander to generate electricity 4 The CO 2 mixture goes into the heat exchanger to cool 5 Water is removed from the CO 2 6 CO 2 is repressurized, captured CO 2 is exported for sequestration or commercial use 7 Recirculated CO 2 is reheated to be used again in the process Natural Gas IN AIR SEPARATION UNIT TURBOEXPANDER 100% clean nitrogen argon CO 2 OUT High Pressure to Pipeline Water Out High Temp High Pressure Air In Lowest Temp & Pressure Water CO 2 High Temp Low Pressure Water CO 2 Highest Temp & Pressure Water CO 2 Low Temp Low Pressure CO 2 COMBUSTOR 2 3 4 HEAT EXCHANGER 5 7 6 COMPRESSOR PUMP WATER SEPARATOR CO 2 KEY OPERATIONAL STATISTICS (1) Feedstock: ~50 MMscfd natural gas Generation capacity: ~300 MWe CO 2 exported (2) : ~864k tonnes / year (Gen 1) ~820k tonnes / year (Gen 2) Lower Heating Value (LHV) efficiency: ~51.5% (Gen 1) 60%+ (Gen 2) Low Temp High Pressure Oxygen In 1

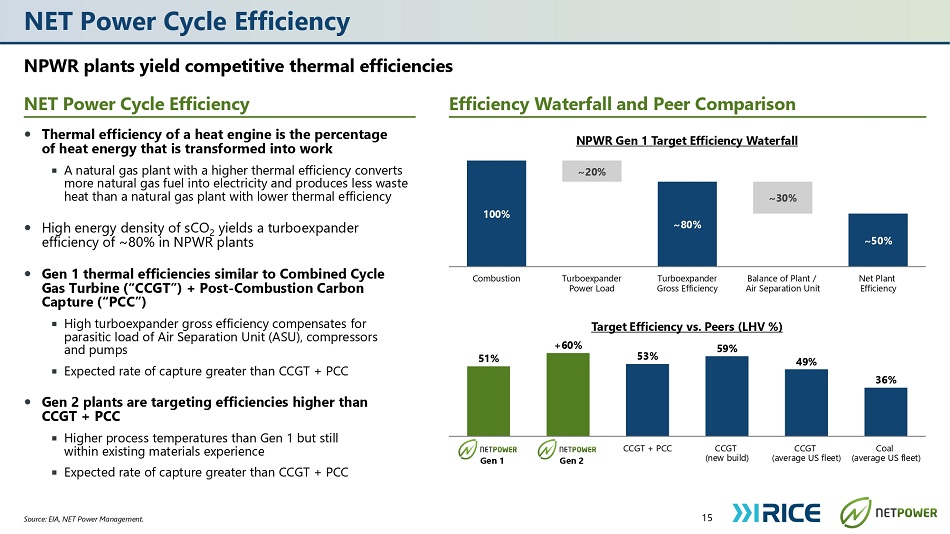

NET Power Cycle Efficiency NPWR plants yield competitive thermal efficiencies NET Power Cycle Efficiency Efficiency Waterfall and Peer Comparison 15 Source: EIA, NET Power Management. Thermal efficiency of a heat engine is the percentage of heat energy that is transformed into work A natural gas plant with a higher thermal efficiency converts more natural gas fuel into electricity and produces less waste heat than a natural gas plant with lower thermal efficiency High energy density of sCO 2 yields a turboexpander efficiency of ~80% in NPWR plants Gen 1 thermal efficiencies similar to Combined Cycle Gas Turbine (“CCGT”) + Post - Combustion Carbon Capture (“PCC”) High turboexpander gross efficiency compensates for parasitic load of Air Separation Unit (ASU), compressors and pumps Expected rate of capture greater than CCGT + PCC Gen 2 plants are targeting efficiencies higher than CCGT + PCC Higher process temperatures than Gen 1 but still within existing materials experience Expected rate of capture greater than CCGT + PCC NPWR Gen 1 Target Efficiency Waterfall 100% ~80% ~50% ~20% ~30% Target Efficiency vs. Peers (LHV %) 51% +60% 53% 59% 49% 36% CCGT + PCC CCGT (new build) CCGT (average US fleet) Coal (average US fleet) Combustion Turboexpander Power Load Turboexpander Gross Efficiency Balance of Plant / Air Separation Unit Net Plant Efficiency Gen 2 Gen 1

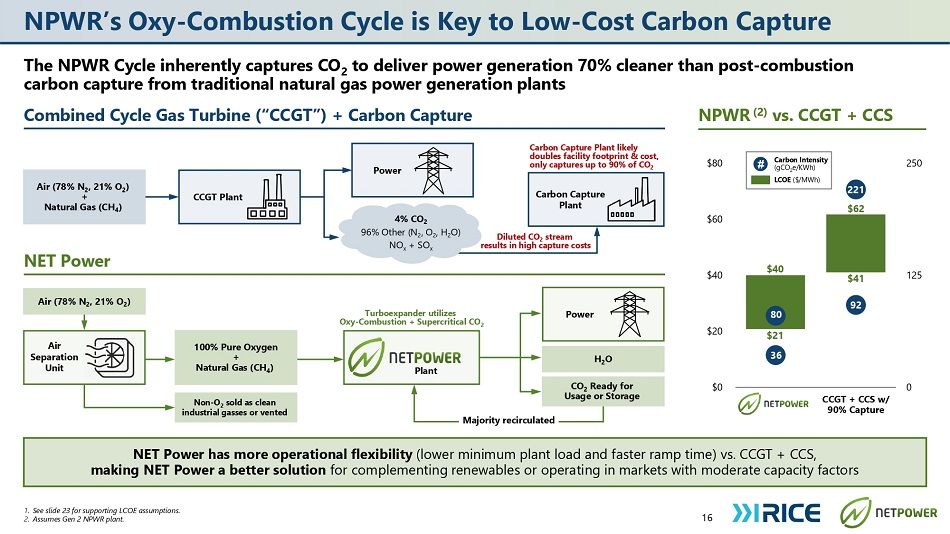

NPWR’s Oxy - Combustion Cycle is Key to Low - Cost Carbon Capture The NPWR Cycle inherently captures CO 2 to deliver power generation 70% cleaner than post - combustion carbon capture from traditional natural gas power generation plants Combined Cycle Gas Turbine (“CCGT”) + Carbon Capture NPWR (2) vs. CCGT + CCS 16 1. See slide 23 for supporting LCOE assumptions. 2. Assumes Gen 2 NPWR plant. CCGT Plant Air (78% N 2 , 21% O 2 ) + Natural Gas (CH 4 ) Power Carbon Capture Plant Carbon Capture Plant likely doubles facility footprint & cost, only captures up to 90% of CO 2 Diluted CO 2 stream results in high capture costs NET Power NET Power has more operational flexibility (lower minimum plant load and faster ramp time) vs. CCGT + CCS, making NET Power a better solution for complementing renewables or operating in markets with moderate capacity factors 4% CO 2 96% Other (N 2 , O 2 , H 2 O) NO x + SO x 0 125 250 $0 $20 $40 $60 $80 CCGT + CCS w/ 90% Capture 221 $62 92 80 $40 $21 36 $41 # Carbon Intensity (gCO 2 e/KWh) LCOE ($/MWh) Non - O 2 sold as clean industrial gasses or vented CO 2 Ready for Usage or Storage 100% Pure Oxygen + Natural Gas (CH 4 ) Plant H 2 O Turboexpander utilizes Oxy - Combustion + Supercritical CO 2 Power Majority recirculated Air Separation Unit Air (78% N 2 , 21% O 2 )

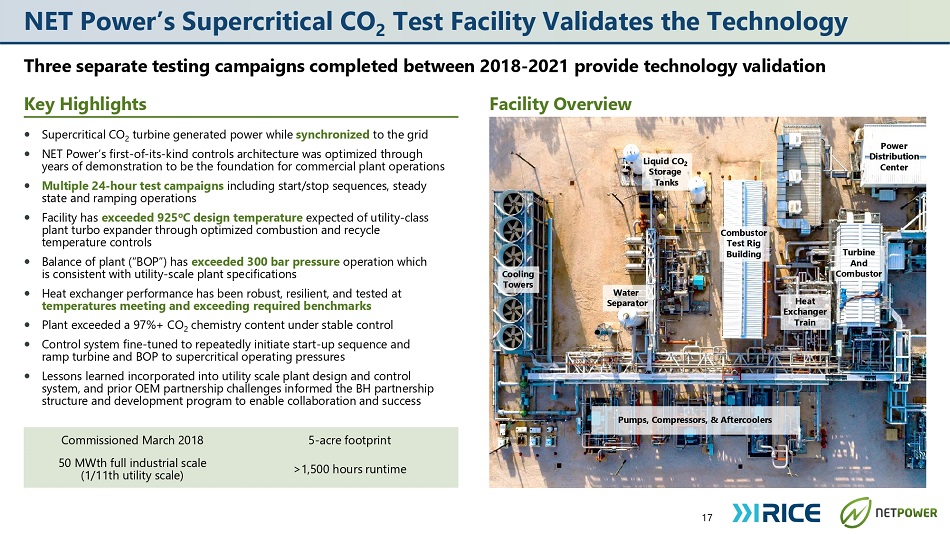

NET Power’s Supercritical CO 2 Test Facility Validates the Technology Three separate testing campaigns completed between 2018 - 2021 provide technology validation Key Highlights Facility Overview 17 Supercritical CO 2 turbine generated power while synchronized to the grid NET Power’s first - of - its - kind controls architecture was optimized through years of demonstration to be the foundation for commercial plant operations Multiple 24 - hour test campaigns including start/stop sequences, steady state and ramping operations Facility has exceeded 925 o C design temperature expected of utility - class plant turbo expander through optimized combustion and recycle temperature controls Balance of plant (“BOP”) has exceeded 300 bar pressure operation which is consistent with utility - scale plant specifications Heat exchanger performance has been robust, resilient, and tested at temperatures meeting and exceeding required benchmarks Plant exceeded a 97%+ CO 2 chemistry content under stable control Control system fine - tuned to repeatedly initiate start - up sequence and ramp turbine and BOP to supercritical operating pressures Lessons learned incorporated into utility scale plant design and control system, and prior OEM partnership challenges informed the BH partnership structure and development program to enable collaboration and success Pumps, Compressors, & Aftercoolers Cooling Towers Water Separator Liquid CO 2 Storage Tanks Combustor Test Rig Building Heat Exchanger Train Turbine And Combustor Power Distribution Center Commissioned March 2018 5 - acre footprint 50 MWth full industrial scale (1/11th utility scale) >1,500 hours runtime

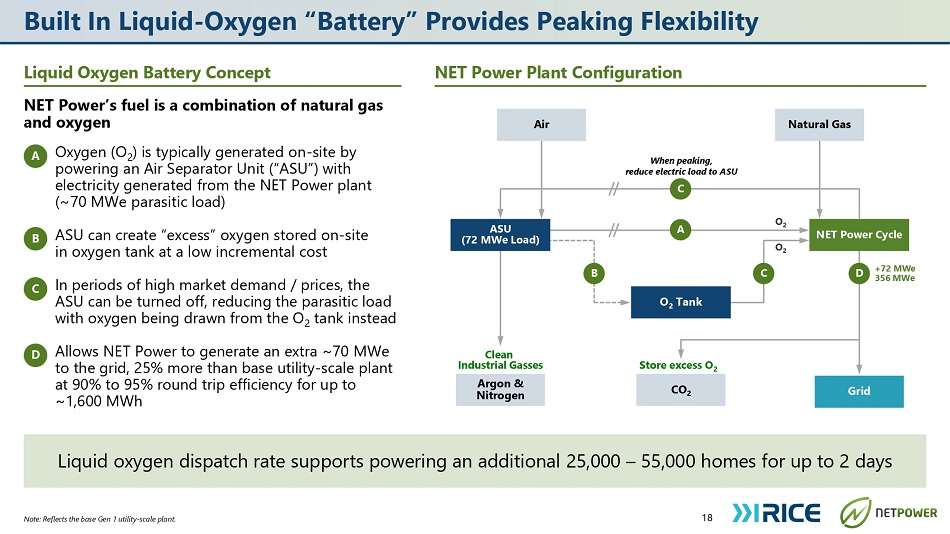

Built In Liquid - Oxygen “Battery” Provides Peaking Flexibility 18 Note: Reflects the base Gen 1 utility - scale plant. Liquid Oxygen Battery Concept NET Power Plant Configuration NET Power’s fuel is a combination of natural gas and oxygen A Oxygen (O 2 ) is typically generated on - site by B powering an Air Separator Unit (“ASU”) with electricity generated from the NET Power plant (~70 MWe parasitic load) ASU can create “excess” oxygen stored on - site in oxygen tank at a low incremental cost C In periods of high market demand / prices, the ASU can be turned off, reducing the parasitic load with oxygen being drawn from the O 2 tank instead D Allows NET Power to generate an extra ~ 70 MWe to the grid, 25 % more than base utility - scale plant at 90 % to 95 % round trip efficiency for up to ~ 1 , 600 MWh Liquid oxygen dispatch rate supports powering an additional 25,000 – 55,000 homes for up to 2 days +72 MWe 356 MWe Grid Argon & Nitrogen CO 2 D O 2 Clean Industrial Gasses Store excess O 2 When peaking, reduce electric load to ASU C NET Power Cycle Air Natural Gas A O 2 Tank C O 2 B ASU (72 MWe Load)

