EX-10.2

Published on August 12, 2024

Exhibit 10.2

NET POWER INC.

2023 OMNIBUS INCENTIVE PLAN

PERFORMANCE STOCK UNIT GRANT NOTICE

Pursuant to the terms and conditions of the NET Power Inc. 2023 Omnibus Incentive Plan, as amended from time to time (the “Plan”), NET Power Inc., a Delaware corporation (the “Company”), hereby grants to the individual listed below (“you” or the “Participant”) the number of performance stock units (the “PSUs”) set forth below. This award of PSUs (this “Award”) is subject to the terms and conditions set forth herein and in the Performance Stock Unit Agreement attached hereto as Exhibit A (the “Agreement”), the restrictive covenants (the “Restrictive Covenants”) set forth in the Company’s Amended & Restated Executive Severance Plan (the “Executive Severance Plan”) and the Plan, each of which is incorporated herein by reference. Capitalized terms used but not defined herein shall have the meanings set forth in the Plan.

| Type of Award: | Performance Stock Units | ||||

| Participant: | |||||

| Date of Grant: | |||||

| Target Number of PSUs: | |||||

| Performance Period: |

The three-year period commencing April 2, 2024, and ending April 2, 2027 (the “Performance Period”).

|

||||

Vesting:

|

Subject to Section 2 of the Agreement, the Plan and the other terms and conditions set forth herein, the PSUs shall vest, if at all, based on achievement of the performance vesting conditions set forth on Exhibit B during the Performance Period, subject to your continued employment by, or provision of services to, the Company or an Affiliate thereof from the Date of Grant through the Certification Date (as defined on Exhibit B). The percentage of the Target PSUs actually earned during the Performance Period are referred to herein as the “Earned PSUs”.

|

||||

| Settlement: |

The Earned PSUs shall be settled in Shares in accordance with Section 4 of the Agreement.

|

||||

By your signature below, you agree to be bound by the terms and conditions of the Plan, the Agreement and this Performance Stock Unit Grant Notice (this “Grant Notice”). You acknowledge that you have reviewed the Agreement, the Plan and this Grant Notice in their entirety and fully understand all provisions of the Agreement, the Plan and this Grant Notice, and have had an opportunity to obtain the advice of counsel prior to executing this Grant Notice. You hereby agree to accept as binding, conclusive and final all decisions or interpretations of the Committee regarding any questions or determinations arising under the Agreement, the Plan or this Grant Notice. This Grant Notice may be executed in one or more counterparts (including portable document format (.pdf) and facsimile counterparts), each of which shall be deemed to be an original, but all of which together shall constitute one and the same agreement.

Notwithstanding any provision of this Grant Notice or the Agreement, if you have not executed and delivered to the Company this Grant Notice within 90 days following the Date of Grant set forth above, then this Award will terminate automatically without any further action by the Company and will be forfeited without further notice and at no cost to the Company.

[Signature Page Follows]

2

IN WITNESS WHEREOF, the Company has caused this Grant Notice to be executed by an officer thereunto duly authorized, and the Participant has executed this Grant Notice, effective for all purposes as provided above.

NET POWER INC.

By:

Name: Danny Rice

Title: Chief Executive Officer

PARTICIPANT

Name:

Signature Page to

Performance Stock Unit Grant Notice

EXHIBIT A

PERFORMANCE STOCK UNIT AGREEMENT

This Performance Stock Unit Agreement (together with the Grant Notice to which this Agreement is attached, this “Agreement”) is made as of the Date of Grant set forth in the Grant Notice to which this Agreement is attached by and between NET Power Inc., a Delaware corporation (the “Company”), and #ParticipantName# (the “Participant”). Capitalized terms used but not specifically defined herein shall have the meanings specified in the Plan or the Grant Notice.

1.Award. In consideration of the Participant’s past and/or continued employment with, or service to, the Company or an Affiliate and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, effective as of the Date of Grant set forth in the Grant Notice (the “Date of Grant”), the Company hereby grants to the Participant the number of PSUs set forth in the Grant Notice on the terms and conditions set forth in the Grant Notice, this Agreement and the Plan, which is incorporated herein by reference as a part of this Agreement. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan shall control. To the extent vested, each PSU represents the right to receive one Share, subject to the terms and conditions set forth in the Grant Notice, this Agreement and the Plan; provided, however, that, depending on the level of performance determined to be attained with respect to the Performance Goal (as set forth on Exhibit B) for the Performance Period, the portion of the Target PSUs that may vest and become the Earned PSUs hereunder may range from 0% to 200% of the Target PSUs. Unless and until the Target PSUs have become vested and become Earned PSUs in the manner set forth in the Grant Notice, the Participant will have no right to receive any Shares or other payments in respect of the PSUs. Prior to settlement of this Award, the PSUs and this Award represent an unsecured obligation of the Company, payable only from the general assets of the Company.

