INVESTOR PRESENTATION, DATED APRIL 24, 2023

Published on April 24, 2023

Exhibit 99.2

Updated Illustrative Transaction Summary April 2023

Disclaimer (1/2) This presentation of Rice Acquisition Corp . II ("RONI") and NET Power, LLC ("NET Power") is for informational purposes only . This presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination between RONI and NET Power or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any securities of RONI, NET Power or any of their respective affiliates . Cautionary Note Regarding Forward - Looking Statements and Projections . Certain statements in this presentation may constitute “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , Section 21 E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 , each as amended . Forward - looking statements provide current expectations of future events and include any statement that does not directly relate to any historical or current fact . Words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “projects,” or other similar expressions may identify such forward - looking statements . Actual results may differ materially from those discussed in forward - looking statements as a result of factors, risks and uncertainties over which RONI and NET Power have no control . These factors, risks and uncertainties include, but are not limited to, the following : (i) conditions to the completion of the proposed business combination and PIPE investment, including stockholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule ; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement between the parties or the termination of any PIPE investor’s subscription agreement ; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally ; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations and potential difficulties in NET Power’s employee retention as a result of the proposed business combination ; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations ; (vi) potential litigation that may be instituted against RONI or NET Power or their respective directors or officers related to the proposed acquisition or the merger agreement or in relation to NET Power’s business ; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment ; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power ; (ix) NET Power’s history of significant losses ; (x) NET Power’s ability to manage future growth effectively ; (xi) NET Power’s ability to utilize its net operating loss and tax credit carryforwards effectively ; (xii) NET Power’s ability to continue as a going concern if the transactions contemplated herein are not completed ; (xiii) the capital - intensive nature of NET Power’s business model, which may require NET Power to raise additional capital in the future ; (xiv) barriers NET Power may face in its attempts to deploy and commercialize its technology ; (xv) the complexity of the machinery NET Power relies on for its operations and development ; (xvi) NET Power’s ability to establish and maintain supply relationships ; (xvii) risks related to NET Power’s joint development arrangements with Baker Hughes and reliance on Baker Hughes to commercialize and deploy its technology ; (xviii) risks related to NET Power’s other strategic investors and partners ; (xix) NET Power’s ability to successfully commercialize its operations ; (xx) the availability and cost of raw materials ; (xxi) the ability of NET Power’s supply base to scale to meet NET Power’s anticipated growth ; (xxii) risks related to NET Power’s ability to meet its projections ; (xxiii) NET Power’s ability to expand internationally ; (xxiv) NET Power’s ability to update the design, construction and operations of its NET Power Process (as defined herein) ; (xxv) the impact of potential delays in discovering manufacturing and construction issues ; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters ; (xxvii) the ability of commercial plants using the NET Power Process to efficiently provide net power output ; (xxviii) NET Power’s ability to obtain and retain licenses ; (xxix) NET Power’s ability to establish an initial commercial scale plant ; (xxx) NET Power’s ability to license to large customers ; (xxxi) NET Power’s ability to accurately estimate future commercial demand ; (xxxii) NET Power’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry ; (xxxiii) NET Power’s ability to comply with all applicable laws and regulations ; (xxxiv) the impact of public perception of fossil fuel derived energy on NET Power’s business ; (xxxv) any political or other disruptions in gas producing nations ; (xxxvi) NET Power’s ability to protect its intellectual property and the intellectual property it licenses ; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination ; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the SEC or as a condition to obtaining regulatory approval of the proposed business combination ; (xxxix) the impact of the global COVID - 19 pandemic on any of the foregoing risks ; and (xl) such other factors as are set forth in RONI’s periodic public filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in its Annual Report on Form 10 - K for the fiscal year ended December 31 , 2022 , its subsequent quarterly reports on Form 10 - Q, and in its other filings made with the SEC from time to time, which are available via the SEC’s website at www . sec . gov . Neither RONI nor NET Power undertake any duty to update these forward - looking statements or the other information contained in this presentation . 2