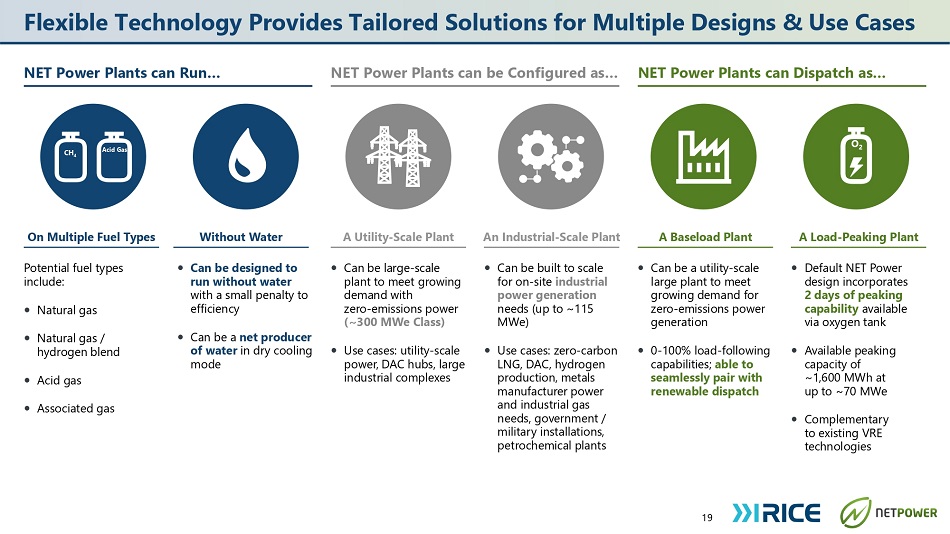

Flexible Technology Provides Tailored Solutions for Multiple Designs & Use Cases 19 NET Power Plants can Run… NET Power Plants can be Configured as… NET Power Plants can Dispatch as… CH 4 Acid Gas O 2 On Multiple Fuel Types Without Water A Utility - Scale Plant An Industrial - Scale Plant A Baseload Plant A Load - Peaking Plant Potential fuel types include: Natural gas Natural gas / hydrogen blend Acid gas Associated gas Can be designed to run without water with a small penalty to efficiency Can be a net producer of water in dry cooling mode Can be large - scale plant to meet growing demand with zero - emissions power (~300 MWe Class) Use cases: utility - scale power, DAC hubs, large industrial complexes Can be built to scale for on - site industrial power generation needs (up to ~115 MWe) Use cases: zero - carbon LNG, DAC, hydrogen production, metals manufacturer power and industrial gas needs, government / military installations, petrochemical plants Can be a utility - scale large plant to meet growing demand for zero - emissions power generation 0 - 100% load - following capabilities; able to seamlessly pair with renewable dispatch Default NET Power design incorporates 2 days of peaking capability available via oxygen tank Available peaking capacity of ~1,600 MWh at up to ~70 MWe Complementary to existing VRE technologies

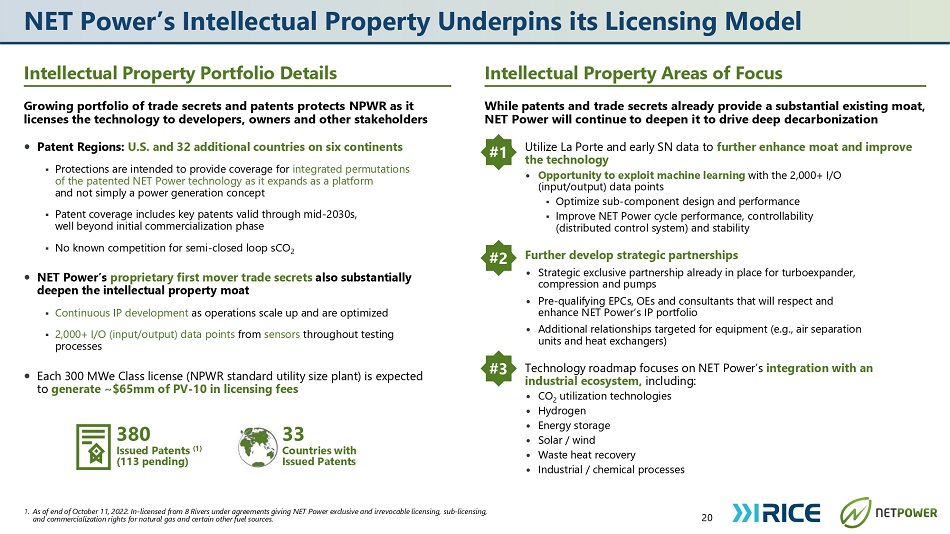

NET Power’s Intellectual Property Underpins its Licensing Model 20 1. As of end of October 11, 2022. In - licensed from 8 Rivers under agreements giving NET Power exclusive and irrevocable licensing, sub - licensing, and commercialization rights for natural gas and certain other fuel sources. Intellectual Property Portfolio Details Intellectual Property Areas of Focus Growing portfolio of trade secrets and patents protects NPWR as it licenses the technology to developers, owners and other stakeholders Patent Regions: U.S. and 32 additional countries on six continents ▪ Protections are intended to provide coverage for integrated permutations of the patented NET Power technology as it expands as a platform and not simply a power generation concept ▪ Patent coverage includes key patents valid through mid - 2030s, well beyond initial commercialization phase ▪ No known competition for semi - closed loop sCO 2 NET Power’s proprietary first mover trade secrets also substantially deepen the intellectual property moat ▪ Continuous IP development as operations scale up and are optimized ▪ 2,000+ I/O (input/output) data points from sensors throughout testing processes Each 300 MWe Class license (NPWR standard utility size plant) is expected to generate ~$65mm of PV - 10 in licensing fees 1) Utilize La Porte and early SN data to further enhance moat and improve the technology Opportunity to exploit machine learning with the 2,000+ I/O (input/output) data points ▪ Optimize sub - component design and performance ▪ Improve NET Power cycle performance, controllability (distributed control system) and stability Further develop strategic partnerships Strategic exclusive partnership already in place for turboexpander, compression and pumps Pre - qualifying EPCs, OEs and consultants that will respect and enhance NET Power’s IP portfolio Additional relationships targeted for equipment (e.g., air separation units and heat exchangers) Technology roadmap focuses on NET Power’s integration with an industrial ecosystem, including: CO 2 utilization technologies Hydrogen Energy storage Solar / wind Waste heat recovery Industrial / chemical processes 2 3) While patents and trade secrets already provide a substantial existing moat, NET Power will continue to deepen it to drive deep decarbonization #1 #2 ) #3 380 Issued Patents (1) (113 pending) 33 Countries with Issued Patents

21 Economics & Business Model Akash Patel Chief Financial Officer

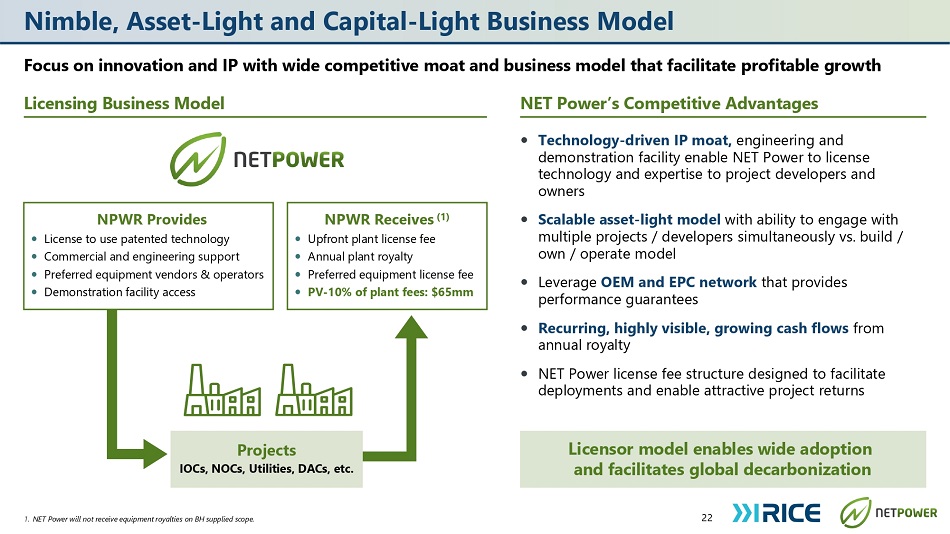

Nimble, Asset - Light and Capital - Light Business Model Focus on innovation and IP with wide competitive moat and business model that facilitate profitable growth Licensing Business Model NET Power’s Competitive Advantages 22 1. NET Power will not receive equipment royalties on BH supplied scope. Technology - driven IP moat, engineering and demonstration facility enable NET Power to license technology and expertise to project developers and owners Scalable asset - light model with ability to engage with multiple projects / developers simultaneously vs . build / own / operate model Leverage OEM and EPC network that provides performance guarantees Recurring, highly visible, growing cash flows from annual royalty NET Power license fee structure designed to facilitate deployments and enable attractive project returns Licensor model enables wide adoption and facilitates global decarbonization NPWR Receives (1) Upfront plant license fee Annual plant royalty Preferred equipment license fee PV - 10% of plant fees: $65mm NPWR Provides License to use patented technology Commercial and engineering support Preferred equipment vendors & operators Demonstration facility access Projects IOCs, NOCs, Utilities, DACs, etc.

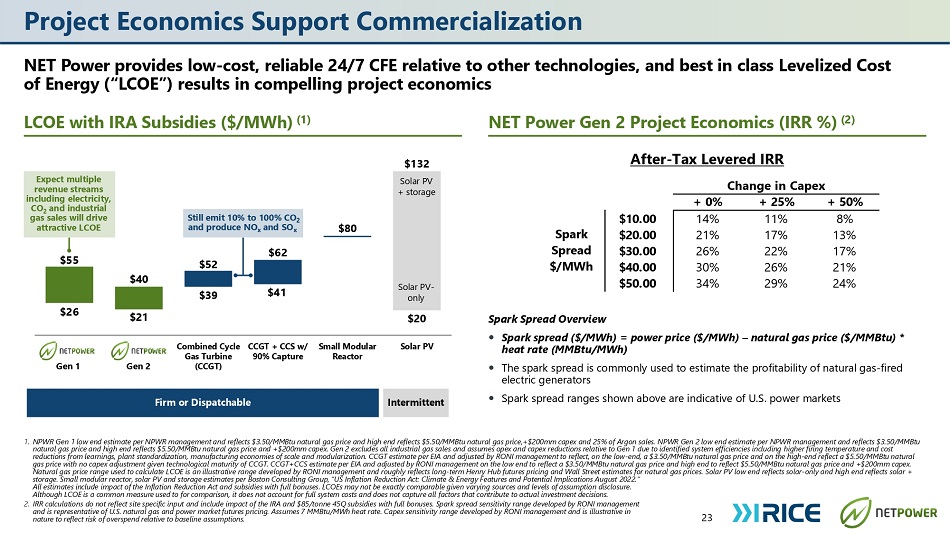

Project Economics Support Commercialization NET Power provides low - cost, reliable 24/7 CFE relative to other technologies, and best in class Levelized Cost of Energy (“LCOE”) results in compelling project economics LCOE with IRA Subsidies ($/MWh) (1) NET Power Gen 2 Project Economics (IRR %) (2) 23 1. NPWR Gen 1 low end estimate per NPWR management and reflects $3.50/MMBtu natural gas price and high end reflects $5.50/MMBtu natural gas price,+$200mm capex and 25% of Argon sales. NPWR Gen 2 low end estimate per NPWR management and reflects $3.50/MMBtu natural gas price and high end reflects $5.50/MMBtu natural gas price and +$200mm capex. Gen 2 excludes all industrial gas sales and assumes opex and capex reductions relative to Gen 1 due to identified system efficiencies including higher firing temperature and cost reductions from learnings, plant standardization, manufacturing economies of scale and modularization. CCGT estimate per EIA and adjusted by RONI management to reflect, on the low - end, a $3.50/MMBtu natural gas price and on the high - end reflect a $5.50/MMBtu natural gas price with no capex adjustment given technological maturity of CCGT. CCGT+CCS estimate per EIA and adjusted by RONI management on the low end to reflect a $3.50/MMBtu natural gas price and high end to reflect $5.50/MMBtu natural gas price and +$200mm capex. Natural gas price range used to calculate LCOE is an illustrative range developed by RONI management and roughly reflects long - term Henry Hub futures pricing and Wall Street estimates for natural gas prices. Solar PV low end reflects solar - only and high end reflects solar + storage. Small modular reactor, solar PV and storage estimates per Boston Consulting Group, “US Inflation Reduction Act: Climate & Energy Features and Potential Implications August 2022.” All estimates include impact of the Inflation Reduction Act and subsidies with full bonuses. LCOEs may not be exactly comparable given varying sources and levels of assumption disclosure. Although LCOE is a common measure used to for comparison, it does not account for full system costs and does not capture all factors that contribute to actual investment decisions. 2. IRR calculations do not reflect site specific input and include impact of the IRA and $85/tonne 45Q subsidies with full bonuses. Spark spread sensitivity range developed by RONI management and is representative of U.S. natural gas and power market futures pricing. Assumes 7 MMBtu/MWh heat rate. Capex sensitivity range developed by RONI management and is illustrative in nature to reflect risk of overspend relative to baseline assumptions. $26 $21 $39 $41 $20 $55 $40 $52 $62 $80 $132 Combined Cycle Gas Turbine (CCGT) CCGT + CCS w/ 90% Capture Small Modular Reactor Solar PV Expect multiple revenue streams including electricity, CO 2 and industrial gas sales will drive attractive LCOE Intermittent Firm or Dispatchable Gen 1 Gen 2 Solar PV + storage Solar PV - only Spark Spread Overview Spark spread ($/MWh) = power price ($/MWh) – natural gas price ($/MMBtu) * heat rate (MMBtu/MWh) The spark spread is commonly used to estimate the profitability of natural gas - fired electric generators Spark spread ranges shown above are indicative of U.S. power markets Spark $20.00 21% 17% 13% Spread $30.00 26% 22% 17% $/MWh $40.00 30% 26% 21% $50.00 34% 29% 24% After - Tax Levered IRR Change in Capex + 0% + 25% + 50% $10.00 14% 11% 8% Still emit 10% to 100% CO 2 and produce NO x and SO x