2.Vesting of PSUs.

(a)Except as otherwise provided in this Section 2, the Target PSUs shall vest, if at all, and become the Earned PSUs in accordance with the vesting schedule set forth in the Grant Notice. Upon the Participant’s Termination of Service prior to the Certification Date (but after giving effect to any accelerated vesting pursuant to this Section 2), any unvested PSUs (and all rights arising from such PSUs and from being a holder thereof) will terminate automatically without any further action by the Company and will be forfeited without further notice and at no cost to the Company.

(b)Notwithstanding anything in the Grant Notice, this Agreement or the Plan to the contrary, subject to Section 10:

(i)Upon the Participant’s Termination of Service due to the Participant’s death or Disability, all PSUs, if any, that remain unvested shall immediately vest at the target level of performance as of the date of such Termination of Service;

B-1

(ii)upon the Participant’s Termination of Service without Cause or for Good Reason (each as defined in the Executive Severance Plan), a pro-rated portion of the outstanding and unvested PSUs shall vest based on the actual performance achieved by the Company during the Performance Period, with such portion determined by multiplying the number of such PSUs by a fraction, (A) the numerator of which equals the number of calendar days that the Participant was employed by, or providing services to, the Company between Date of Grant and the date of the Participant’s Termination of Service and (B) the denominator of which equals the number of calendar days in the Performance Period; and

(iii)upon a Change in Control (as defined in the Executive Severance Plan), (A) to the extent the PSUs are not assumed by the surviving entity in connection with such Change in Control, all PSUs, if any, that remain unvested shall immediately become vested as of the date of such Change in Control in an amount equal to the greater of (1) the Target PSUs or (2) the number of PSUs based on the actual performance achieved by the Company on the date immediately preceding the date of the Change in Control; and (B) to the extent the PSUs are assumed by the surviving entity in connection with such Change in Control, upon the Participant’s Termination of Service by the Company or an Affiliate without Cause during the Change in Control Protection Period (as defined below), all PSUs, if any, that remain unvested shall immediately become vested as of the date of such Termination of Service in an amount equal to the greater of (1) the Target PSUs or (2) the number of PSUs based on the actual performance achieved by the Company on the date immediately preceding the date of the Change in Control. As used herein, the “Change in Control Protection Period” means, with respect to a Change in Control, the period commencing on the date that is three months prior to the date on which such Change in Control is consummated and ending on the date that is 24 months after the date on which such Change in Control is consummated.

3.Dividend Equivalent Rights. The Participant is hereby granted dividend equivalent rights with respect to each PSU. In the event that the Company declares and pays a regular cash dividend in respect of its outstanding Shares (which, for clarity, does not include any extraordinary cash dividend) and, on the record date for such dividend, the Participant holds PSUs granted pursuant to this Agreement that have not been settled, the Company shall record the amount of such dividend (a “Subject Dividend”) in a bookkeeping account. Within 60 days after the date on which a PSU becomes an Earned PSU, the Company will pay the Participant an amount equal to (a) the aggregate value of the Subject Dividends, multiplied by (b) the number of PSUs that become vested on such date under this Agreement. For clarity, if any of the PSUs are forfeited by the Participant pursuant to the terms of this Agreement, then the Participant shall also forfeit all Dividend Equivalent Rights with respect to such forfeited PSUs. No interest will accrue on the Dividend Equivalent Rights between the declaration and payment of the applicable dividends and the settlement of the Dividend Equivalent Rights.

4.Settlement of PSUs. Subject to Section 6, any PSUs that become the Earned PSUs at the conclusion of the Performance Period shall be settled into an equal number of Shares on a date selected by the Company that is on or within 60 days following the Certification Date (such selected date, the “Settlement Date”); provided, however, that, in the case of accelerated vesting of PSUs pursuant to Section 2(b), the Settlement Date shall occur on a date selected by

A-2

the Company that is within 60 days following the accelerated vesting of such Earned PSUs. All Shares issued hereunder shall be delivered either by delivering one or more certificates for such shares to the Participant or by entering such shares in book-entry form, as determined by the Committee in its sole discretion. The value of Shares shall not bear any interest owing to the passage of time. Neither this Section 4 nor any action taken pursuant to or in accordance with this Agreement shall be construed to create a trust or a funded or secured obligation of any kind.