Disclaimer (2/2) No Representations or Warranties . Neither RONI nor NET Power makes any representation or warranty, express or implied, as to the accuracy or completeness of this document or any other information (whether written or oral) that has been or will be provided to you . Nothing contained herein or in any other oral or written information provided to you is, nor shall be relied upon as, a promise or representation of any kind by RONI or NET Power . Without limitation of the foregoing, RONI and NET Power expressly disclaim any representation regarding any projections concerning future operating results or any other forward - looking statement contained herein or that otherwise has been or will be provided to you . Neither RONI nor NET Power shall be liable to you or any prospective investor or any other person for any information contained herein or that otherwise has been or will be provided to you . Important Information about the Business Combination and Where to Find It . This presentation is being made in respect of the proposed business combination transaction involving RONI and NET Power . RONI has filed a registration statement on Form S - 4 (as may be amended from time to time, the “registration statement”) with the U . S . Securities and Exchange Commission (the “SEC”) on December 23 , 2022 , which includes a preliminary proxy statement/prospectus, and RONI may file other documents with the SEC regarding the proposed transaction . The information in the preliminary proxy statement/prospectus is not complete and may be changed . After the registration statement is declared effective by the SEC, a definitive proxy statement/prospectus will be sent to the shareholders of RONI . Before making any voting or investment decision, investors and security holders of RONI are urged to carefully read the entire registration statement and definitive proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction . The documents filed by RONI with the SEC may be obtained free of charge at the SEC’s website at www . sec . gov . In addition, the documents filed by RONI may be obtained free of charge from RONI at www . ricespac . com/rac - ii . Participants in Solicitation . RONI and NET Power and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of RONI, in favor of the approval of the proposed transaction . For information regarding RONI’s directors and executive officers, please see RONI’s Annual Report on Form 10 - K for the year ended December 31 , 2022 filed with the SEC on March 2 , 2023 . Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus, as they may be amended, and other relevant documents filed with the SEC when they become available . Free copies of these documents may be obtained as described in the preceding section . No Offer or Solicitation . This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination transaction . This communication shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, or an exemption therefrom . 3

