S-1: General form of registration statement for all companies including face-amount certificate companies

Published on July 7, 2023

As filed with the Securities and Exchange Commission on July 7, 2023

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_________________________________________

(Exact name of registrant as specified in its charter)

_________________________________________

| | 3620 | 98-1580612 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer |

404 Hunt Street, Suite 410

Durham, North Carolina

(919) 287-4750

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

_________________________________________

Akash Patel

Chief Financial Officer

404 Hunt Street, Suite 410

Durham, North Carolina

(919) 287-4750

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_________________________________________

Copies of all communications, including communications sent to agent for service, should be sent to:

Matthew R. Pacey, P.C.

Lanchi D. Huynh

Kirkland & Ellis LLP

609 Main Street

Houston, Texas 77002

(713) 836-3600

_________________________________________

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||

| | ☒ | Smaller reporting company | | |||||

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. The preliminary prospectus is not an offer to sell these securities and does not constitute the solicitation of offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 7, 2023

NET POWER INC.

201,480,913 SHARES OF CLASS A COMMON STOCK

10,900,000 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

This prospectus relates to the resale from time to time of 201,480,913 shares of our Class A common stock, par value $0.0001 per share (the “Class A Common Stock”), by the selling security holders named in this prospectus or their permitted transferees (each, a “Selling Securityholder” and, collectively, the “Selling Securityholders”), which consist of (i) 54,044,995 shares of Class A Common Stock issued in a private placement that closed substantially concurrently with the consummation of the Merger (as defined herein), (ii) 2,500 shares of Class A Common Stock issued to Rice Acquisition Sponsor II LLC (“Sponsor”) in a private placement prior to the consummation of the initial public offering (the “IPO”) of Rice Acquisition Corp. II (“RONI”), (iii) 10,900,000 shares of Class A Common Stock issuable upon exercise of the Private Placement Warrants (as defined below), (iv) 7,625,000 shares of Class A Common Stock issuable upon redemption of the 7,625,000 units of NET Power Operations LLC (f/k/a Rice Acquisition Holdings II LLC and referred to herein as “Opco”) held by the initial shareholders of RONI or transferees thereof, all of which were issued prior to the consummation of the IPO, and (v) 128,908,418 shares of Class A Common Stock issuable upon redemption of the 128,908,418 units of Opco (“Opco Units”) issued as consideration upon consummation of the Merger to the Legacy NET Power Holders (as defined herein) party to the Stockholders’ Agreement (as defined herein). In addition, this prospectus relates to the resale from time to time of the 10,900,000 warrants (the “Private Placement Warrants”) issued to Sponsor in a private placement that closed simultaneously with the consummation of the IPO. Each Private Placement Warrant is exercisable to purchase for $11.50 one share of Class A Common Stock, subject to adjustment.

The shares of Class A Common Stock and the Private Placement Warrants that may be sold by the Selling Securityholders are collectively referred to in this prospectus as the “Offered Securities.” Our registration of the resale of the Offered Securities does not mean that the Selling Securityholders will offer or sell any of the Offered Securities.

We will not receive any of the proceeds from the sale by the Selling Securityholders of any of the Offered Securities. We will receive the proceeds from the exercise of the Private Placement Warrants for cash, but not from the sale of the underlying shares of Class A Common Stock. We will bear all costs, expenses and fees in connection with the registration of the resale of the Offered Securities. The Selling Securityholders will bear all commissions and discounts, if any, attributable to their respective sales of the Offered Securities.

The Selling Securityholders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholders may sell the shares in the section titled “Plan of Distribution.” In addition, certain of the securities being registered hereby are subject to vesting and/or transfer restrictions that may prevent the Selling Securityholders from offering or selling such securities upon the effectiveness of the registration statement of which this prospectus is a part. See the section titled “Description of Securities” for more information.

You should carefully read this prospectus, and any applicable prospectus supplement, before you invest in any of our securities.

The Class A Common Stock and warrants initially sold as part of the units issued in the IPO (the “Public Warrants”) are listed on the New York Stock Exchange (the “NYSE”) under the symbols “NPWR” and “NPWR WS,” respectively. On July 5, 2023, the last sale price of the Class A Common Stock and the Public Warrants as reported on the NYSE were $12.52 per share and $3.29 per warrant, respectively.

_________________________________________

Investing in our securities involves certain risks, including those that are described in the section titled “Risk Factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________________________

The date of this prospectus is , 2023.

TABLE OF CONTENTS

|

Page |

||

|

ii |

||

|

iii |

||

|

vii |

||

|

viii |

||

|

1 |

||

|

8 |

||

|

41 |

||

|

42 |

||

|

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

43 |

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

58 |

|

|

68 |

||

|

89 |

||

|

97 |

||

|

107 |

||

|

118 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

121 |

|

|

123 |

||

|

127 |

||

|

137 |

||

|

140 |

||

|

140 |

||

|

140 |

||

|

F-1 |

You should rely only on the information contained in this prospectus. No one has been authorized to provide you with information that is different from that contained in this prospectus. This prospectus is dated as of the date set forth on the cover hereof. You should not assume that the information contained in this prospectus is accurate as of any date other than that date.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using a “shelf” registration process. Under this shelf registration process, the Selling Securityholders may, from time to time, offer and sell, as applicable, any combination of the securities described in this prospectus in one or more offerings. The Selling Securityholders may use the shelf registration statement to sell up to an aggregate of 201,480,913 shares of Class A Common Stock (which includes up to 10,900,000 shares of Class A Common Stock issuable upon exercise of the Private Placement Warrants and 136,533,418 shares of Class A Common Stock issuable upon redemption of Opco Units) and up to 10,900,000 Private Placement Warrants from time to time through any means described in the section titled “Plan of Distribution.” More specific terms of any securities that the Selling Securityholders offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the shares of Class A Common Stock and/or Private Placement Warrants being offered and the terms of the offering.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus.

You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find Additional Information.”

ii

CERTAIN DEFINED TERMS

Unless otherwise expressly stated or, unless the context otherwise requires, references in this prospectus to:

• “8 Rivers” means 8 Rivers Capital, LLC, a Delaware limited liability company;

• “Areca” means Areca, Inc., a Delaware corporation;

• “Amended and Restated JDA” means the Amended and Restated Joint Development Agreement, dated December 13, 2022, by and among Old NET Power, RONI, RONI Opco, NPI and NPT, as amended, supplemented or otherwise modified from time to time in accordance with its terms;

• “Baker Hughes” means Baker Hughes Company, a Delaware corporation;

• “BH License Agreement” means the License Agreement, dated February 3, 2022, by and between Old NET Power and NPT, as amended, supplemented or otherwise modified from time to time in accordance with its terms;

• “BHES” means Baker Hughes Energy Services LLC, a Delaware limited liability company and affiliate of Baker Hughes;

• “Board” or “Board of Directors” means the board of directors of the Company.