5.Restrictive Covenants.

The Participant acknowledges and agrees that the grant of the PSUs further aligns the Participant’s interests with the Company’s long-term business interests, and as a condition to the Company’s willingness to enter into this Agreement, the Participant agrees to abide by the Restrictive Covenants, which are deemed to be part of this Agreement as if fully set forth herein. The Participant acknowledges and agrees that the Restrictive Covenants are reasonable and enforceable in all respects. By accepting this Award, the Participant agrees to be bound, and promises to abide, by the terms of the Restrictive Covenants and expressly acknowledges and affirms that this Award would not be granted to the Participant if the Participant had not agreed to be bound by such Restrictive Covenants.

(a)Notwithstanding any provision in this Agreement or the Plan to the contrary, in the event the Committee determines that the Participant has failed to abide by any of the terms of the Restrictive Covenants or the provisions of any other confidentiality, non-disclosure, non-competition, non-solicitation, non-disparagement or other restrictive covenants in any other agreement by and between the Company or any Affiliate and the Participant, then, in addition to and without limiting the remedies set forth in the Executive Severance Plan:

(i)all PSUs that have not been settled as of the date of such determination (and all rights arising from such PSUs and from being a holder thereof) will terminate automatically without any further action by the Company and will be forfeited without further notice and at no cost to the Company; and

(ii)the Participant shall, within 30 days following the Participant’s receipt of a written notice from the Company, pay to the Company a cash amount equal to the Fair Market Value of any Shares previously received by the Participant pursuant to the settlement of the PSUs as of the date of receipt of such Shares.

6.Tax Withholding. To the extent that the receipt, vesting or settlement of this Award results in compensation income or wages to the Participant for federal, state, local and/or foreign tax purposes, the Participant shall make arrangements satisfactory to the Company regarding the payment of any income tax, social insurance contribution or other applicable taxes that are required to be withheld in respect of this Award, which arrangements include the delivery of cash or cash equivalents, Shares (including previously owned Shares (which are not subject to any pledge or other security interest), net settlement, a broker-assisted sale, or other cashless withholding or reduction of the amount of shares otherwise issuable or delivered pursuant to this Award), other property, or any other legal consideration the Committee deems appropriate. If such tax obligations are satisfied through net settlement or the surrender of

A-3

previously owned Shares, the maximum number of Shares that may be so withheld (or surrendered) shall be the number of Shares that have an aggregate Fair Market Value on the date of withholding or surrender equal to the aggregate amount of such tax liabilities determined based on the greatest withholding rates for federal, state, local and/or foreign tax purposes, including payroll taxes, that may be utilized without creating adverse accounting treatment for the Company with respect to this Award, as determined by the Committee. Any fraction of a Share required to satisfy such tax obligations shall be disregarded and the amount due shall be paid instead in cash to the Participant. The Participant acknowledges that there may be adverse tax consequences upon the receipt, vesting or settlement of this Award or disposition of the underlying shares and that the Participant has been advised, and hereby is advised, to consult a tax advisor. The Participant represents that the Participant is in no manner relying on the Board, the Committee, the Company or any of their respective managers, directors, officers, employees or authorized representatives (including attorneys, accountants, consultants, bankers, lenders, prospective lenders and financial representatives) for tax advice or an assessment of such tax consequences.

7.Non-Transferability. During the lifetime of the Participant, the PSUs may not be sold, pledged, assigned or transferred in any manner other than by will or the laws of descent and distribution, unless and until the Shares underlying the PSUs have been issued, and all restrictions applicable to such Shares have lapsed. Neither the PSUs nor any interest or right therein shall be liable for the debts, contracts or engagements of the Participant or his or her successors in interest or shall be subject to disposition by transfer, alienation, anticipation, pledge, encumbrance, assignment or any other means, whether such disposition be voluntary or involuntary or by operation of law by judgment, levy, attachment, garnishment or any other legal or equitable proceedings (including bankruptcy), and any attempted disposition thereof shall be null and void and of no effect, except to the extent that such disposition is permitted by the preceding sentence.