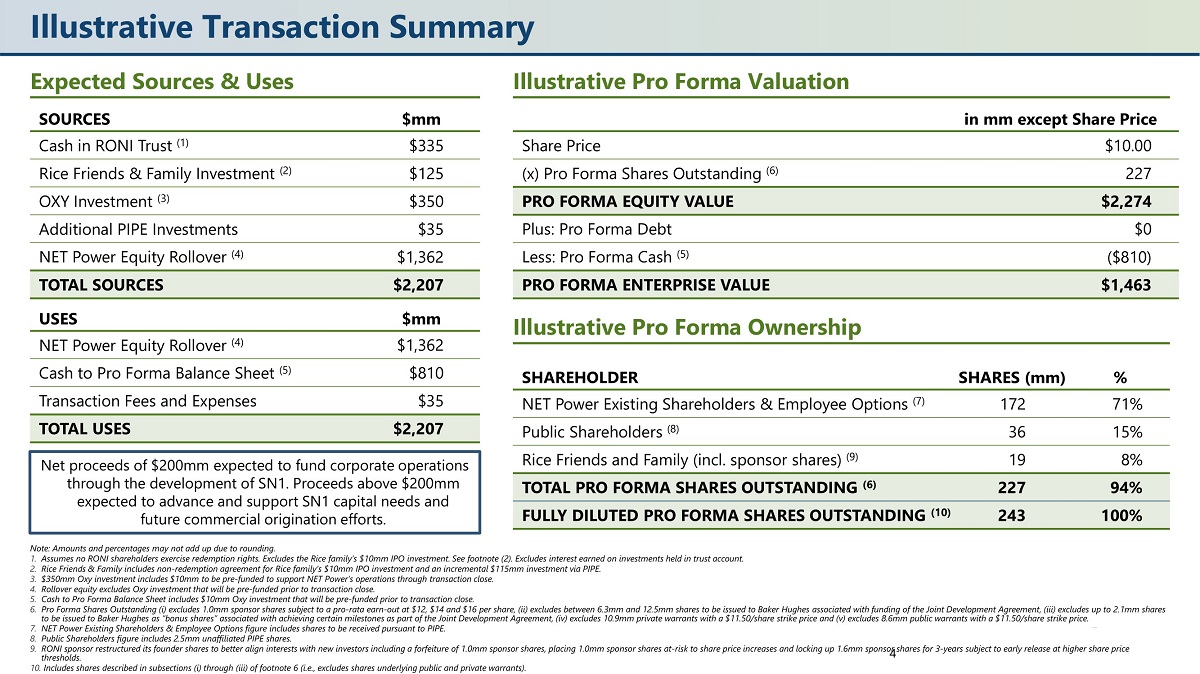

Illustrative Transaction Summary 4 Expected Sources & Uses SOURCES $mm Cash in RONI Trust (1) $335 Rice Friends & Family Investment (2) $125 OXY Investment (3) $350 Additional PIPE Investments $35 NET Power Equity Rollover (4) $1,362 TOTAL SOURCES $2,207 USES $mm NET Power Equity Rollover (4) $1,362 Cash to Pro Forma Balance Sheet (5) $810 Transaction Fees and Expenses $35 TOTAL USES $2,207 Illustrative Pro Forma Valuation in mm except Share Price Share Price $10.00 (x) Pro Forma Shares Outstanding (6) 227 PRO FORMA EQUITY VALUE $2,274 Plus: Pro Forma Debt $0 Less: Pro Forma Cash (5) ($810) PRO FORMA ENTERPRISE VALUE $1,463 Illustrative Pro Forma Ownership SHAREHOLDER SHARES (mm) % NET Power Existing Shareholders & Employee Options (7) 172 71% Public Shareholders (8) 36 15% Rice Friends and Family (incl. sponsor shares) (9) 19 8% TOTAL PRO FORMA SHARES OUTSTANDING (6) 227 94% FULLY DILUTED PRO FORMA SHARES OUTSTANDING (10) 243 100% Net proceeds of $200mm expected to fund corporate operations through the development of SN1. Proceeds above $200mm expected to advance and support SN1 capital needs and future commercial origination efforts. Note: Amounts and percentages may not add up due to rounding. 1. Assumes no RONI shareholders exercise redemption rights. Excludes the Rice family’s $10mm IPO investment. See footnote (2). E xcl udes interest earned on investments held in trust account. 2. Rice Friends & Family includes non - redemption agreement for Rice family’s $10mm IPO investment and an incremental $115mm investm ent via PIPE. 3. $350mm Oxy investment includes $10mm to be pre - funded to support NET Power’s operations through transaction close. 4. Rollover equity excludes Oxy investment that will be pre - funded prior to transaction close. 5. Cash to Pro Forma Balance Sheet includes $10mm Oxy investment that will be pre - funded prior to transaction close. 6. Pro Forma Shares Outstanding (i) excludes 1.0mm sponsor shares subject to a pro - rata earn - out at $12, $14 and $16 per share, (ii ) excludes between 6.3mm and 12.5mm shares to be issued to Baker Hughes associated with funding of the Joint Development Agre eme nt, (iii) excludes up to 2.1mm shares to be issued to Baker Hughes as “bonus shares” associated with achieving certain milestones as part of the Joint Development Agr eement, (iv) excludes 10.9mm private warrants with a $11.50/share strike price and (v) excludes 8.6mm public warrants with a $11 .50/share strike price. 7. NET Power Existing Shareholders & Employee Options figure includes shares to be received pursuant to PIPE. 8. Public Shareholders figure includes 2.5mm unaffiliated PIPE shares. 9. RONI sponsor restructured its founder shares to better align interests with new investors including a forfeiture of 1.0mm spo nso r shares, placing 1.0mm sponsor shares at - risk to share price increases and locking up 1.6mm sponsor shares for 3 - years subject to early release at higher share price thresholds. 10. Includes shares described in subsections (i) through (iii) of footnote 6 (i.e., excludes shares underlying public and private w arrants).