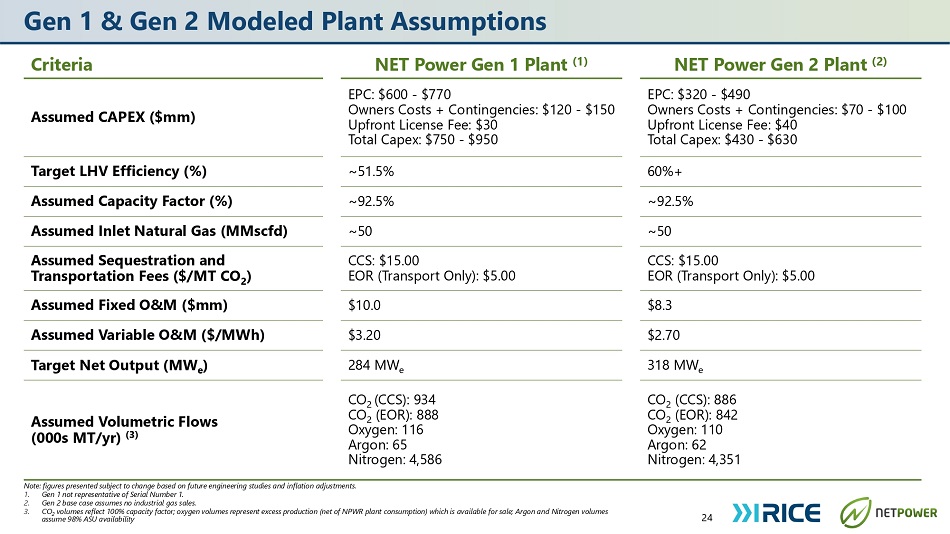

Criteria NET Power Gen 1 Plant (1) NET Power Gen 2 Plant (2) Assumed CAPEX ($mm) EPC: $600 - $770 Owners Costs + Contingencies: $120 - $150 Upfront License Fee: $30 Total Capex: $750 - $950 EPC: $320 - $490 Owners Costs + Contingencies: $70 - $100 Upfront License Fee: $40 Total Capex: $430 - $630 Target LHV Efficiency (%) ~51.5% 60%+ Assumed Capacity Factor (%) ~92.5% ~92.5% Assumed Inlet Natural Gas (MMscfd) ~50 ~50 Assumed Sequestration and Transportation Fees ($/MT CO 2 ) CCS: $15.00 EOR (Transport Only): $5.00 CCS: $15.00 EOR (Transport Only): $5.00 Assumed Fixed O&M ($mm) $10.0 $8.3 Assumed Variable O&M ($/MWh) $3.20 $2.70 Target Net Output (MW e ) 284 MW e 318 MW e Assumed Volumetric Flows (000s MT/yr) (3) CO 2 (CCS): 934 CO 2 (EOR): 888 Oxygen: 116 Argon: 65 Nitrogen: 4,586 CO 2 (CCS): 886 CO 2 (EOR): 842 Oxygen: 110 Argon: 62 Nitrogen: 4,351 Gen 1 & Gen 2 Modeled Plant Assumptions 24 Note: figures presented subject to change based on future engineering studies and inflation adjustments. 1. Gen 1 not representative of Serial Number 1. 2. Gen 2 base case assumes no industrial gas sales. 3. CO 2 volumes reflect 100% capacity factor; oxygen volumes represent excess production (net of NPWR plant consumption) which is available for sale; Argon and Nitrogen volumes assume 98% ASU availability

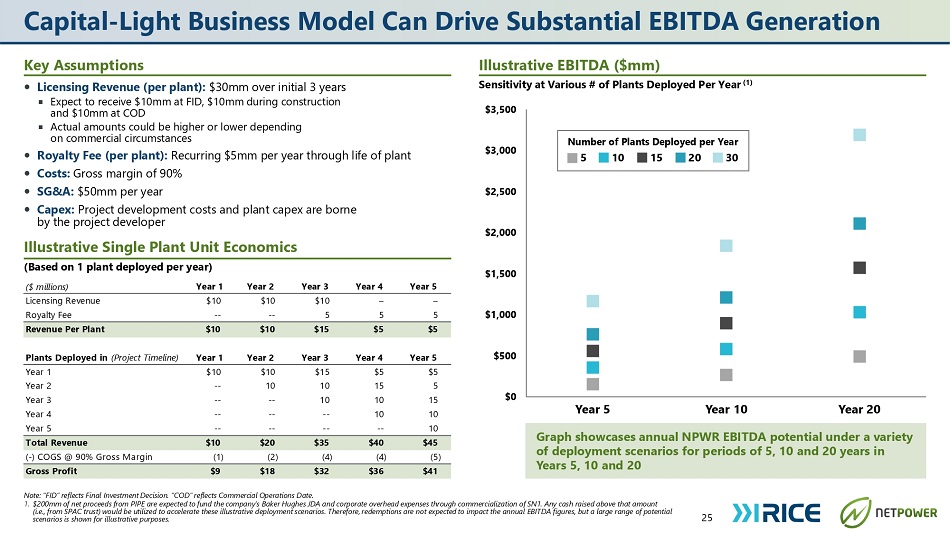

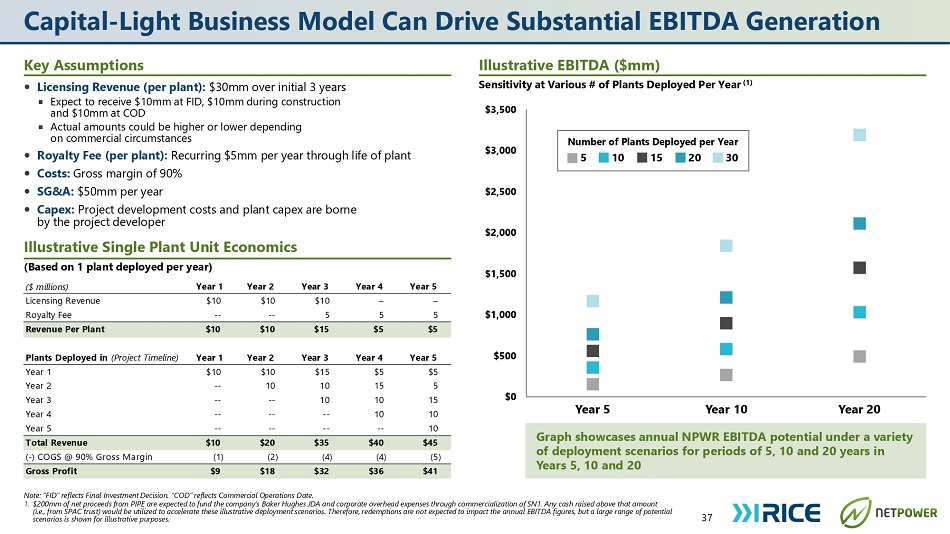

Capital - Light Business Model Can Drive Substantial EBITDA Generation 25 h commercialization of SN1. Any cash raised above that amount (i.e., from SPAC trust) would be utilized to accelerate these illustrative deployment scenarios. Therefore, redemptions are not expected to impact the annual EBITDA figures, but a large range of potential scenarios is shown for illustrative purposes. Key Assumptions Licensing Revenue (per plant): $30mm over initial 3 years Expect to receive $10mm at FID, $10mm during construction and $10mm at COD Actual amounts could be higher or lower depending on commercial circumstances Royalty Fee (per plant): Recurring $5mm per year through life of plant Costs: Gross margin of 90% SG&A: $50mm per year Capex: Project development costs and plant capex are borne by the project developer Illustrative Single Plant Unit Economics (Based on 1 plant deployed per year) ($ millions) Year 1 Year 2 Year 3 Year 4 Year 5 Licensing Revenue $10 $10 $10 – – Royalty Fee - - - - 5 5 5 Revenue Per Plant $10 $10 $15 $5 $5 Plants Deployed in (Project Timeline) Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 $10 $10 $15 $5 $5 Year 2 - - 10 10 15 5 Year 3 - - - - 10 10 15 Year 4 - - - - - - 10 10 Year 5 - - - - - - - - 10 Total Revenue $10 $20 $35 $40 $45 ( - ) COGS @ 90% Gross Margin (1) (2) (4) (4) (5) Gross Profit $9 $18 $32 $36 $41 Note: “FID” reflects Final Investment Decision. “COD” reflects Commercial Operations Date. 1. $200mm of net proceeds from PIPE are expected to fund the company’s Baker Hughes JDA and corporate overhead expenses throug Illustrative EBITDA ($mm) Sensitivity at Various # of Plants Deployed Per Year (1) $2,000 $2,500 $3,000 $3,500 A e Number of Plants Deployed per Year 5 10 15 20 30 $1,500 $1,000 $500 $0 Year 5 Year 10 Year 20 Graph showcases annual NPWR EBITDA potential under a variety of deployment scenarios for periods of 5, 10 and 20 years in Years 5, 10 and 20

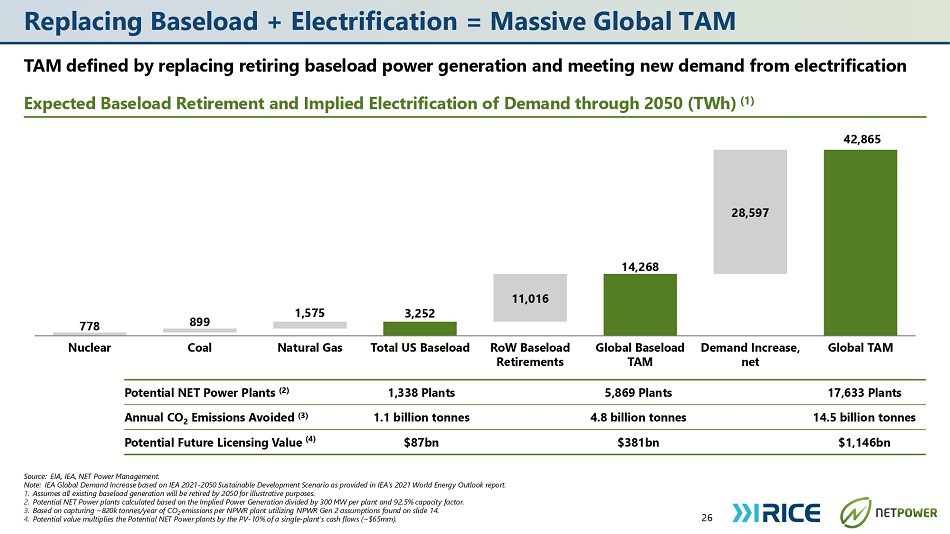

Replacing Baseload + Electrification = Massive Global TAM 26 Source: EIA, IEA, NET Power Management. Note: IEA Global Demand Increase based on IEA 2021 - 2050 Sustainable Development Scenario as provided in IEA’s 2021 World Energy Outlook report. 1. Assumes all existing baseload generation will be retired by 2050 for illustrative purposes. 2. Potential NET Power plants calculated based on the Implied Power Generation divided by 300 MW per plant and 92.5% capacity factor. 3. Based on capturing ~820k tonnes/year of CO 2 emissions per NPWR plant utilizing NPWR Gen 2 assumptions found on slide 14. 4. Potential value multiplies the Potential NET Power plants by the PV - 10% of a single - plant’s cash flows (~$65mm). TAM defined by replacing retiring baseload power generation and meeting new demand from electrification Expected Baseload Retirement and Implied Electrification of Demand through 2050 (TWh) (1) 42,865 778 3,252 14,268 899 1,575 11,016 28,597 Nuclear Coal Natural Gas Total US Baseload RoW Baseload Retirements Global Baseload TAM Demand Increase, net Global TAM Potential NET Power Plants (2) 1,338 Plants 5,869 Plants 17,633 Plants Annual CO 2 Emissions Avoided (3) 1.1 billion tonnes 4.8 billion tonnes 14.5 billion tonnes Potential Future Licensing Value (4) $87bn $381bn $1,146bn