8.Compliance with Applicable Law. Notwithstanding any provision of this Agreement to the contrary, the issuance of Shares hereunder will be subject to compliance with all applicable requirements of applicable law with respect to such securities and with the requirements of any stock exchange or market system upon which the Shares may then be listed. No Shares will be issued hereunder if such issuance would constitute a violation of any applicable law or regulation or the requirements of any stock exchange or market system upon which the Shares may then be listed. In addition, Shares will not be issued hereunder unless (a) a registration statement under the Securities Act is in effect at the time of such issuance with respect to the Shares to be issued or (b) in the opinion of legal counsel to the Company, the Shares to be issued are permitted to be issued in accordance with the terms of an applicable exemption from the registration requirements of the Securities Act. The inability of the Company to obtain from any regulatory body having jurisdiction the authority, if any, deemed by the Company’s legal counsel to be necessary for the lawful issuance and sale of any Shares hereunder will relieve the Company of any liability in respect of the failure to issue such shares as to which such requisite authority has not been obtained. As a condition to any issuance of Shares hereunder, the Company may require the Participant to satisfy any requirements that may be necessary or appropriate to evidence compliance with any applicable law or regulation and to

A-4

make any representation or warranty with respect to such compliance as may be requested by the Company.

9.Rights as a Stockholder. The Participant shall have no rights as a stockholder of the Company with respect to any Shares that may become deliverable hereunder unless and until the Participant has become the holder of record of such Shares, and no adjustments shall be made for dividends in cash or other property, distributions or other rights in respect of any such Shares, except as otherwise specifically provided for in the Plan or this Agreement.

10.Execution of Receipts and Releases. Any issuance or transfer of Shares or other property to the Participant or the Participant’s legal representative, heir, legatee or distributee, in accordance with this Agreement shall be in full satisfaction of all claims of such Person hereunder. As a condition precedent to such payment or issuance, the Company may require the Participant or the Participant’s legal representative, heir, legatee or distributee to execute (and not revoke within any time provided to do so) a release and receipt therefor in such form as it shall determine appropriate; provided, however, that any review period under such release will not modify the date of settlement with respect to any Earned PSUs.

11.No Right to Continued Employment, Service or Awards. Neither the adoption of the Plan nor the award of the PSUs hereunder pursuant to the Grant Notice and this Agreement, shall confer upon the Participant the right to continued employment by, or a continued service relationship with, the Company or any Affiliate, or any other entity, or affect in any way the right of the Company or any such Affiliate, or any other entity to terminate such employment or other service relationship at any time. Unless otherwise provided in a written employment agreement or by applicable law, the Participant’s employment by the Company, or any such Affiliate, or any other entity shall be on an at-will basis, and the employment relationship may be terminated at any time by either the Participant or the Company, or any such Affiliate, or other entity for any or no reason whatsoever, with or without Cause or notice. Any question as to whether and when there has been a termination of such employment, and the cause of such termination, shall be determined by the Committee or its delegate, and such determination shall be final, conclusive and binding for all purposes. The grant of the PSUs hereunder is a one-time benefit that was made at the sole discretion of the Company and does not create any contractual or other right to receive any grant of Awards in the future or any benefits in lieu of any Awards in the future, including any adjustment to wages, overtime, benefits or other compensation. Any future Awards will be granted at the sole discretion of the Company.

12.Legal and Equitable Remedies. The Participant acknowledges that a violation or attempted breach of any of the Participant’s covenants and agreements in this Agreement will cause such damage as will be irreparable, the exact amount of which would be difficult to ascertain and for which there will be no adequate remedy at law, and accordingly, the parties hereto agree that the Company and its Affiliates shall be entitled as a matter of right to an injunction issued by any court of competent jurisdiction, restraining the Participant or the affiliates, partners or agents of the Participant from such breach or attempted violation of such covenants and agreements, as well as to recover from the Participant any and all costs and expenses sustained or incurred by the Company or any Affiliate in obtaining such an injunction,

A-5

including reasonable attorneys’ fees. The parties to this Agreement agree that no bond or other security shall be required in connection with such injunction. Any exercise by either of the parties to this Agreement of its rights pursuant to this Section 12 shall be cumulative and in addition to any other remedies to which such party may be entitled.

13.Notices. All notices and other communications under this Agreement shall be in writing and shall be delivered to the parties at the following addresses (or at such other address for a party as shall be specified by like notice):

If to the Company, unless otherwise designated by the Company in a written notice to the Participant (or other holder):

NET Power Inc.