• “Business Combination Agreement” means the Business Combination Agreement, dated as of December 13, 2022, by and among RONI, RONI Opco, Buyer, Merger Sub and Old NET Power, as amended by the First Amendment to the Business Combination Agreement, dated as of April 23, 2023, by and between Buyer and Old NET Power;

• “Business Combination” means the Domestications, the Merger and other transactions contemplated by the Business Combination Agreement, collectively, including the PIPE Financing;

• “Buyer” means Topo Buyer Co, LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of Opco (following the Domestications) or of RONI Opco (prior to the Domestications);

• “Bylaws” means the bylaws of NET Power adopted on June 8, 2023;

• “Certificate of Incorporation” means the certificate of incorporation of NET Power filed with the Secretary of State of the State of Delaware on June 8, 2023;

• “Chamaedorea” means Chamaedorea, Inc., a Delaware corporation;

• “Class A Common Stock” means the Class A common stock, par value $0.0001 per share, of NET Power;

• “Class A Shares” means the Class A ordinary shares, par value $0.0001 per share, of RONI, which automatically converted, on a one-for-one basis, into shares of Class A Common Stock in connection with the Domestication;

• “Class B Common Stock” means the Class B common stock, par value $0.0001 per share, of NET Power;

• “Class B Shares” means the Class B ordinary shares, par value $0.0001 per share, of RONI, which automatically converted, on a one-for-one basis, into shares of Class B Common Stock in connection with the Domestication;

• “Closing” means the consummation of the business combination contemplated by the Business Combination Agreement;

• “Closing Date” means June 8, 2023, the date on which the Closing occurred;

• “Code” means the Internal Revenue Code of 1986, as amended;

• “Common Stock” means the Class A Common Stock and Class B Common Stock;

iii

• “Company,” “our,” “we” or “us” means, prior to the Business Combination, RONI or Old NET Power, as the context suggests, and, following the Business Combination, NET Power.

• “Constellation” means Constellation Energy Generation, LLC, a Pennsylvania limited liability company formerly known as Exelon Generation Company, LLC;

• “Continental” means Continental Stock Transfer & Trust Company;

• “Domestication” means the change of RONI’s jurisdiction of registration by deregistering as a Cayman Islands exempted company and continuing and domesticating as a corporation registered under the laws of the State of Delaware, upon which RONI changed its name to NET Power Inc.;

• “Domestications” means the Domestication and the Opco Domestication;

• “Effective Time” means the time at which the Merger became effective;

• “Exchange Act” means the Securities Exchange Act of 1934, as amended.

• “IPO” means RONI’s initial public offering, which was consummated on June 18, 2021;

• “Legacy NET Power Holders” means the holders of equity securities of Old NET Power prior to the consummation of the Merger;

• “Merger” means the merger of Merger Sub with and into Old NET Power pursuant to the Business Combination Agreement, in which Old NET Power survived and became a wholly owned direct subsidiary of Buyer;

• “Merger Sub” means Topo Merger Sub, LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of Buyer;

• “NET Power” means NET Power Inc., a Delaware corporation (f/k/a Rice Acquisition Corp. II), upon and after the Domestication;

• “NPEH” means NPEH, LLC, a Delaware limited liability company;

• “NPI” means Nuovo Pignone International, S.r.l., an Italian limited liability company and affiliate of Baker Hughes;

• “NPT” means Nuovo Pignone Tecnologie S.r.l., an Italian limited liability company and affiliate of Baker Hughes;

• “NYSE” means the New York Stock Exchange;

• “Old NET Power” means, prior to the consummation of the Merger, NET Power, LLC, a Delaware limited liability company;

• “Opco” means NET Power Operations LLC, a Delaware limited liability company (f/k/a Rice Acquisition Holdings II LLC), upon and after the Opco Domestication;

• “Opco Domestication” means the change of RONI Opco’s jurisdiction of registration by deregistering as a Cayman Islands exempted company and continuing and domesticating as a limited liability company registered under the laws of the State of Delaware, upon which RONI Opco changed its name to NET Power Operations LLC;

• “Opco LLC Agreement” means the Second Amended and Restated Limited Liability Company Agreement of Opco, dated as of June 8, 2023, which was entered into in connection with the Closing;

• “Opco Unitholder” means a holder of Opco Units;

• “Opco Units” means the units of Opco;

• “Ordinary Shares” means the Class A Shares and the Class B Shares together;

iv

• “Original JDA” means the Joint Development Agreement, dated February 3, 2022, by and among Old NET Power, NPI and NPT, as amended by the First Amendment to Joint Development Agreement, dated effective June 30, 2022, by and among the same parties;

• “OXY” means OLCV NET Power, LLC, a Delaware limited liability company;

• “PIPE Financing” means the issuance and sale of 54,044,995 shares of Class A Common Stock for aggregate consideration of $540,449,950 in private placements pursuant to subscription agreements that RONI entered into with certain qualified institutional buyers and accredited investors, which was consummated immediately prior to the Merger;

• “PIPE Investors” means the investors who participated in the PIPE Financing;

• “PIPE Subscription Agreements” means the subscription agreements, entered into by RONI and the PIPE Investors in connection with the PIPE Financing;

• “Preferred Stock” means shares of NET Power preferred stock, par value $0.0001;

• “Principal Legacy NET Power Holders” means OXY, Constellation and 8 Rivers (through NPEH);

• “Private Placement Warrants” means the 10,900,000 warrants to purchase shares of Class A Common Stock that were issued and sold to Sponsor in a private placement in connection with the IPO;

• “Public Warrants” means the warrants to purchase shares of Class A Common Stock that were issued and sold as part of the RONI Units in the IPO;

• “RONI” means Rice Acquisition Corp. II, a Cayman Islands exempted company, prior to the Domestication;

• “RONI Opco” means Rice Acquisition Holdings II LLC, a Cayman Islands limited liability company and direct subsidiary of RONI, prior to the Domestications;

• “RONI Units” means the units of RONI sold in the IPO, each of which consisted of one Class A Share and one-fourth of one Public Warrant;

• “SEC” means the Securities and Exchange Commission;

• “Securities Act” means the Securities Act of 1933, as amended;

• “Selling Securityholders” means the persons listed in the table in the section titled “Selling Securityholders” and the pledgees, donees, transferees, assignees, successors, designees and others who later come to hold any of such persons’ interest in the Class A Common Stock or Warrants other than through a public sale;

• “Serial Number 1” means our first commercial plant deployment;

• “SK” means SK Inc., a company registered in South Korea;

• “Sponsor” means Rice Acquisition Sponsor II LLC, a Delaware limited liability company;

• “Sponsor Letter Agreement” means the letter agreement, dated December 13, 2022, by and among RONI, Sponsor, RONI Opco, Old NET Power and RONI’s directors and officers;

• “Stockholders’ Agreement” means the Stockholders’ Agreement, dated as of June 8, 2023, by and among RONI, RONI Opco, Sponsor and the NET Power Holders (as defined therein);

• “Tax Receivable Agreement” means the Tax Receivable Agreement, dated June 8, 2023, entered into by NET Power and Opco with Opco Unitholders who received Opco Units pursuant to the Business Combination Agreement as consideration for equity interests in Old NET Power and the Agent (as defined therein);

• “Tillandsia” means Tillandsia, Inc., a Delaware corporation;

v

• “Warrant Agreement” means the Warrant Agreement, dated as of June 15, 2021, by and among RONI, RONI Opco and Continental as it may be amended and/or restated from time to time in accordance with its terms; and

• “Warrants” means, collectively, the Public Warrants and Private Placement Warrants.