27 Commercialization Brian Allen President and Chief Operating Officer

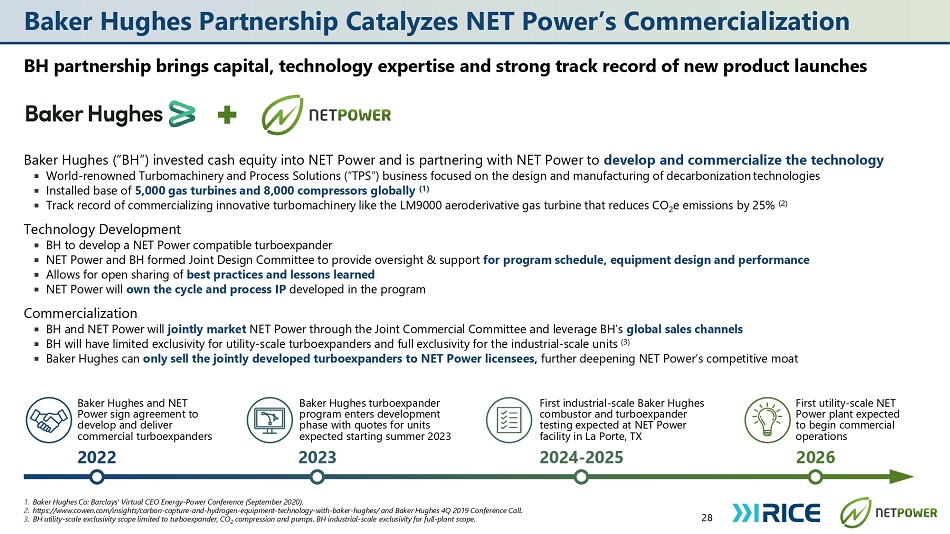

Baker Hughes Partnership Catalyzes NET Power’s Commercialization BH partnership brings capital, technology expertise and strong track record of new product launches 28 1. Baker Hughes Co: Barclays' Virtual CEO Energy - Power Conference (September 2020). 2. https: //w ww .cowen.com/insights/carbon - capture - and - hydrogen - equipment - technology - with - baker - hughes/ and Baker Hughes 4Q 2019 Conference Call. 3. BH utility - scale exclusivity scope limited to turboexpander, CO 2 compression and pumps. BH industrial - scale exclusivity for full - plant scope. Baker Hughes and NET Power sign agreement to develop and deliver commercial turboexpanders 2022 Baker Hughes turboexpander program enters development phase with quotes for units expected starting summer 2023 2023 First industrial - scale Baker Hughes combustor and turboexpander testing expected at NET Power facility in La Porte, TX 2024 - 2025 First utility - scale NET Power plant expected to begin commercial operations 2026 Baker Hughes (“BH”) invested cash equity into NET Power and is partnering with NET Power to develop and commercialize the technology World - renowned Turbomachinery and Process Solutions (“TPS”) business focused on the design and manufacturing of decarbonization technologies Installed base of 5,000 gas turbines and 8,000 compressors globally (1) Track record of commercializing innovative turbomachinery like the LM9000 aeroderivative gas turbine that reduces CO 2 e emissions by 25% (2) Technology Development BH to develop a NET Power compatible turboexpander NET Power and BH formed Joint Design Committee to provide oversight & support for program schedule, equipment design and performance Allows for open sharing of best practices and lessons learned NET Power will own the cycle and process IP developed in the program Commercialization BH and NET Power will jointly market NET Power through the Joint Commercial Committee and leverage BH’s global sales channels BH will have limited exclusivity for utility - scale turboexpanders and full exclusivity for the industrial - scale units (3) Baker Hughes can only sell the jointly developed turboexpanders to NET Power licensees, further deepening NET Power’s competitive moat

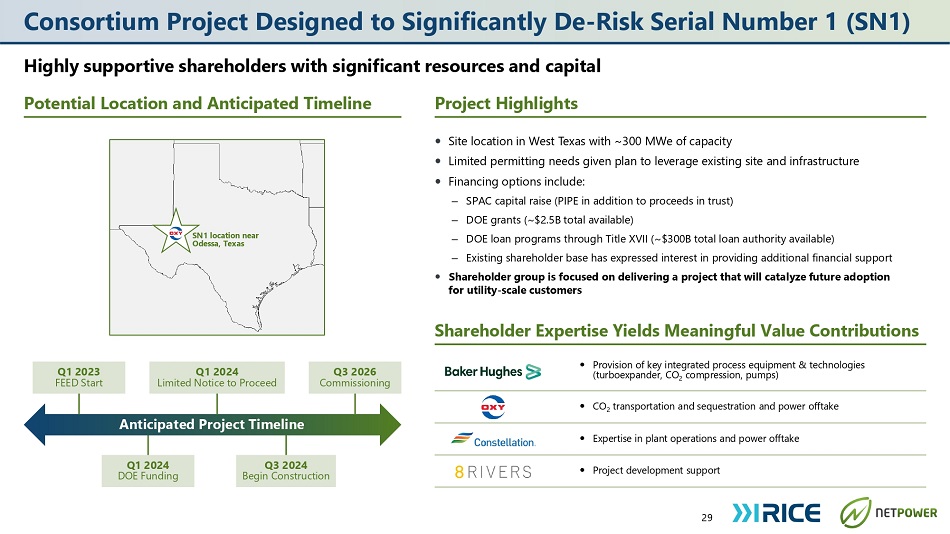

Consortium Project Designed to Significantly De - Risk Serial Number 1 (SN1) Highly supportive shareholders with significant resources and capital Potential Location and Anticipated Timeline Project Highlights 29 Q1 2024 DOE Funding Q3 2024 Begin Construction Q1 2024 Limited Notice to Proceed SN1 location near Odessa, Texas Q3 2026 Commissioning Q1 2023 FEED Start Anticipated Project Timeline Site location in West Texas with ~300 MWe of capacity Limited permitting needs given plan to leverage existing site and infrastructure Financing options include: ‒ SPAC capital raise (PIPE in addition to proceeds in trust) ‒ DOE grants (~$2.5B total available) ‒ DOE loan programs through Title XVII (~$300B total loan authority available) ‒ Existing shareholder base has expressed interest in providing additional financial support Shareholder group is focused on delivering a project that will catalyze future adoption for utility - scale customers Shareholder Expertise Yields Meaningful Value Contributions Provision of key integrated process equipment & technologies (turboexpander, CO 2 compression, pumps) CO 2 transportation and sequestration and power offtake Expertise in plant operations and power offtake Project development support

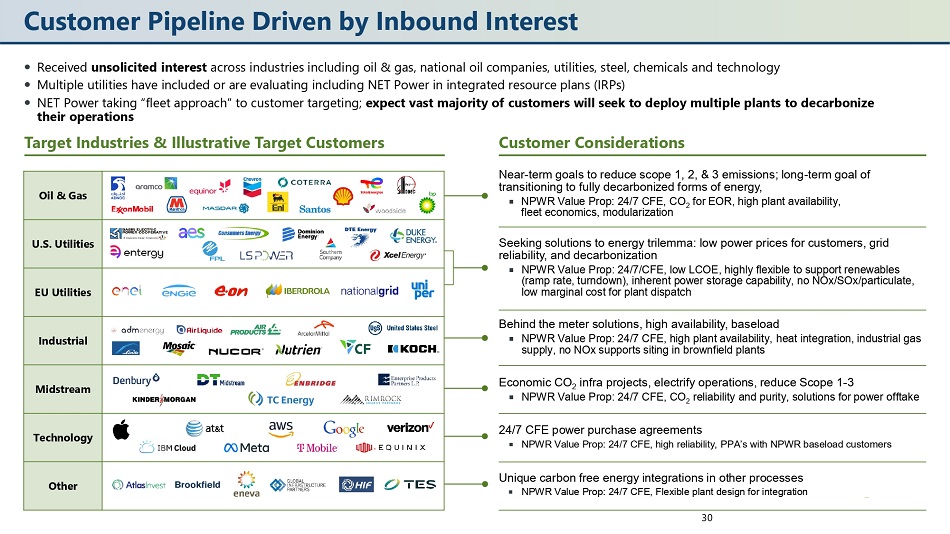

Customer Pipeline Driven by Inbound Interest Oil & Gas U.S. Utilities EU Utilities Industrial Midstream Technology Other Received unsolicited interest across industries including oil & gas, national oil companies, utilities, steel, chemicals and technology Multiple utilities have included or are evaluating including NET Power in integrated resource plans (IRPs) NET Power taking “fleet approach” to customer targeting; expect vast majority of customers will seek to deploy multiple plants to decarbonize their operations Target Industries & Illustrative Target Customers Customer Considerations Near - term goals to reduce scope 1, 2, & 3 emissions; long - term goal of transitioning to fully decarbonized forms of energy, NPWR Value Prop: 24/7 CFE, CO 2 for EOR, high plant availability, fleet economics, modularization Seeking solutions to energy trilemma: low power prices for customers, grid reliability, and decarbonization NPWR Value Prop: 24/7/CFE, low LCOE, highly flexible to support renewables (ramp rate, turndown), inherent power storage capability, no NOx/SOx/particulate, low marginal cost for plant dispatch Behind the meter solutions, high availability, baseload NPWR Value Prop: 24/7 CFE, high plant availability, heat integration, industrial gas supply, no NOx supports siting in brownfield plants Economic CO 2 infra projects, electrify operations, reduce Scope 1 - 3 NPWR Value Prop: 24/7 CFE, CO 2 reliability and purity, solutions for power offtake 24/7 CFE power purchase agreements NPWR Value Prop: 24/7 CFE, high reliability, PPA’s with NPWR baseload customers Unique carbon free energy integrations in other processes NPWR Value Prop: 24/7 CFE, Flexible plant design for integration 30

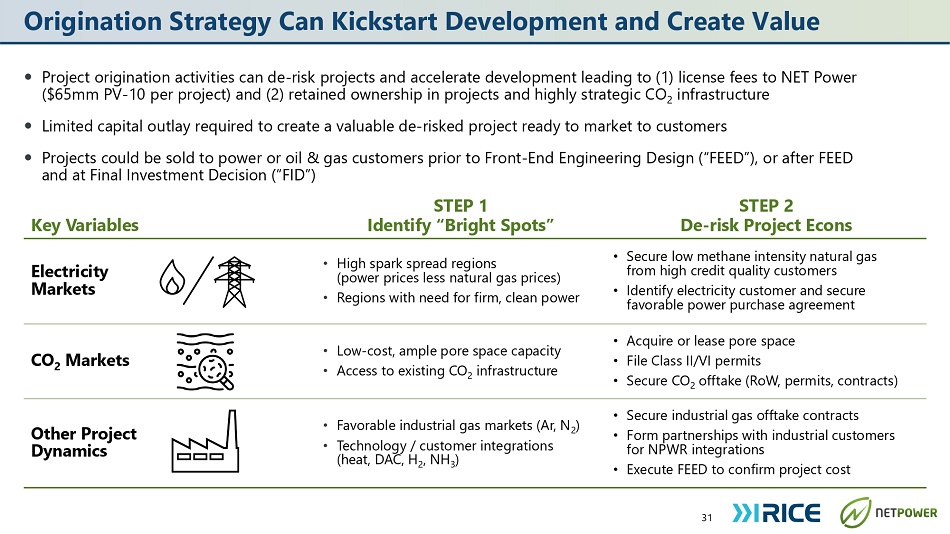

Origination Strategy Can Kickstart Development and Create Value Project origination activities can de - risk projects and accelerate development leading to (1) license fees to NET Power ($65mm PV - 10 per project) and (2) retained ownership in projects and highly strategic CO 2 infrastructure Limited capital outlay required to create a valuable de - risked project ready to market to customers Projects could be sold to power or oil & gas customers prior to Front - End Engineering Design (“FEED”), or after FEED and at Final Investment Decision (“FID”) 31 Key Variables STEP 1 Identify “Bright Spots” STEP 2 De - risk Project Econs Electricity Markets • High spark spread regions (power prices less natural gas prices) • Regions with need for firm, clean power • Secure low methane intensity natural gas from high credit quality customers • Identify electricity customer and secure favorable power purchase agreement CO 2 Markets • Low - cost, ample pore space capacity • Access to existing CO 2 infrastructure • Acquire or lease pore space • File Class II/VI permits • Secure CO 2 offtake (RoW, permits, contracts) Other Project Dynamics • Favorable industrial gas markets (Ar, N 2 ) • Technology / customer integrations (heat, DAC, H 2 , NH 3 ) • Secure industrial gas offtake contracts • Form partnerships with industrial customers for NPWR integrations • Execute FEED to confirm project cost

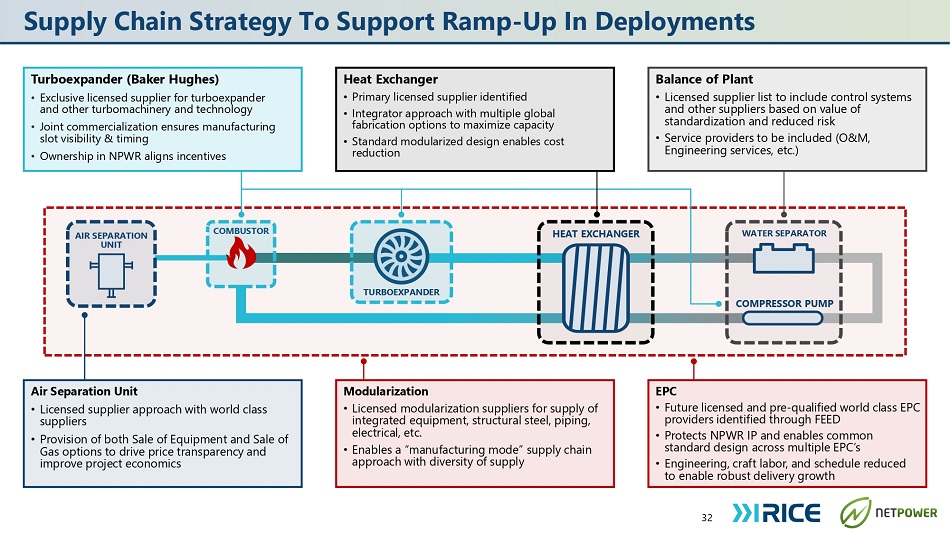

upply Chain Strategy To Support Ramp - Up In Deployments 32 COMBUSTOR WATER SEPARATOR Air Separation Unit • Licensed supplier approach with world class suppliers • Provision of both Sale of Equipment and Sale of Gas options to drive price transparency and improve project economics Turboexpander (Baker Hughes) • Exclusive licensed supplier for turboexpander and other turbomachinery and technology • Joint commercialization ensures manufacturing slot visibility & timing • Ownership in NPWR aligns incentives Heat Exchanger • Primary licensed supplier identified • Integrator approach with multiple global fabrication options to maximize capacity • Standard modularized design enables cost reduction Balance of Plant • Licensed supplier list to include control systems and other suppliers based on value of standardization and reduced risk • Service providers to be included (O&M, Engineering services, etc.) EPC • Future licensed and pre - qualified world class EPC providers identified through FEED • Protects NPWR IP and enables common standard design across multiple EPC’s • Engineering, craft labor, and schedule reduced to enable robust delivery growth Modularization • Licensed modularization suppliers for supply of integrated equipment, structural steel, piping, electrical, etc. • Enables a “manufacturing mode” supply chain approach with diversity of supply COMPRESSOR PUMP TURBOEXPANDER AIR SEPARATION UNIT HEAT EXCHANGER

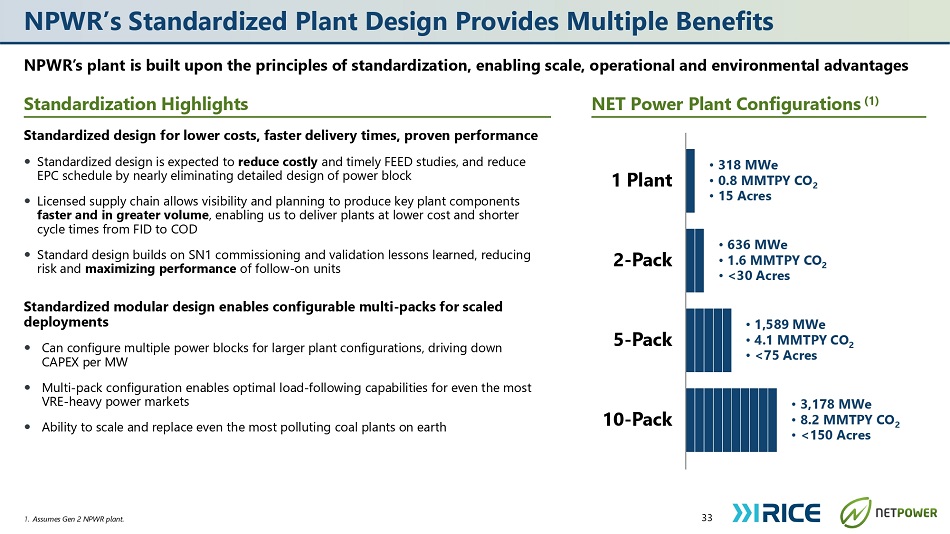

NPWR’s Standardized Plant Design Provides Multiple Benefits NPWR’s plant is built upon the principles of standardization, enabling scale, operational and environmental advantages Standardization Highlights NET Power Plant Configurations (1) 33 1. Assumes Gen 2 NPWR plant. Standardized design for lower costs, faster delivery times, proven performance Standardized design is expected to reduce costly and timely FEED studies, and reduce EPC schedule by nearly eliminating detailed design of power block Licensed supply chain allows visibility and planning to produce key plant components faster and in greater volume , enabling us to deliver plants at lower cost and shorter cycle times from FID to COD Standard design builds on SN 1 commissioning and validation lessons learned, reducing risk and maximizing performance of follow - on units Standardized modular design enables configurable multi - packs for scaled deployments Can configure multiple power blocks for larger plant configurations, driving down CAPEX per MW Multi - pack configuration enables optimal load - following capabilities for even the most VRE - heavy power markets Ability to scale and replace even the most polluting coal plants on earth • 318 MWe • 0.8 MMTPY CO 2 • 15 Acres • 636 MWe • 1.6 MMTPY CO 2 • <30 Acres • 1,589 MWe • 4.1 MMTPY CO 2 • <75 Acres • 3,178 MWe • 8.2 MMTPY CO 2 • <150 Acres 1 Plant 2 - Pack 5 - Pack 10 - Pack

34 Valuation & Funding Kyle Derham Chief Executive Officer, RONI and Incoming Board Member, NPWR

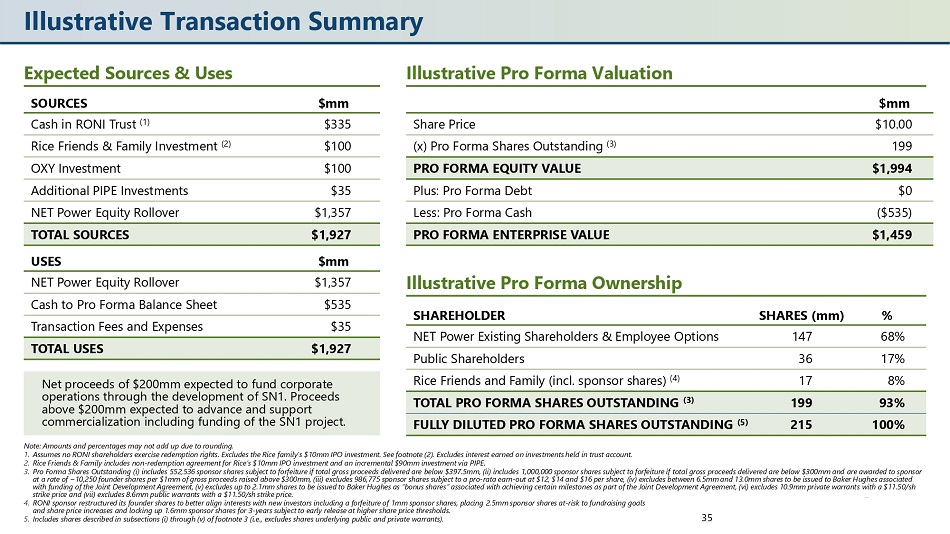

ustrative Transaction Summary 35 Note: Amounts and percentages may not add up due to rounding. 1. Assumes no RONI shareholders exercise redemption rights. Excludes the Rice family’s $10mm IPO investment. See footnote (2). Excludes interest earned on investments held in trust account. 2. Rice Friends & Family includes non - redemption agreement for Rice’s $10mm IPO investment and an incremental $90mm investment via PIPE. 3. Pro Forma Shares Outstanding (i) includes 552,536 sponsor shares subject to forfeiture if total gross proceeds delivered are below $397.5mm, (ii) includes 1,000,000 sponsor shares subject to forfeiture if total gross proceeds delivered are below $300mm and are awarded to sponsor at a rate of ~10,250 founder shares per $1mm of gross proceeds raised above $300mm, (iii) excludes 986,775 sponsor shares subject to a pro - rata earn - out at $12, $14 and $16 per share, (iv) excludes between 6.5mm and 13.0mm shares to be issued to Baker Hughes associated with funding of the Joint Development Agreement, (v) excludes up to 2.1mm shares to be issued to Baker Hughes as “bonus shares” associated with achieving certain milestones as part of the Joint Development Agreement, (vi) excludes 10.9mm private warrants with a $11.50/sh strike price and (vii) excludes 8.6mm public warrants with a $11.50/sh strike price. 4. RONI sponsor restructured its founder shares to better align interests with new investors including a forfeiture of 1mm sponsor shares, placing 2.5mm sponsor shares at - risk to fundraising goals and share price increases and locking up 1.6mm sponsor shares for 3 - years subject to early release at higher share price thresholds. 5. Includes shares described in subsections (i) through (v) of footnote 3 (i.e., excludes shares underlying public and private warrants). Expected Sources & Uses Illustrative Pro Forma Valuation SOURCES $mm Cash in RONI Trust (1) $335 Rice Friends & Family Investment (2) $100 OXY Investment $100 Additional PIPE Investments $35 NET Power Equity Rollover $1,357 TOTAL SOURCES $1,927 USES $mm NET Power Equity Rollover $1,357 Cash to Pro Forma Balance Sheet $535 Transaction Fees and Expenses $35 TOTAL USES $1,927 Net proceeds of $200mm expected to fund corporate operations through the development of SN1. Proceeds above $200mm expected to advance and support commercialization including funding of the SN1 project. $mm Share Price $10.00 (x) Pro Forma Shares Outstanding (3) 199 PRO FORMA EQUITY VALUE $1,994 Plus: Pro Forma Debt $0 Less: Pro Forma Cash ($535) PRO FORMA ENTERPRISE VALUE $1,459 Illustrative Pro Forma Ownership SHAREHOLDER SHARES (mm) % NET Power Existing Shareholders & Employee Options 147 68% Public Shareholders 36 17% Rice Friends and Family (incl. sponsor shares) (4) 17 8% TOTAL PRO FORMA SHARES OUTSTANDING (3) 199 93% FULLY DILUTED PRO FORMA SHARES OUTSTANDING (5) 215 100%

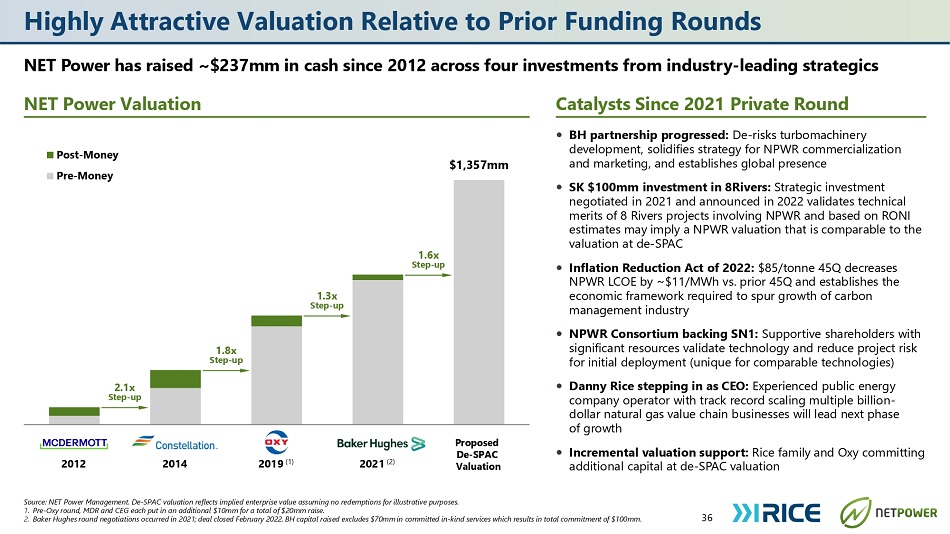

Highly Attractive Valuation Relative to Prior Funding Rounds NET Power has raised ~$237mm in cash since 2012 across four investments from industry - leading strategics NET Power Valuation Catalysts Since 2021 Private Round 36 Source: NET Power Management. De - SPAC valuation reflects implied enterprise value assuming no redemptions for illustrative purposes. 1. Pre - Oxy round, MDR and CEG each put in an additional $10mm for a total of $20mm raise. 2. Baker Hughes round negotiations occurred in 2021; deal closed February 2022. BH capital raised excludes $70mm in committed in - kind services which results in total commitment of $100mm. BH partnership progressed: De - risks turbomachinery development, solidifies strategy for NPWR commercialization and marketing, and establishes global presence SK $100mm investment in 8Rivers: Strategic investment negotiated in 2021 and announced in 2022 validates technical merits of 8 Rivers projects involving NPWR and based on RONI estimates may imply a NPWR valuation that is comparable to the valuation at de - SPAC Inflation Reduction Act of 2022: $85/tonne 45Q decreases NPWR LCOE by ~$11/MWh vs. prior 45Q and establishes the economic framework required to spur growth of carbon management industry NPWR Consortium backing SN 1 : Supportive shareholders with significant resources validate technology and reduce project risk for initial deployment (unique for comparable technologies) Danny Rice stepping in as CEO: Experienced public energy company operator with track record scaling multiple billion - dollar natural gas value chain businesses will lead next phase of growth Incremental valuation support : Rice family and Oxy committing additional capital at de - SPAC valuation $1,357mm Post - Money Pre - Money 2012 2014 2019 (1) 2021 (2) Proposed De - SPAC Valuation 2.1x Step - up 1.8x Step - up 1.3x Step - up 1.6x Step - up