In addition, the following is a glossary of key industry terms used herein:

• “$/MWh” means dollar per megawatt-hour;

• “CI” means Carbon Intensity;

• “CO2” means carbon dioxide;

• “CO2e/kWh” means carbon dioxide emissions per kilowatt-hour;

• “GW” means gigawatt;

• “MW” means megawatt;

• “MWe” means megawatt electrical;

• “MWth” means megawatt thermal;

• “NOX” means nitrogen oxides;

• “sCO2” means supercritical CO2; and

• “SOX” means sulfur oxides.

vi

Sources of Industry and Market Data

Where information has been sourced from a third party, the source of such information has been identified. Unless otherwise indicated, the information contained in this prospectus on the market environment, market developments, growth rates, market trends and competition in the markets in which we operate is taken from publicly available sources, including third-party sources, or reflects our estimates that are principally based on information from publicly available sources.

vii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Statements that do not relate strictly to historical or current facts are forward-looking and usually identified by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “opportunity,” “plan,” “project,” “seek,” “should,” “strategy,” “will,” “will likely result,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements may relate to the benefits of the Business Combination, the development of the Company’s technology, the anticipated demand for the Company’s technology and the markets in which the Company operates, the timing of the deployment of plant deliveries, and the Company’s business strategies, capital requirements, potential growth opportunities and expectations for future performance (financial or otherwise). Forward-looking statements are based on current expectations, estimates, projections, targets, opinions and/or beliefs of the Company, and such statements involve known and unknown risks, uncertainties and other factors.

The risks and uncertainties that could cause those actual results to differ materially from those expressed or implied by these forward-looking statements include, but are not limited to: (i) risks relating to the uncertainty of the projected financial information with respect to the Company and risks related to the Company’s ability to meet its projections; (ii) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the Company to grow and manage growth profitably and the ability of the Company retain its management and key employees; (iii) the Company’s ability to utilize its net operating loss and tax credit carryforwards effectively; (iv) the capital-intensive nature of the Company’s business model, which may require the Company to raise additional capital in the future; (v) barriers the Company may face in its attempts to deploy and commercialize its technology; (vi) the complexity of the machinery the Company relies on for its operations and development; (vii) the Company’s ability to establish and maintain supply relationships; (viii) risks related to the Company’s arrangements with third parties for the development, commercialization and deployment of technology associated with the Company’s technology; (ix) risks related to the Company’s other strategic investors and partners; (x) the Company’s ability to successfully commercialize its operations; (xi) the availability and cost of raw materials; (xii) the ability of the Company’s supply base to scale to meet the Company’s anticipated growth; (xiii) the Company’s ability to expand internationally; (xiv) the Company’s ability to update the design, construction and operations of its technology; (xv) the impact of potential delays in discovering manufacturing and construction issues; (xvi) the possibility of damage to the Company’s Texas facilities as a result of natural disasters; (xvii) the ability of commercial plants using the Company’s technology to efficiently provide net power output; (xviii) the Company’s ability to obtain and retain licenses; (xix) the Company’s ability to establish an initial commercial scale plant; (xx) the Company’s ability to license to large customers; (xxi) the Company’s ability to accurately estimate future commercial demand; (xxii) the Company’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry; (xxiii) the Company’s ability to comply with all applicable laws and regulations; (xxiv) the impact of public perception of fossil fuel-derived energy on the Company’s business; (xxv) any political or other disruptions in gas producing nations; (xxvi) the Company’s ability to protect its intellectual property and the intellectual property it licenses; (xxvii) the Company’s ability to meet stock exchange listing standards following the Business Combination; (xxviii) potential litigation that may be instituted against the Company; and (xxix) other risks and uncertainties indicated in this prospectus, including those under the section titled “Risk Factors,” and other documents filed or to be filed with the SEC by the Company.

Should one or more of these risks or uncertainties materialize, or should any of the assumptions made by our management prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements contained in this prospectus. Accordingly, you should not place undue reliance on these forward-looking statements in deciding whether to invest in our securities.

Forward-looking statements speak only as of the date they are made. Except to the extent required by applicable law or regulation, we undertake no obligation to update the forward-looking statements contained herein to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events. The Company gives no assurance that it will achieve its expectations.

viii

SUMMARY OF THE PROSPECTUS

This summary highlights selected information from this prospectus and may not contain all of the information that is important to you in making an investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our Business

NET Power is a clean energy technology company that has developed a novel power generation system (the “NET Power Cycle”) that produces clean, reliable and low-cost electricity from natural gas while capturing virtually all atmospheric emissions. NET Power, LLC was founded in 2010 and since inception, has methodically progressed the technology from a theoretical concept to reality. The NET Power Cycle is designed to inherently capture carbon dioxide (CO2) while producing no air pollutants such as sulfur oxides (SOX), nitrogen oxides (NOX) and particulates. It is nearly immune to differences in altitude, humidity and temperature and can be a net water producer rather than consumer, allowing for easier siting and operation in areas particularly impacted by climate change. It can operate as a traditional baseload power plant, providing reliable electricity to the grid at capacity factors targeted to be above 90%. It can also complement intermittent renewables, providing zero-emission dispatchable electricity that can be programmed on demand at the request of power grid operators and according to market needs, while demonstrating substantial improvements in efficiency, effectiveness, affordability and environmental performance as compared to existing carbon capture technologies for power generation and industry. It leverages existing infrastructure and avoids issues of generation capacity and grid transmission overbuild created by other technologies, further reducing system-wide costs incurred in transitioning to net zero.

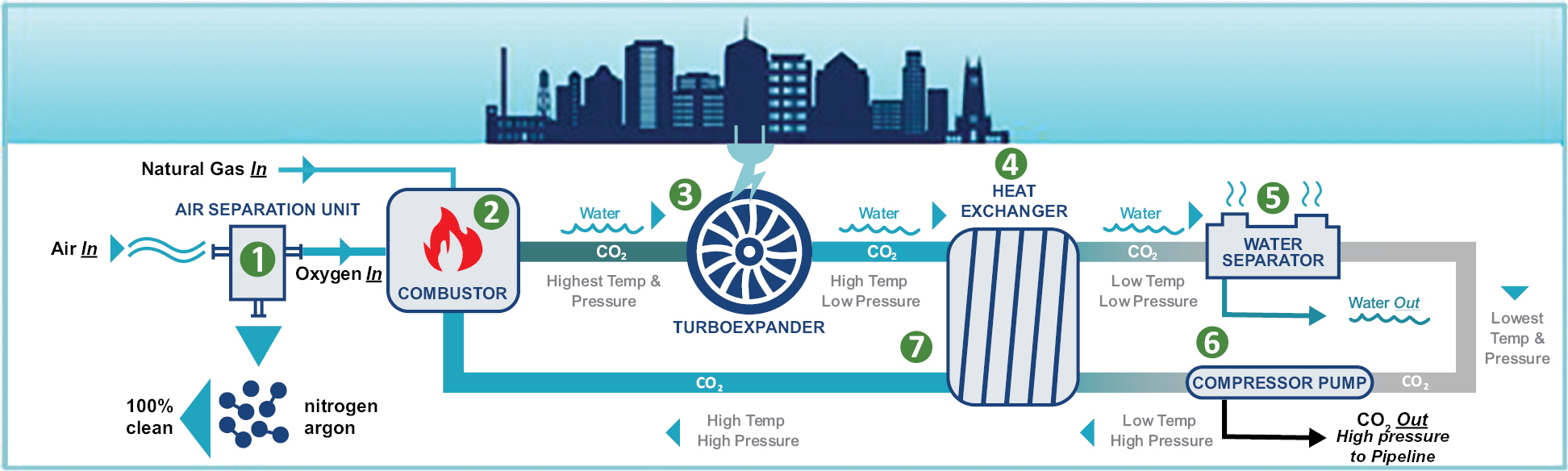

The NET Power Cycle is designed to achieve clean, reliable and low-cost electricity generation through NET Power’s patented highly recuperative oxy-combustion process. This process involves the combination of two technologies:

• Oxy-combustion, a clean heat generation process in which fuel is mixed with oxygen such that the resulting byproducts from combustion consist of only water and pure CO2; and

• Supercritical CO2 power cycle, a closed or semi-closed loop process which replaces the air or steam used in most power cycles with recirculating CO2 at high pressure, as sCO2, producing power by expanding sCO2 continuously through a turbo expander.