Capital - Light Business Model Can Drive Substantial EBITDA Generation 37 h commercialization of SN1. Any cash raised above that amount (i.e., from SPAC trust) would be utilized to accelerate these illustrative deployment scenarios. Therefore, redemptions are not expected to impact the annual EBITDA figures, but a large range of potential scenarios is shown for illustrative purposes. Key Assumptions Licensing Revenue (per plant): $30mm over initial 3 years Expect to receive $10mm at FID, $10mm during construction and $10mm at COD Actual amounts could be higher or lower depending on commercial circumstances Royalty Fee (per plant): Recurring $5mm per year through life of plant Costs: Gross margin of 90% SG&A: $50mm per year Capex: Project development costs and plant capex are borne by the project developer Illustrative Single Plant Unit Economics (Based on 1 plant deployed per year) ($ millions) Year 1 Year 2 Year 3 Year 4 Year 5 Licensing Revenue $10 $10 $10 – – Royalty Fee - - - - 5 5 5 Revenue Per Plant $10 $10 $15 $5 $5 Plants Deployed in (Project Timeline) Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 $10 $10 $15 $5 $5 Year 2 - - 10 10 15 5 Year 3 - - - - 10 10 15 Year 4 - - - - - - 10 10 Year 5 - - - - - - - - 10 Total Revenue $10 $20 $35 $40 $45 ( - ) COGS @ 90% Gross Margin (1) (2) (4) (4) (5) Gross Profit $9 $18 $32 $36 $41 Note: “FID” reflects Final Investment Decision. “COD” reflects Commercial Operations Date. 1. $200mm of net proceeds from PIPE are expected to fund the company’s Baker Hughes JDA and corporate overhead expenses throug Illustrative EBITDA ($mm) Sensitivity at Various # of Plants Deployed Per Year (1) $2,000 $2,500 $3,000 $3,500 A e Number of Plants Deployed per Year 5 10 15 20 30 $1,500 $1,000 $500 $0 Year 5 Year 10 Year 20 Graph showcases annual NPWR EBITDA potential under a variety of deployment scenarios for periods of 5, 10 and 20 years in Years 5, 10 and 20

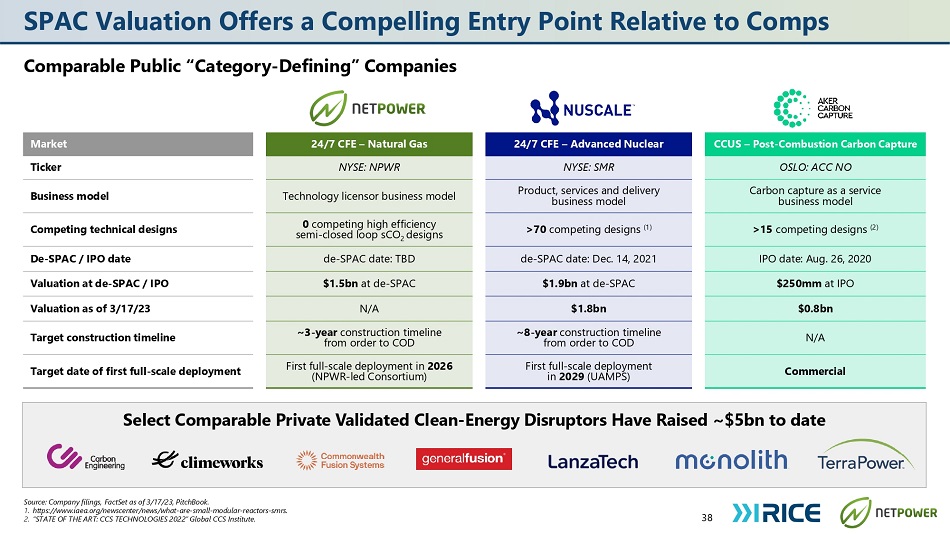

PAC Valuation Offers a Compelling Entry Point Relative to Comps Comparable Public “Category - Defining” Companies 38 Source: Company filings, FactSet as of 3/17/23, PitchBook. 1. https: //w ww .iaea.org/newscenter/news/what - are - small - modular - reactors - smrs. 2. “STATE OF THE ART: CCS TECHNOLOGIES 2022” Global CCS Institute. Market 24/7 CFE – Natural Gas 24/7 CFE – Advanced Nuclear CCUS – Post - Combustion Carbon Capture Ticker NYSE: NPWR NYSE: SMR OSLO: ACC NO Business model Technology licensor business model Product, services and delivery business model Carbon capture as a service business model Competing technical designs 0 competing high efficiency semi - closed loop sCO 2 designs >70 competing designs (1) >15 competing designs (2) De - SPAC / IPO date de - SPAC date: TBD de - SPAC date: Dec. 14, 2021 IPO date: Aug. 26, 2020 Valuation at de - SPAC / IPO $1.5bn at de - SPAC $1.9bn at de - SPAC $250mm at IPO Valuation as of 3/17/23 N/A $1.8bn $0.8bn Target construction timeline ~3 - year construction timeline from order to COD ~8 - year construction timeline from order to COD N/A Target date of first full - scale deployment First full - scale deployment in 2026 (NPWR - led Consortium) First full - scale deployment in 2029 (UAMPS) Commercial Select Comparable Private Validated Clean - Energy Disruptors Have Raised ~$5bn to date

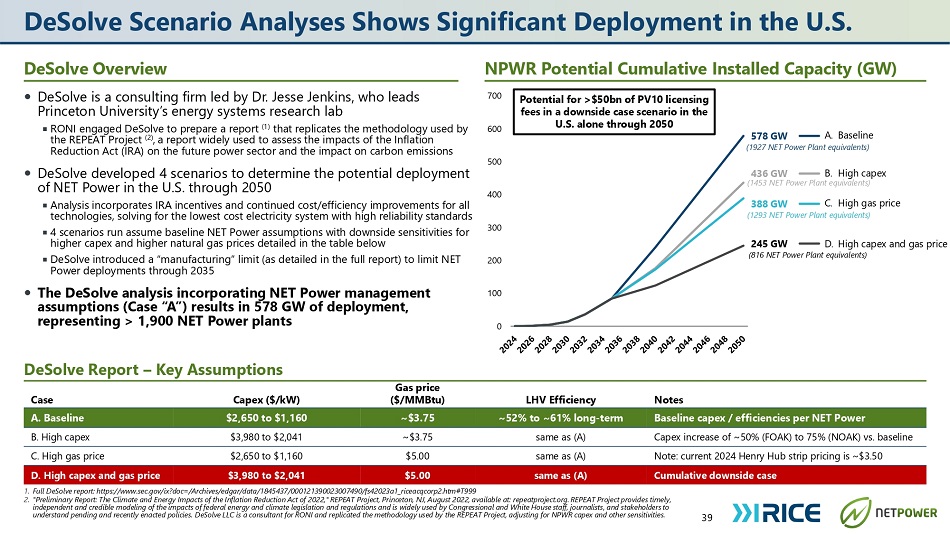

0 100 200 300 400 500 700 DeSolve is a consulting firm led by Dr. Jesse Jenkins, who leads Princeton University’s energy systems research lab RONI engaged DeSolve to prepare a report (1) that replicates the methodology used by 600 the REPEAT Project (2) , a report widely used to assess the impacts of the Inflation Reduction Act (IRA) on the future power sector and the impact on carbon emissions DeSolve developed 4 scenarios to determine the potential deployment of NET Power in the U.S. through 2050 Analysis incorporates IRA incentives and continued cost/efficiency improvements for all technologies, solving for the lowest cost electricity system with high reliability standards 4 scenarios run assume baseline NET Power assumptions with downside sensitivities for higher capex and higher natural gas prices detailed in the table below DeSolve introduced a “manufacturing” limit (as detailed in the full report) to limit NET Power deployments through 2035 The DeSolve analysis incorporating NET Power management assumptions (Case “A”) results in 578 GW of deployment, representing > 1,900 NET Power plants DeSolve Scenario Analyses Shows Significant Deployment in the U.S. 39 1. Full DeSolve report : https : //w ww . sec . gov/ix?doc=/Archives/edgar/data/ 1845437 / 000121390023007490 /fs 42023 a 1 _riceacqcorp 2 . htm#T 999 2. "Preliminary Report : The Climate and Energy Impacts of the Inflation Reduction Act of 2022 ," REPEAT Project, Princeton, NJ, August 2022 , available at : repeatproject . org . REPEAT Project provides timely, independent and credible modeling of the impacts of federal energy and climate legislation and regulations and is widely used by Congressional and White House staff, journalists, and stakeholders to understand pending and recently enacted policies . DeSolve LLC is a consultant for RONI and replicated the methodology used by the REPEAT Project, adjusting for NPWR capex and other sensitivities . DeSolve Overview NPWR Potential Cumulative Installed Capacity (GW) DeSolve Report – Key Assumptions Case Capex ($/kW) Gas price ($/MMBtu) LHV Efficiency Notes A. Baseline $2,650 to $1,160 ~$3.75 ~52% to ~61% long - term Baseline capex / efficiencies per NET Power B. High capex $3,980 to $2,041 ~$3.75 same as (A) Capex increase of ~50% (FOAK) to 75% (NOAK) vs. baseline C. High gas price $2,650 to $1,160 $5.00 same as (A) Note: current 2024 Henry Hub strip pricing is ~$3.50 D. High capex and gas price $3,980 to $2,041 $5.00 same as (A) Cumulative downside case 578 GW A. Baseline (1927 NET Power Plant equivalents) 436 GW B. High capex (1453 NET Power Plant equivalents) 388 GW C. High gas price (1293 NET Power Plant equivalents) 245 GW D. High capex and gas price (816 NET Power Plant equivalents) Potential for >$50bn of PV10 licensing fees in a downside case scenario in the U.S. alone through 2050

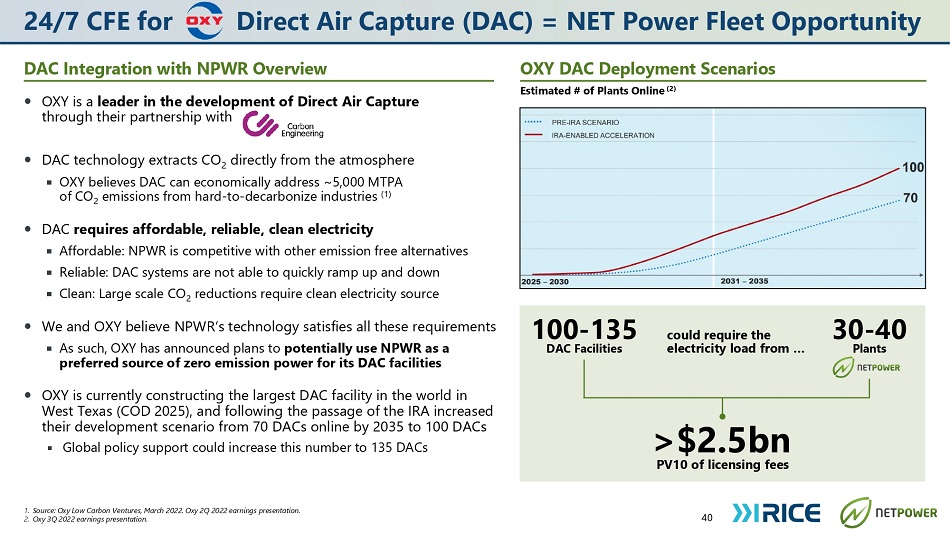

40 1. Source: Oxy Low Carbon Ventures, March 2022. Oxy 2Q 2022 earnings presentation. 2. Oxy 3Q 2022 earnings presentation. 24/7 CFE for Direct Air Capture (DAC) = NET Power Fleet Opportunity DAC Integration with NPWR Overview OXY DAC Deployment Scenarios OXY is a leader in the development of Direct Air Capture through their partnership with DAC technology extracts CO 2 directly from the atmosphere OXY believes DAC can economically address ~5,000 MTPA of CO 2 emissions from hard - to - decarbonize industries (1) DAC requires affordable, reliable, clean electricity Affordable: NPWR is competitive with other emission free alternatives Reliable: DAC systems are not able to quickly ramp up and down Clean: Large scale CO 2 reductions require clean electricity source We and OXY believe NPWR’s technology satisfies all these requirements As such, OXY has announced plans to potentially use NPWR as a preferred source of zero emission power for its DAC facilities OXY is currently constructing the largest DAC facility in the world in West Texas (COD 2025), and following the passage of the IRA increased their development scenario from 70 DACs online by 2035 to 100 DACs Global policy support could increase this number to 135 DACs Estimated # of Plants Online (2) 100 - 135 >$2.5bn DAC Facilities could require the electricity load from … 30 - 40 Plants PV10 of licensing fees

Q&A

Appendix

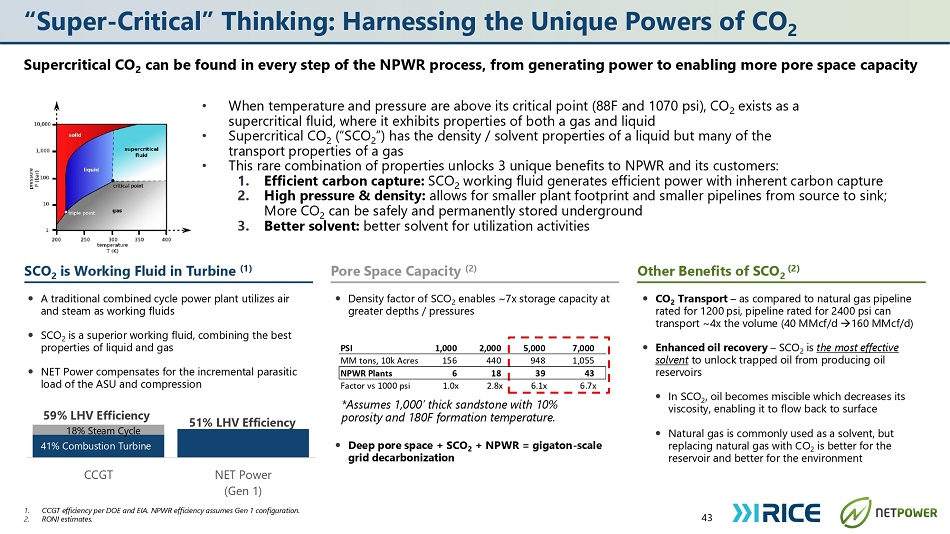

41% Combustion Turbine 18% Steam Cycle 59% LHV Efficiency 51% LHV Efficiency CCGT NET Power (Gen 1) Super - Critical” Thinking: Harnessing the Unique Powers of CO 2 Supercritical CO 2 can be found in every step of the NPWR process, from generating power to enabling more pore space capacity • When temperature and pressure are above its critical point (88F and 1070 psi), CO 2 exists as a supercritical fluid, where it exhibits properties of both a gas and liquid • Supercritical CO 2 (“SCO 2 ”) has the density / solvent properties of a liquid but many of the transport properties of a gas • This rare combination of properties unlocks 3 unique benefits to NPWR and its customers: 1. Efficient carbon capture: SCO 2 working fluid generates efficient power with inherent carbon capture 2. High pressure & density: allows for smaller plant footprint and smaller pipelines from source to sink; More CO 2 can be safely and permanently stored underground 3. Better solvent: better solvent for utilization activities 43 SCO 2 is Working Fluid in Turbine (1) Pore Space Capacity (2) Density factor of SCO 2 enables ~7x storage capacity at greater depths / pressures Other Benefits of SCO 2 (2) A traditional combined cycle power plant utilizes air and steam as working fluids SCO 2 is a superior working fluid, combining the best properties of liquid and gas NET Power compensates for the incremental parasitic load of the ASU and compression *Assumes 1,000’ thick sandstone with 10% porosity and 180F formation temperature. Deep pore space + SCO 2 + NPWR = gigaton - scale grid decarbonization CO 2 Transport – as compared to natural gas pipeline rated for 1200 psi, pipeline rated for 2400 psi can transport ~4x the volume (40 MMcf/d 160 MMcf/d) Enhanced oil recovery – SCO 2 is the most effective solvent to unlock trapped oil from producing oil reservoirs In SCO 2 , oil becomes miscible which decreases its viscosity, enabling it to flow back to surface Natural gas is commonly used as a solvent, but replacing natural gas with CO 2 is better for the reservoir and better for the environment PSI 1,000 2,000 5,000 7,000 MM tons, 10k Acres 156 440 948 1,055 NPWR Plants 6 18 39 43 Factor vs 1000 psi 1.0x 2.8x 6.1x 6.7x 1. CCGT efficiency per DOE and EIA. NPWR efficiency assumes Gen 1 configuration. 2. RONI estimates.

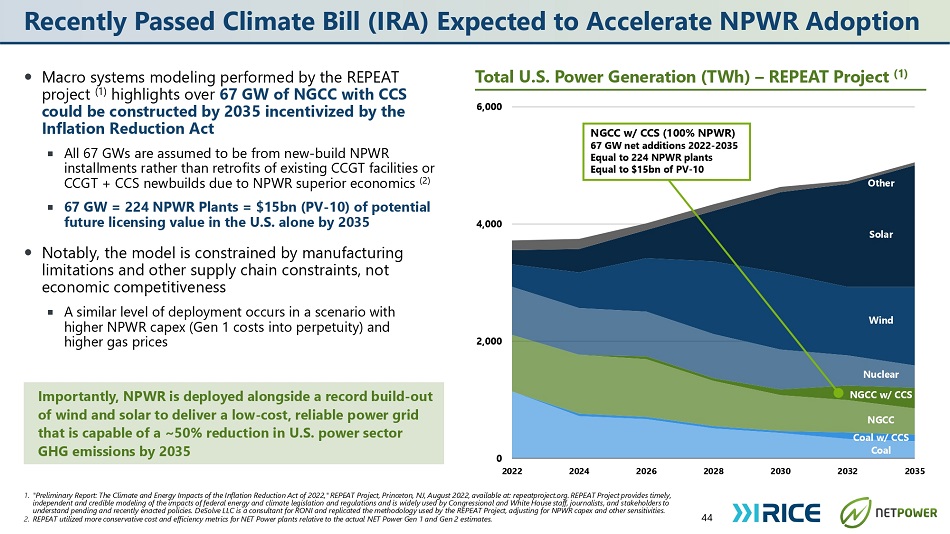

Macro systems modeling performed by the REPEAT project (1) highlights over 67 GW of NGCC with CCS could be constructed by 2035 incentivized by the Inflation Reduction Act All 67 GWs are assumed to be from new - build NPWR installments rather than retrofits of existing CCGT facilities or CCGT + CCS newbuilds due to NPWR superior economics (2) 67 GW = 224 NPWR Plants = $15bn (PV - 10) of potential future licensing value in the U.S. alone by 2035 Notably, the model is constrained by manufacturing limitations and other supply chain constraints, not economic competitiveness A similar level of deployment occurs in a scenario with higher NPWR capex (Gen 1 costs into perpetuity) and higher gas prices 44 0 2022 2024 2026 2,000 4,000 6,000 2028 2030 2032 2035 Importantly, NPWR is deployed alongside a record build - out of wind and solar to deliver a low - cost, reliable power grid that is capable of a ~50% reduction in U.S. power sector GHG emissions by 2035 Total U.S. Power Generation (TWh) – REPEAT Project (1) NGCC Coal w/ CCS Coal Nuclear NGCC w/ CCS Wind Solar Other NGCC w/ CCS (100% NPWR) 67 GW net additions 2022 - 2035 Equal to 224 NPWR plants Equal to $15bn of PV - 10 1. "Preliminary Report : The Climate and Energy Impacts of the Inflation Reduction Act of 2022 ," REPEAT Project, Princeton, NJ, August 2022 , available at : repeatproject . org . REPEAT Project provides timely, independent and credible modeling of the impacts of federal energy and climate legislation and regulations and is widely used by Congressional and White House staff, journalists, and stakeholders to understand pending and recently enacted policies . DeSolve LLC is a consultant for RONI and replicated the methodology used by the REPEAT Project, adjusting for NPWR capex and other sensitivities . 2. REPEAT utilized more conservative cost and efficiency metrics for NET Power plants relative to the actual NET Power Gen 1 and Gen 2 estimates . ecently Passed Climate Bill (IRA) Expected to Accelerate NPWR Adoption

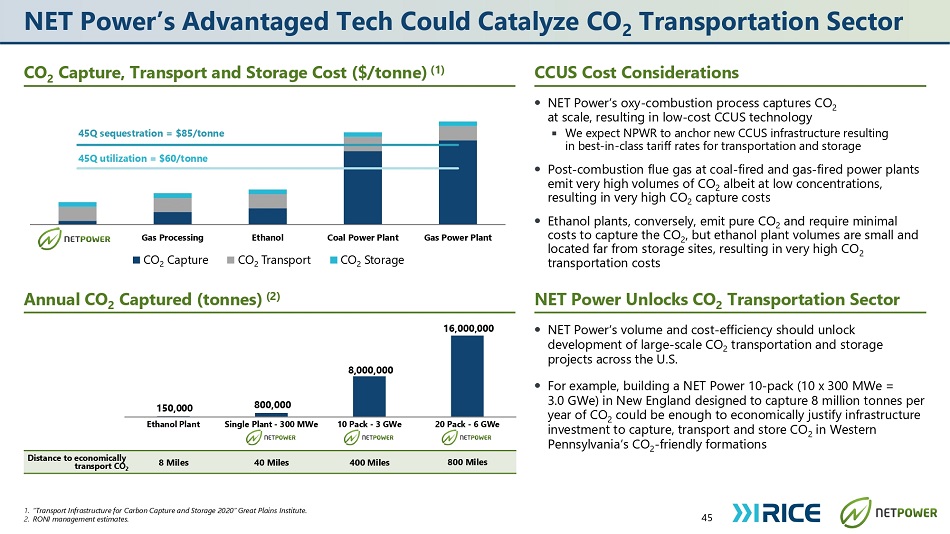

Gas Power Plant Coal Power Plant Ethanol Gas Processing NET Power CO2 Capture CO2 Transport CO2 Storage 150,000 800,000 8,000,000 16,000,000 Ethanol Plant Single Plant - 300 MWe 10 Pack - 3 GWe 20 Pack - 6 GWe NET Power’s Advantaged Tech Could Catalyze CO 2 Transportation Sector 1. “Transport Infrastructure for Carbon Capture and Storage 2020” Great Plains Institute. 2. RONI management estimates. at scale, resulting in low - cost CCUS technology We expect NPWR to anchor new CCUS infrastructure resulting in best - in - class tariff rates for transportation and storage Post - combustion flue gas at coal - fired and gas - fired power plants emit very high volumes of CO 2 albeit at low concentrations, resulting in very high CO 2 capture costs Ethanol plants, conversely, emit pure CO 2 and require minimal costs to capture the CO 2 , but ethanol plant volumes are small and located far from storage sites, resulting in very high CO 2 transportation costs NET Power’s volume and cost - efficiency should unlock development of large - scale CO 2 transportation and storage projects across the U.S. For example, building a NET Power 10 - pack (10 x 300 MWe = 3.0 GWe) in New England designed to capture 8 million tonnes per year of CO 2 could be enough to economically justify infrastructure investment to capture, transport and store CO 2 in Western Pennsylvania’s CO 2 - friendly formations 45Q sequestration = $85/tonne 45Q utilization = $60/tonne 400 Miles 800 Miles 40 Miles 8 Miles Distance to economically transport CO 2 45 CO 2 Capture, Transport and Storage Cost ($/tonne) (1) CCUS Cost Considerations NET Power’s oxy - combustion process captures CO 2 Annual CO 2 Captured (tonnes) (2) NET Power Unlocks CO 2 Transportation Sector 2 CO Transport 2 CO Capture 2 CO Storage