In the NET Power Cycle, CO2 produced in oxy-combustion is immediately captured in a sCO2 cycle which produces electricity. As CO2 is added through oxy-combustion and recirculated, excess captured CO2 is siphoned from the cycle at high purity for export to permanent storage or utilization.

The NET Power Cycle was first demonstrated at the Company’s 50 MWth demonstration facility in La Porte, Texas which broke ground in 2016 and began testing in 2018. The Company conducted three testing campaigns over three years and synchronized to the Texas grid in the fall of 2021. Through these tests, it achieved technology validation, reached critical operational milestones and accumulated over 1,500 hours of total facility runtime as of October 2022.

NET Power plans to license its technology through offering plant designs ranging from industrial-scale configurations between 25-115 MW net electric output to utility-scale units of between approximately 115-300 MW net electric output capacity. This technology is supported by a portfolio of 380 issued patents in-licensed on an exclusive basis (in the applicable field) from 8 Rivers, as well as significant know-how and trade secrets generated through experience at the La Porte, Texas demonstration facility. NET Power’s first generation utility-scale design (“Gen1U”) will be a 300 MWe Class power plant, targeting a CO2 capture rate of 97% or greater. Early Gen1U deployments are focused on ensuring a clean and reliable system. Based on the Company’s work to date, NET Power expects these early projects to target a net efficiency of approximately 45%. Incorporating the lessons learned from early plants’ operations, NET Power targets to deliver later Gen1U plants with net efficiency of approximately 50%. NET Power expects that later facilities adopting its second-generation utility-scale design (“Gen2U”) will benefit from net efficiencies targeting 60% and lower costs. Gen2U will have higher operating temperatures and heat exchanger effectiveness, similar to the conditions present at the La Porte demonstration facility, and higher efficiency

1

key balance of plant turbomachinery such as compressors and pumps. The Gen2U assumptions provide the technical and economic basis for the substantial majority of expected future NET Power deployments. With multiple Gen1U projects currently in development, NET Power expects the first utility-scale plant utilizing the NET Power Cycle will be commissioned and operational in 2026. NET Power intends to deploy its technology in the United States and around the world; leveraging experience gained from the La Porte, Texas demonstration facility as well as from the expertise of NET Power’s current owners, including OXY, BHES and 8 Rivers (through NPEH).

NET Power’s potential customers include electric utilities, oil and gas companies, midstream oil and gas companies, technology companies and industrial facilities, both in domestic and international markets. NET Power has engaged in active dialogue with potential customers in each of these industries. NET Power’s end-markets can be broken down into three general categories: baseload generation, dispatchable generation and industrial applications. Baseload generation includes replacing emitting fossil fuel-fired facilities (brownfield) or installing new clean baseload capacity (greenfield). Many customers need to balance the intermittency of renewable generation and, NET Power believes, will seek its technology’s dispatchable capability to pair with significant renewable capacity build outs. Industrial customers such as direct air capture facilities, steel facilities, chemical plants and hydrogen production facilities have significant 24-hour energy needs and goals to decarbonize. NET Power’s technology can provide the necessary clean, reliable, low-cost electricity and heat energy to these facilities as well.

Key benefits for customers include the following:

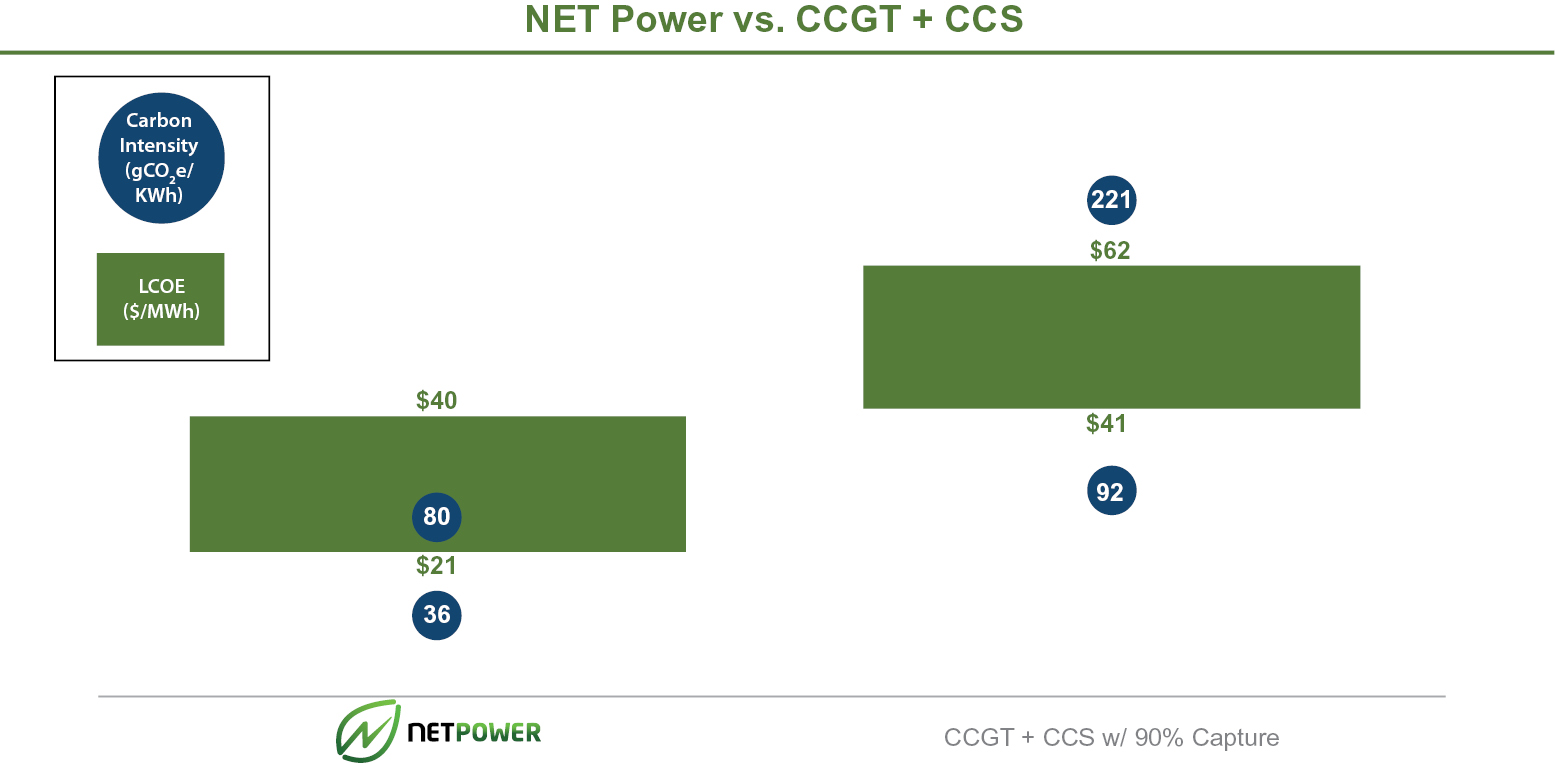

• Clean: The NET Power Cycle will result in an average Carbon Intensity (“CI”) of 58g CO2e/kWh and can capture CO2 at >97% rate, providing for 87% CO2 emissions reduction in comparison to combined cycle gas turbine technology. CO2 is inherently captured at pipeline pressure and ready for transportation. There are no NOx, SOx or particulate emissions to atmosphere that plague traditional coal or natural gas fossil fuel generation allowing for project siting near population centers. NET Power expects efforts to reduce upstream methane emissions will further reduce the NET Power Cycle CI.

• Reliable: The NET Power Cycle can provide 24/7 baseload power, with a targeted capacity factor of 92.5%, power ramp rates of 10% to 15% per minute and 0% to 100% load following capabilities. It can function as a utility-scale large plant or seamlessly pair as a load-following asset to support variable renewable energy.

• Low-cost: NET Power’s targeted Gen2U levelized cost of energy of $21-$40 $/MWh in the U.S. is lower than both legacy firm generation technology like combined cycle gas turbine and intermittent technologies such as solar photovoltaics (“PVs”) coupled with four hours or more of battery storage. Gen1U levelized cost of energy is expected between $26-$55 $/MWh.

• Utilizes existing infrastructure: The United States alone has over 3 million miles of natural gas pipeline infrastructure, with over 270,000 miles of high-strength steel pipe suitable for high-capacity natural gas transmission. Approximately 50 individual CO2 pipelines with a combined length of over 4,500 miles exist in the U.S. today. According to the Energy Information Administration (the “EIA”), there further exists hundreds of thermal power generation facilities at or nearing their retirement or replacement period through 2050, which NET Power believes could serve as potential brownfield site locations. For example, 27% of the 56 GW of coal-fired capacity currently operating in the U.S. have plans to retire by the end of 2029. Their transmission interconnections and auxiliary systems can be repurposed with minimal changes to serve NET Power’s facilities. With the addition of CO2 infrastructure, NET Power can fit within the existing grid network with low incremental cost.

• Compact footprint: NET Power’s modular design and the inherent energy density of sCO2 as a working fluid leads to a low surface footprint of approximately 13 acres, equal to 1/100th that of solar PV of a similar electric output. This footprint is smaller than existing unabated combined cycle facilities of similar capacity, allowing NET Power to serve as a re-powering option for retiring facilities or facilities that cannot secure additional space for capture equipment.

NET Power believes that the NET Power Cycle can serve as a key enabling platform for a low-carbon future, addressing shortfalls inherent to alternative options while contributing to an overall lower system-wide cost of decarbonization. NET Power believes that through its innovative process, it can provide a lower cost of electricity, reduction and in some cases elimination of environmental impacts related to thermal power use (air pollution, water

2

use, land use and deforestation), reliability and dispatchability contributing to energy security and lower costs, as well as an ability to achieve required carbon reduction targets. NET Power believes the build-out of the NET Power Cycle will provide the world with clean, reliable and low-cost energy.

The Business Combination

On June 6, 2023, the Business Combination was approved by the shareholders of RONI, and on June 8, 2023, RONI consummated the Merger pursuant to the Business Combination Agreement.

Immediately prior to the consummation of the Merger, on June 8, 2023, as contemplated by the Business Combination Agreement, RONI became a Delaware corporation named “NET Power Inc.,” and (i) each issued and outstanding Class A Share was automatically converted, on a one-for-one basis, into a share of Class A Common Stock of NET Power Inc., (ii) each issued and outstanding Class B Share was automatically converted, on a one-for-one basis, into a share of Class B Common Stock of NET Power Inc., and (iii) each issued and outstanding warrant of RONI (which was exercisable for a Class A Share) automatically converted into a warrant to purchase one share of Class A Common Stock of NET Power Inc. Immediately following the Domestication, RONI Opco became a Delaware limited liability company and was renamed NET Power Operations LLC.

Following the Domestications, on June 8, 2023, pursuant to the Business Combination Agreement, Merger Sub merged with and into Old NET Power, with Old NET Power surviving the Merger as a direct, wholly owned subsidiary of Buyer. At the Effective Time, all of the equity interests of Old NET Power issued and outstanding immediately prior to the Merger (other than any such equity interests held in the treasury of Old NET Power or owned by any subsidiary of Old NET Power immediately prior to the Effective Time) were canceled and converted into the right to receive an aggregate of 137,192,563 Opco Units and an equivalent number of shares of Class B Common Stock. The Opco LLC Agreement provides each member of Opco (other than the Company) the right to cause the Company to cause Opco to redeem all or a portion of such member’s Class A units of Opco in exchange for an equal number of shares of Class A Common Stock or, at the Company’s election under certain circumstances set forth therein, cash, in each case, subject to certain restrictions set forth therein. Upon redemption of any Opco Units, an equal number of shares of Class B Common Stock held by the redeeming member of Opco shall be canceled.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors,” that represent challenges that we face in connection with the successful implementation of our strategy and the growth of our business. In particular, the following risks, among others, may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decline in the price of the Class A Common Stock or Warrants and result in a loss of all or a portion of your investment:

• Old NET Power has incurred significant losses since inception, and we anticipate that we will continue to incur losses in the future, and we may not be able to achieve or maintain profitability.

• We may be unable to manage our future growth effectively.

• We face significant barriers in our attempts to deploy our technology and may not be able to successfully develop our technology.

• The technology we are developing will rely on complex machinery for its operation, and deployment involves a significant degree of risk and uncertainty in terms of operational performance and costs.

• Our deployment plans rely on the development and supply of turbomachinery and process equipment by NPI pursuant to a joint development agreement.

• Our commercialization strategy relies heavily on our relationship with Baker Hughes, Occidental Petroleum Corporation (“Occidental”) and other strategic investors and partners, who may have interests that diverge from ours and who may not be easily replaced if our relationships terminate.

3

• Our partners have not yet completed development of, and finalized schedules for, delivery of key process equipment to customers, and any setbacks we may experience during our first commercial delivery planned for 2026 and other demonstration and commercial missions could have material adverse effects on our business, financial condition and results of operations and could harm our reputation.

• Manufacturing and transportation of key equipment may be dependent on open global supply chains.

• Manufacturing and construction issues not identified prior to design finalization, long-lead procurement and/or module fabrication could potentially be realized during production, fabrication or construction and may impact plant deployment cost and schedule.

• Our test facility has not yet overcome all power loads to provide net positive power delivery to the commercial grid during its operation.

• We may encounter difficulty in attracting licensees prior to the deployment of an initial full-scale commercial plant.