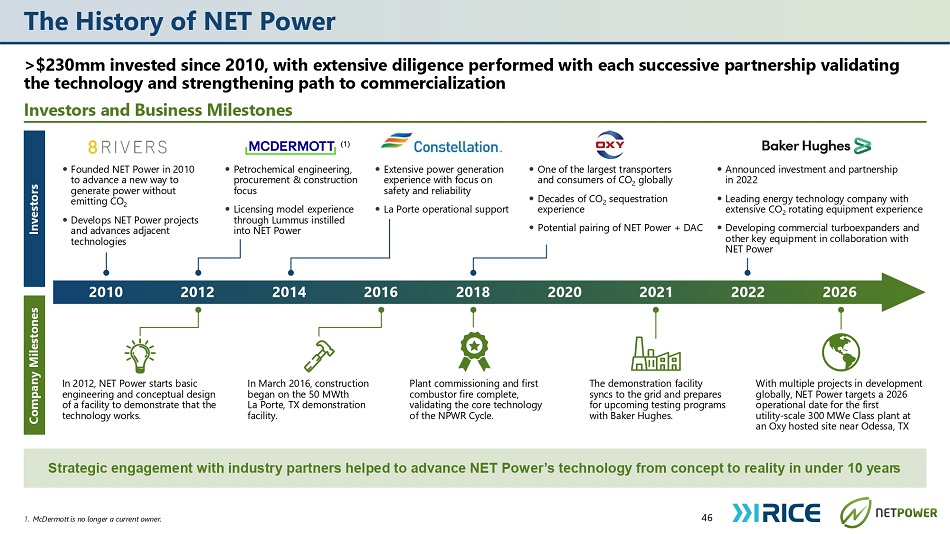

The History of NET Power >$230mm invested since 2010, with extensive diligence performed with each successive partnership validating the technology and strengthening path to commercialization Investors and Business Milestones 46 1. McDermott is no longer a current owner. Strategic engagement with industry partners helped to advance NET Power’s technology from concept to reality in under 10 years Investors Company Milestones 2010 2012 2014 2016 2018 2020 2022 2021 2026 Founded NET Power in 2010 to advance a new way to generate power without emitting CO 2 Develops NET Power projects and advances adjacent technologies Petrochemical engineering, procurement & construction focus Licensing model experience through Lummus instilled into NET Power Extensive power generation experience with focus on safety and reliability La Porte operational support One of the largest transporters and consumers of CO 2 globally Decades of CO 2 sequestration experience Potential pairing of NET Power + DAC Announced investment and partnership in 2022 Leading energy technology company with extensive CO 2 rotating equipment experience Developing commercial turboexpanders and other key equipment in collaboration with NET Power (1) In 2012, NET Power starts basic engineering and conceptual design of a facility to demonstrate that the technology works. In March 2016, construction began on the 50 MWth La Porte, TX demonstration facility. Plant commissioning and first combustor fire complete, validating the core technology of the NPWR Cycle. The demonstration facility syncs to the grid and prepares for upcoming testing programs with Baker Hughes. With multiple projects in development globally, NET Power targets a 2026 operational date for the first utility - scale 300 MWe Class plant at an Oxy hosted site near Odessa, TX

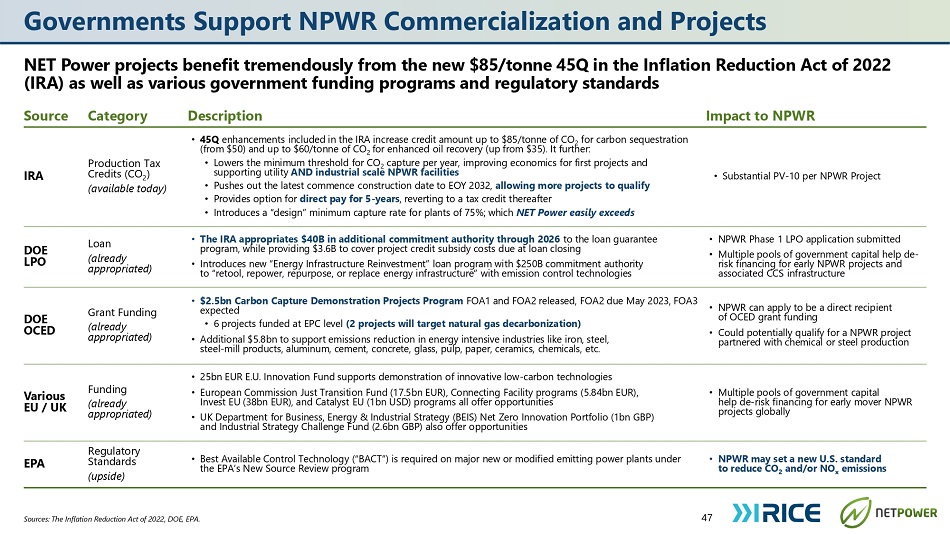

Governments Support NPWR Commercialization and Projects NET Power projects benefit tremendously from the new $85/tonne 45Q in the Inflation Reduction Act of 2022 (IRA) as well as various government funding programs and regulatory standards 47 Sources: The Inflation Reduction Act of 2022, DOE, EPA. Source Category Description Impact to NPWR IRA Production Tax Credits (CO 2 ) (available today) • 45Q enhancements included in the IRA increase credit amount up to $85/tonne of CO 2 for carbon sequestration (from $50) and up to $60/tonne of CO 2 for enhanced oil recovery (up from $35). It further: • Lowers the minimum threshold for CO 2 capture per year, improving economics for first projects and supporting utility AND industrial scale NPWR facilities • Pushes out the latest commence construction date to EOY 2032, allowing more projects to qualify • Provides option for direct pay for 5 - years , reverting to a tax credit thereafter • Introduces a “design” minimum capture rate for plants of 75%; which NET Power easily exceeds • Substantial PV - 10 per NPWR Project DOE LPO Loan (already appropriated) • The IRA appropriates $40B in additional commitment authority through 2026 to the loan guarantee program, while providing $3.6B to cover project credit subsidy costs due at loan closing • Introduces new “Energy Infrastructure Reinvestment” loan program with $250B commitment authority to “retool, repower, repurpose, or replace energy infrastructure” with emission control technologies • NPWR Phase 1 LPO application submitted • Multiple pools of government capital help de - risk financing for early NPWR projects and associated CCS infrastructure DOE OCED Grant Funding (already appropriated) • $2.5bn Carbon Capture Demonstration Projects Program FOA1 and FOA2 released, FOA2 due May 2023, FOA3 expected • 6 projects funded at EPC level (2 projects will target natural gas decarbonization) • Additional $5.8bn to support emissions reduction in energy intensive industries like iron, steel, steel - mill products, aluminum, cement, concrete, glass, pulp, paper, ceramics, chemicals, etc. • NPWR can apply to be a direct recipient of OCED grant funding • Could potentially qualify for a NPWR project partnered with chemical or steel production Various EU / UK Funding (already appropriated) • 25bn EUR E.U. Innovation Fund supports demonstration of innovative low - carbon technologies • European Commission Just Transition Fund (17.5bn EUR), Connecting Facility programs (5.84bn EUR), Invest EU (38bn EUR), and Catalyst EU (1bn USD) programs all offer opportunities • UK Department for Business, Energy & Industrial Strategy (BEIS) Net Zero Innovation Portfolio (1bn GBP) and Industrial Strategy Challenge Fund (2.6bn GBP) also offer opportunities • Multiple pools of government capital help de - risk financing for early mover NPWR projects globally EPA Regulatory Standards (upside) • Best Available Control Technology (“BACT”) is required on major new or modified emitting power plants under the EPA’s New Source Review program • NPWR may set a new U.S. standard to reduce CO 2 and/or NO x emissions

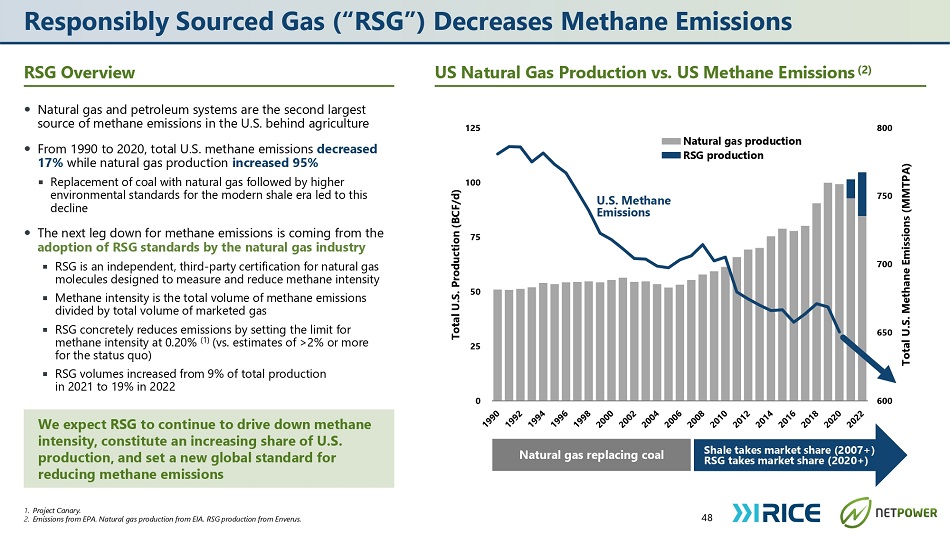

Responsibly Sourced Gas (“RSG”) Decreases Methane Emissions Natural gas and petroleum systems are the second largest source of methane emissions in the U.S. behind agriculture From 1990 to 2020, total U.S. methane emissions decreased 17% while natural gas production increased 95% Replacement of coal with natural gas followed by higher environmental standards for the modern shale era led to this decline The next leg down for methane emissions is coming from the adoption of RSG standards by the natural gas industry RSG is an independent, third - party certification for natural gas molecules designed to measure and reduce methane intensity Methane intensity is the total volume of methane emissions divided by total volume of marketed gas RSG concretely reduces emissions by setting the limit for methane intensity at 0.20% (1) (vs. estimates of >2% or more for the status quo) RSG volumes increased from 9% of total production in 2021 to 19% in 2022 1. Project Canary. 2. Emissions from EPA. Natural gas production from EIA. RSG production from Enverus. 600 650 700 750 800 0 25 50 75 100 125 Total U.S. Methane Emissions (MMTPA) Total U.S. Production (BCF/d) Natural gas production RSG production U.S. Methane Emissions Shale takes market share (2007+) RSG takes market share (2020+) Natural gas replacing coal 48 We expect RSG to continue to drive down methane intensity, constitute an increasing share of U.S. production, and set a new global standard for reducing methane emissions RSG Overview US Natural Gas Production vs. US Methane Emissions (2)

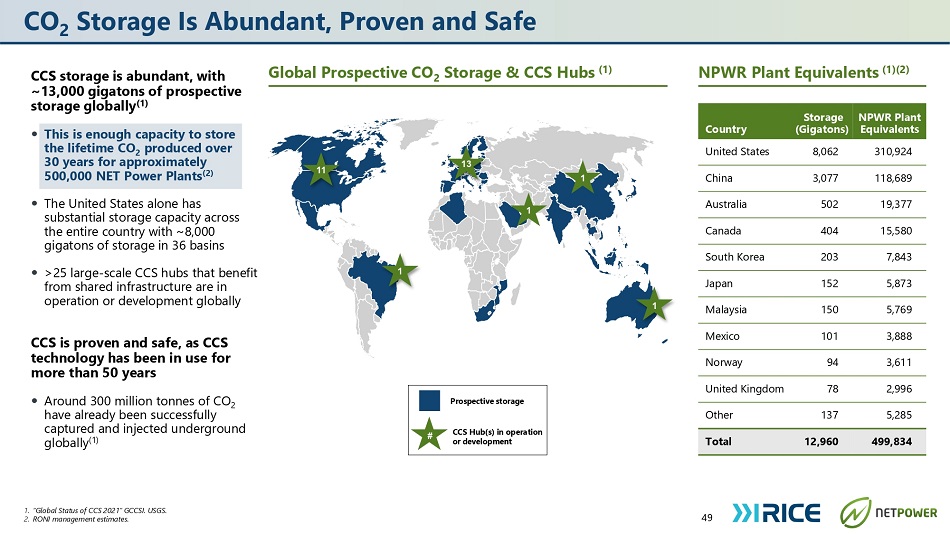

CO 2 Storage Is Abundant, Proven and Safe 49 1. “Global Status of CCS 2021” GCCSI. USGS. 2. RONI management estimates. Global Prospective CO 2 Storage & CCS Hubs (1) CCS storage is abundant, with ~13,000 gigatons of prospective storage globally (1) This is enough capacity to store the lifetime CO 2 produced over 30 years for approximately 500,000 NET Power Plants (2) The United States alone has substantial storage capacity across the entire country with ~8,000 gigatons of storage in 36 basins >25 large - scale CCS hubs that benefit from shared infrastructure are in operation or development globally CCS is proven and safe, as CCS technology has been in use for more than 50 years Around 300 million tonnes of CO 2 have already been successfully captured and injected underground globally (1) 11 13 1 1 1 1 CCS Hub(s) in operation or development Prospective storage # NPWR Plant Equivalents (1)(2) Country Storage (Gigatons) NPWR Plant Equivalents United States 8,062 310,924 China 3,077 118,689 Australia 502 19,377 Canada 404 15,580 South Korea 203 7,843 Japan 152 5,873 Malaysia 150 5,769 Mexico 101 3,888 Norway 94 3,611 United Kingdom 78 2,996 Other 137 5,285 Total 12,960 499,834