• We expect a consortium led by NET Power to undertake the first commercial plant deployment to establish our technology. Such a deployment will require significant capital expenditure.

• Our future growth and success depend on our ability to license to customers and their ability to secure suitable sites. We have not yet entered into a binding contract with a customer to license the NET Power Cycle, and we may not be able to do so.

• Conflicts of interest may arise because several directors on the Board are designated by the Principal Legacy NET Power Holders and Sponsor.

• The energy market continues to evolve and is highly competitive. The development and adoption of competing technology could materially and adversely affect our ability to license our technology.

• The market for power plants implementing the NET Power Cycle is not yet established and may not achieve the growth potential we expect and may grow more slowly than we expect.

• There is limited infrastructure to efficiently transport and store carbon dioxide, which may limit deployment of the NET Power Cycle.

• The cost of electricity generated from NET Power Cycle may not be cost competitive with other electricity generation sources in some markets.

• Our business relies on the deployment of power plants that are subject to a wide variety of extensive and evolving government laws and regulations, including environmental laws and regulations.

• We and our potential licensees may encounter substantial delays in the design, manufacture, regulatory approval and launch of power plants. Regulatory approvals and permits may also be denied.

• Any potential changes or reductions in available government incentives promoting greenhouse gas emissions projects, such as the Inflation Reduction Act of 2022’s financial assistance program funding installation of zero-emission technology, may adversely affect our ability to grow our business.

• We are developing NET Power-owned intellectual property, but we rely heavily on the intellectual property we have in-licensed and which is core to the NET Power Cycle. The ability to protect these patents, patent applications and other proprietary rights may be challenged or may be faced with our inability or failure to obtain, maintain, protect, defend and enforce.

• We may lose our rights to some or all of the core intellectual property that is in-licensed by way of either the licensor not paying renewal fees or maintenance fees, or by way of third parties challenging the validity of the intellectual property, thereby resulting in competitors easily entering into the same market and decreasing the revenue that we receive from our customers.

4

• Our patent applications may not result in issued patents and our patent rights may be contested, circumvented, invalidated or limited in scope, any of which could have a material adverse effect on our ability to prevent others from interfering with commercialization of our technology.

• The trading price of the Class A Common Stock and Warrants may be volatile.

• Concentration of ownership among the Principal Legacy NET Power Holders may prevent new investors from influencing significant corporate decisions.

• We will incur significant increased costs to implement an effective system of internal controls as a result of operating as a public company as compared to Old NET Power, and our management will be required to devote substantial time to public company compliance initiatives.

• Pursuant to the Tax Receivable Agreement, NET Power will be required to pay to certain Opco Unitholders 75% of the tax savings that NET Power realizes as a result of increases in tax basis in Opco’s assets resulting from the future exchange of Opco Units for shares of Class A Common Stock (or cash) pursuant to the Opco LLC Agreement, as well as certain other tax benefits, including tax benefits attributable to payments under the Tax Receivable Agreement, and those payments may be substantial. In certain cases, payments under the Tax Receivable Agreement may exceed the actual tax benefits we realize or may be accelerated.

• We are a holding company and our only material asset is our interest in Opco, and we are accordingly dependent upon distributions made by Opco and its subsidiaries to pay taxes, make payments under the Tax Receivable Agreement and pay dividends (it being understood that we do not anticipate paying any cash dividends on the Class A Common Stock in the foreseeable future).

Corporate Information

On June 8, 2023, we completed the Business Combination, pursuant to which we were renamed “NET Power Inc.” As of the open of trading on June 9, 2023, the Class A Common Stock and Public Warrants of NET Power, formerly those of RONI, began trading on the NYSE as “NPWR” and “NPWR WS,” respectively.

Our principal executive offices are located at 404 Hunt Street, Suite 410, Durham, North Carolina, and our telephone number at that location is (919) 287-4750. Our website address is https://www.ir.netpower.com. Information contained on our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

Emerging Growth Company and Smaller Reporting Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

Further, Section 102(b) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act are required to comply with the new or revised financial accounting standards). The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or

5

revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible because of the potential differences in accounting standards used.

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year (a) following the fifth anniversary of the IPO, which occurred on June 18, 2021, (b) in which we have total annual gross revenue of at least $1.235 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, and (ii) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (i) the market value of our common equity held by non-affiliates exceeds $250 million as of the last business day of the most recently completed second fiscal quarter or (ii) the market value of our common equity held by non-affiliates exceeds $700 million as of the last business day of the most recently completed second fiscal quarter and our annual revenue in the most recent fiscal year completed before the last business day of such second fiscal quarter exceeded $100 million. To the extent we take advantage of such reduced disclosure obligations, it may make comparison of our financial statements with other public companies difficult or impossible.

6

THE OFFERING

We are registering the resale by the Selling Securityholders of (i) up to 201,480,913 shares of Class A Common Stock (which includes up to 10,900,000 shares of Class A Common Stock issuable upon the exercise of the Private Placement Warrants and 136,533,418 shares of Class A Common Stock issuable upon redemption of the Opco Units) and (ii) up to 10,900,000 Private Placement Warrants. The shares of Class A Common Stock and the Private Placement Warrants that may be sold by the Selling Securityholders are collectively referred to in this prospectus as the “Offered Securities.”

Any investment in the Offered Securities is speculative and involves a high degree of risk. You should carefully consider the information set forth under the section titled “Risk Factors” in this prospectus.

|

Shares of Class A Common Stock offered by the Selling Securityholders |

|

|

|

Warrants offered by the Selling Securityholders |

|

|

|

Use of proceeds |

We will not receive any proceeds from the sale of the Class A Common Stock and Private Placement Warrants to be offered by the Selling Securityholders. With respect to shares of Class A Common Stock underlying the Private Placement Warrants, we will not receive any proceeds from such shares except with respect to amounts received by us upon exercise of such Private Placement Warrants to the extent such Private Placement Warrants are exercised for cash. |

|

|

Lock-up agreements |

Certain of our stockholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods. See “Securities Act Restrictions on Resale of Securities — Lock-up Agreements” for further discussion. |

|

|

NYSE ticker symbols |

“NPWR” and “NPWR WS” for the Class A Common Stock and Public Warrants, respectively. |

7

RISK FACTORS

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks set forth herein. If any of these risks actually occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment. Additionally, the risks and uncertainties described in this prospectus, any prospectus supplement or in any document incorporated by reference herein or therein are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

Risks Related to Our Business and Our Industry

Old NET Power has incurred significant losses since inception, we anticipate that we will continue to incur losses in the future, and we may not be able to achieve or maintain profitability.

Old NET Power has historically incurred significant losses and experienced negative cash flows since inception, including net losses of $50.0 million and $38.3 million for the years ended December 31, 2022 and 2021, respectively. We have not generated any material revenue, but we have substantial overhead expenses. We do not expect to generate meaningful revenue unless and until we are able to complete our first commercial plant deployment and begin licensing the NET Power Cycle and we may not be able to accomplish either of these milestones on our anticipated timetable, if at all. We have not yet commercialized the NET Power Cycle and may never do so successfully, and, as a result, it is difficult for us to predict our future operating results. Our losses may be larger than anticipated, and we may not achieve profitability according to our expected timeline or at all; even if we do, we may not be able to maintain or increase profitability.

We expect our operating expenses to increase over the next several years as we begin to commercialize the NET Power Cycle, continue to refine and streamline our technology, make technical improvements, hire additional employees and continue research and development efforts relating to new products and technologies. These efforts may be more costly than we expect and may not result in increased revenue, profits or growth in our business. Any failure to increase our revenue sufficiently to keep pace with our expenses could prevent us from achieving or maintaining profitability or positive cash flow. Furthermore, if our future growth and operating performance fail to meet investor or analyst expectations, or if we have future negative cash flow or losses resulting from our investment in acquiring customers or expanding our operations, this could have a material adverse effect on our business and financial condition.

We may be unable to manage our future growth effectively, and such inability could make it difficult to execute our business strategy.

If our operations grow as planned, we may need to expand our sales and marketing, research and development and supply and manufacturing functions, and there is no guarantee that we will be able to scale the business and the sale of licenses as planned. We have relied heavily on key partnerships to date, and there is no guarantee that we will be able to maintain these relationships or find additional suitable partners in the future, and as such we may have difficulty commercializing our technology or broadening our internal capabilities.

Any failure to effectively incorporate updates to the design, construction and operations of power plants using the NET Power Cycle to ensure cost competitiveness could reduce the marketability of the NET Power Cycle and has the potential to impact deployment schedules. Updating the design, construction and operations of such power plants will be necessary to ensure their competitiveness and attractiveness in the market, particularly in the United States, where the price of power is generally lower than in other countries. If we are not able to achieve and maintain cost competitiveness in the United States or elsewhere, our business could be materially and adversely affected.

Our continued growth could increase the strain on our resources, and we could experience operating difficulties, including difficulties in hiring, training and managing an increasing number of employees and delays in production and launches. These difficulties may result in the erosion of our brand image, divert the attention of management and key employees and impact financial and operational results. If we are unable to drive

8

commensurate growth, these costs, which include lease commitments, headcount and capital assets, could result in decreased margins, which could have a material adverse effect on our business, financial condition and results of operations.

We face significant barriers in our attempts to deploy our technology and may not be able to successfully develop our technology. If we cannot successfully overcome those barriers, it could adversely impact our business and operations.

The technology behind the NET Power Cycle is very complex, and, while we successfully achieved grid synchronization with our test facility, we have not yet built any commercial facilities and may face significant barriers in continuing to operate our test facility, developing and commercializing Serial Number 1 and developing and commercializing subsequent facilities. The NET Power Cycle has yet to be integrated with a combustion system and turbine operating coincidentally at target temperature and pressure. We are reliant on NPI to successfully deliver a turbo expander that can meet these conditions to support commercial initiatives. Furthermore, project execution risks associated with deployment of a nascent technology include, but are not limited to, supply chain management, schedule compliance, general engineering, procurement, and construction (“EPC”) competence, commissioning and startup tuning. If we are unable to successfully develop our technology, this would materially adversely affect our business and we may be forced to cease operations.

The technology we are developing will rely on complex machinery for its operation, and deployment involves a significant degree of risk and uncertainty in terms of operational performance and costs.

The NET Power Cycle relies heavily on complex machinery and involves a significant degree of uncertainty and risk in terms of operational performance and costs. Our test facility consists, and our future NET Power plants are expected to consist, of large-scale machinery combining many components. These manufacturing plant components are likely to suffer unexpected malfunctions from time to time and will depend on repairs and spare parts to resume operations, and such repairs and spare parts may not be available when needed. If there are delays in the development and manufacturing of our technology by our partners or third-party suppliers, it may adversely impact our business and financial condition.

Unexpected malfunctions of the plant components may significantly affect our intended operational efficiency. Operational performance and costs can be difficult to predict and are often influenced by factors outside of our control, such as, but not limited to, scarcity of natural resources, supply chain issues, environmental hazards and remediation, costs associated with decommissioning of machines, labor disputes and strikes, difficulty or delays in obtaining governmental permits, damages or defects in electronic systems, industrial accidents, pandemics, war, fire, seismic activity and natural disasters. Should operational risks materialize, it may result in the personal injury to or death of workers, the loss of production equipment, damage to manufacturing facilities, monetary losses, delays and unanticipated fluctuations in production, environmental damage, administrative fines, increased insurance costs and potential legal liabilities, all which could have a material and adverse effect on our business, results of operations, cash flows, financial condition or prospects.

If we, our partners or our third-party suppliers experience any delays in the development and manufacturing of turbo expanders, heat exchangers and other implementing technology, our business and financial condition may be adversely impacted.

We have previously experienced, and it is possible that we may experience in the future, delays and other complications from our partners and third-party suppliers in the development and manufacturing of turbo expanders, heat exchangers and other implementing technology required for deploying the NET Power Cycle. We have in the past faced a number of delays relating to the NET Power Cycle; for example, we had to obtain a redesigned rotor following synchronization, our recuperative heat exchanger train underwent modifications to meet welding specifications necessary for improved strength associated with nickel material portions and we changed sealing materials compatible with the plant process chemistry for the remaining balance of the plant associated with compressors and pumps. Any disruption or delay in the development or supply of such components and technology could result in the delay or other complication in the design, manufacture, production and delivery of our technology that could prevent us from commercializing the NET Power Cycle according to our planned timeline and scale. If

9

delays like this recur, if our remediation measures and process changes do not continue to be successful or if we experience issues with planned manufacturing activities, supply of components from third parties or design and safety, we could experience issues or delays in commencing or sustaining our commercial operations.

If we encounter difficulties in scaling our production and delivery capabilities, if we fail to develop and successfully commercialize our technologies, if we fail to develop such technologies before our competitors or if such technologies fail to perform as expected, are inferior to those of our competitors or are perceived as less safe than those of our competitors, our business, reputation and financial condition could be materially and adversely impacted.

We, our licensees or our partners may not be able to establish supply relationships for necessary components or may be required to pay costs for components that are higher than anticipated, and such inability or increased costs could delay the deployment of our technology and negatively impact our business.

We, our licensees and our partners rely on third-party suppliers for components and materials used to develop, and eventually commercialize, the NET Power Cycle. Any disruption or delay in the supply of components or materials by our key third-party suppliers or pricing volatility of such components or materials could temporarily disrupt production of our components or materials until an alternative supplier is able to supply the required material. In such circumstances, we may experience prolonged delays, which may materially and adversely affect our results of operations, financial condition and prospects.

We may not be able to control fluctuation in the prices for these materials or negotiate agreements with suppliers on terms that are beneficial to us. Our business depends on the continued supply to us and to our licensees of certain proprietary materials. We are exposed to multiple risks relating to the availability and pricing of such materials and components. Substantial increases in the prices for our raw materials or components would increase our operating costs and the operating costs of our licensees, either of which could materially impact our financial condition.

Currency fluctuations, inflation, trade barriers, extreme weather, pandemics, war, tariffs or shortages and other general economic or political conditions may limit our ability or our licensees’ ability to obtain key components or significantly increase freight charges, raw material costs and other expenses associated with our business and our licensees’ business, and such increased costs could materially and adversely affect our results of operations, financial condition and prospects.

Our deployment plans rely on the development and supply of turbomachinery and process equipment by NPI pursuant to a joint development agreement. We and NPI may not be able to commercialize technology developed under our joint development relationship. If NPI fails to commercialize such equipment, or such equipment fails to perform as expected, our ability to develop, market and license our technology could be harmed.

In February 2022, we entered into a strategic exclusive partnership with NPI pursuant to the Original JDA, which was amended and restated by the Amended and Restated JDA on December 13, 2022, pursuant to which NPI is developing sCO2 turbo expanders for use in facilities implementing the NET Power Cycle. These turbo expanders are intended to be compatible with our existing technology, and as such, they are highly specialized and difficult to design. We expect these turbo expanders, as well as other critical technology such as our heat exchangers, to be vital to the success of Serial Number 1, other future commercial-scale facilities and our licensing operations, and as such, any delay in their development or manufacture would likely adversely impact our business and financial condition.

There can be no assurance that we will be able to maintain or further our relationship with NPI and/or that NPI will be successful in developing a turbo expander that successfully integrates with our other technology. Our relationship with NPI is subject to various risks that could adversely affect the value of our investments and our results of operations. These risks include the following:

• our interests may diverge from those of NPI, or we may not be able to agree with them on ongoing development, manufacturing and operational activities, or on the amount, timing or nature of further investments in our joint development;

• our control over NPI’s operations is limited;

10

• the terms of our arrangement under the Amended and Restated JDA with NPI may turn out to be unfavorable to us;

• provisions of the joint development agreement could give rise to disputes regarding the rights and obligations of the parties, potentially leading to termination of the agreement, delays in development or commercialization of the turbo expander, or litigation or arbitration; or

• changes in tax, legal or regulatory requirements may necessitate changes to our arrangement under the joint development agreement.

If our strategic relationship with NPI is ultimately unsuccessful or less successful than anticipated, our business, results of operations or financial condition may be materially adversely affected. Any such lack of success could also reduce our ability to secure collaboration agreements in the future or impair our relationships with other existing collaborators.

Our commercialization strategy relies heavily on our relationship with Baker Hughes, Occidental and other strategic investors and partners, who may have interests that diverge from ours and who may not be easily replaced if our relationships terminate, and any such divergent interests or inability to replace could adversely impact our business and financial condition.

We are, and for a period of time will be, substantially reliant on our relationship with Baker Hughes, Occidental and other strategic investors and strategic partners to develop and commercialize the NET Power Cycle. We are also reliant on our license agreement with 8 Rivers for the in-license of the core technology of the NET Power Cycle. For a fulsome discussion of such partnerships, see the section titled “Business — Partnerships.” Our strategic partners may have interests that diverge from our interests, and that may hinder our ability to license our technology to customers. If we lose our agreements with strategic partners, we may need to find new contractors who may have less experience designing and building power plants and complex machinery. We may also need to locate alternative sources of intellectual property rights enabling us to carry out our operations and to avoid infringing previously licensed intellectual property, and we may be unsuccessful in securing such new licenses or unsuccessful in finding suitable alternatives that would not infringe previously licensed intellectual property. The loss of any such relationships, if not adequately replaced, could substantially hinder or prevent our ability to commercialize our technology and adversely affect our business, financial condition and future prospects.

Our partners have not yet completed development of and finalized schedules for delivery of key process equipment to customers, and any setbacks we may experience during our first commercial delivery planned for 2026 and other demonstration and commercial missions could have material adverse effects on our business, financial condition and results of operations and could harm our reputation.

The success of our business will depend on our ability to successfully license our technology to customers on-time and on-budget at guaranteed performance levels, and such success would tend to establish greater confidence in our subsequent customers. Our partners have not yet completed development of and finalized schedules for delivery of key process equipment, including turbo expanders, sCO2 combustors, primary recuperative heat exchangers, air separation units and other long-lead items and lessons learned integrated products, to customers. There is no guarantee that our planned commercialization efforts will be successful. There can be no assurance that we will not experience operational or process failures and other problems during our first commercial deployments. Any failures or setbacks, particularly on our first commercial ventures, could harm our reputation and have a material adverse effect on our business and financial condition.

Any actual or perceived safety or reliability issues may result in significant reputational harm to our businesses, in addition to tort liability and other costs that may arise. Such issues could result in delaying or cancelling planned licenses, increased regulation or other systemic consequences. Our inability to meet our safety standards or adverse publicity affecting our reputation as a result of accidents or mechanical failures could have a material adverse effect on our business and financial condition.

11

Lack of availability or increased costs of component raw materials may affect manufacturing processes for plant equipment and increase our overall costs or those of our licensees.

Recent global supply chain disruptions have increasingly affected both the availability and cost of raw materials, component manufacturing and deliveries. While these disruptions have not affected our business in a materially adverse way yet, such disruptions may, in the future, result in delays in equipment deliveries and cost escalations that could adversely affect our business.

Our processes are reliant on certain supply, including natural gas, and the profitability of our processes will be dependent on the price of such supply. The increased cost of natural gas and other raw materials, in isolation or relative to other energy sources, may adversely affect the potential profitability and cost effectiveness of our processes.

We intend to license the NET Power Cycle for the generation of electrical power using natural gas. Accordingly, the prices we eventually receive for our licenses will likely be tied to the prevailing market prices of natural gas. Historically, the price of natural gas has been volatile, and this volatility may continue to increase in the future. Factors that may cause volatility in the prices of natural gas include, among others, (i) changes in supply and availability of natural gas; (ii) governmental regulations; (iii) inventory levels; (iv) consumer demand; (v) price and availability of alternatives; (vi) weather conditions; (vii) negative publicity about natural gas; (viii) production or transportation techniques and methods; (ix) macro-economic environment and political conditions, including the conflict between Ukraine and Russia; (x) transportation costs and (xi) the price of foreign imports. We expect that natural gas prices will remain volatile for the near future because of these and other factors. High natural gas prices in isolation or relative to other energy sources are likely to adversely affect the demand for the NET Power Cycle and our potential profitability and cost effectiveness. The prices we receive for our licenses depend on numerous factors beyond our control, including, but not limited to, the following:

• changes in global supply of, and demand for, natural gas;

• worldwide and regional economic conditions impacting the global supply and demand for natural gas;

• social unrest, political instability or armed conflict in major natural gas producing regions outside the United States, such as the conflict between Ukraine and Russia, and acts of terrorism or sabotage;

• the ability and willingness of the Organization of the Petroleum Exporting Countries and allied producers (known as OPEC+) to agree and maintain oil price and production controls;

• the price and quantity of imports of foreign natural gas;

• governmental, scientific, and public concern over the threat of climate change arising from greenhouse gas emissions;

• the level of global natural gas exploration and production;

• the level of global natural gas inventories;

• localized supply and demand fundamentals of regional, domestic and international transportation availability;

• weather conditions, natural disasters and seasonal trends;

• domestic and foreign governmental regulations, including embargoes, sanctions, tariffs and environmental regulations;

• speculation as to the future price of natural gas and the speculative trading of natural gas futures contracts;

• technological advances affecting energy consumption;

• increasing attention to environmental, social and governance (“ESG”) matters; and

• the price, availability and use of alternative fuels and energy sources.

12

While Russia’s invasion of Ukraine and its contribution to the volatility in the price of natural gas could impact demand for the NET Power Cycle, we have not yet been affected by such volatility in a materially adverse manner.

Manufacturing and transportation of key equipment may be dependent on open global supply chains. Supply chain issues could negatively impact deployment schedules.