Attn: Legal Department

Attn: Legal Department

320 Roney Street, Suite 200

Durham, North Carolina 27701

If to the Participant, at the Participant’s last known address on file with the Company.

Any notice that is delivered personally or by overnight courier or telecopier in the manner provided herein shall be deemed to have been duly given to the Participant when it is mailed by the Company or, if such notice is not mailed to the Participant, upon receipt by the Participant. Any notice that is addressed and mailed in the manner herein provided shall be conclusively presumed to have been given to the party to whom it is addressed at the close of business, local time of the recipient, on the fourth day after the day it is so placed in the mail.

14.Consent to Electronic Delivery; Electronic Signature. In lieu of receiving documents in paper format, the Participant agrees, to the fullest extent permitted by law, to accept electronic delivery of any documents that the Company may be required to deliver (including, but not limited to, prospectuses, prospectus supplements, grant or award notifications and agreements, account statements, annual and quarterly reports and all other forms of communications) in connection with this and any other Award made or offered by the Company. Electronic delivery may be made via a Company electronic mail system or by reference to a location on a Company intranet to which the Participant has access. The Participant hereby consents to any and all procedures the Company has established or may establish for an electronic signature system for delivery and acceptance of any such documents that the Company may be required to deliver, and agrees that his or her electronic signature is the same as, and shall have the same force and effect as, his or her manual signature.

15.Agreement to Furnish Information. The Participant agrees to furnish to the Company all information requested by the Company to enable it to comply with any reporting or other requirement imposed upon the Company by or under any applicable statute or regulation.

16.Entire Agreement; Amendment. This Agreement constitutes the entire agreement of the parties with regard to the subject matter hereof, and contains all the covenants, promises, representations, warranties and agreements between the parties with respect to the

A-6

PSUs granted hereby; provided¸ however, that (a) the terms of this Agreement shall not modify and shall be subject to the terms and conditions of any employment, consulting and/or severance agreement between the Company (or an Affiliate or other entity) and the Participant in effect as of the date a determination is to be made under this Agreement; and (b) the Restrictive Covenants are in addition to and complement (and do not replace or supersede) all other agreements and obligations between the Company or any Affiliate and the Participant with respect to confidentiality, non-disclosure, non-competition, non-solicitation, non-disparagement and other restrictive covenants. Without limiting the scope of the preceding sentence, except as provided therein, all prior understandings and agreements, if any, among the parties hereto relating to the subject matter hereof are hereby null and void and of no further force or effect. The Committee may, in its sole discretion, amend this Agreement from time to time in any manner that is not inconsistent with the Plan; provided, however, that except as otherwise provided in the Plan or this Agreement, any such amendment that materially reduces the rights of the Participant shall be effective only if it is in writing and signed by both the Participant and an authorized officer of the Company.

17.Severability and Waiver. If a court of competent jurisdiction determines that any provision of this Agreement is invalid or unenforceable, then the invalidity or unenforceability of such provision shall not affect the validity or enforceability of any other provision of this Agreement, and all other provisions shall remain in full force and effect. Waiver by any party of any breach of this Agreement or failure to exercise any right hereunder shall not be deemed to be a waiver of any other breach or right. The failure of any party to take action by reason of such breach or to exercise any such right shall not deprive such party of the right to take action at any time while or after such breach or condition giving rise to such right occurs.

18.Company Recoupment of Awards. The Participant’s rights with respect to this Award shall in all events be subject to (a) any right that the Company may have under any Company recoupment policy, including the Company’s Clawback Policy, as in effect from time to time, or any other agreement or arrangement with the Participant, and (b) any right or obligation that the Company may have regarding the clawback of “incentive-based compensation” under Section 10D of the Exchange Act and any applicable rules and regulations promulgated thereunder from time to time by the U.S. Securities and Exchange Commission or any other Applicable Law.

19.Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware applicable to contracts made and to be performed therein, exclusive of the conflict of laws provisions of Delaware law.

20.Successors and Assigns. The Company may assign any of its rights under this Agreement without the Participant’s consent. This Agreement will be binding upon and inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth herein and in the Plan, this Agreement will be binding upon the Participant and the Participant’s beneficiaries, executors, administrators and the Person(s) to whom the PSUs may be transferred by will or the laws of descent or distribution.

A-7

21.Headings; References; Interpretation. Headings are for convenience only and are not deemed to be part of this Agreement. The words “hereof,” “herein” and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole and not to any particular provision of this Agreement. All references herein to Sections shall, unless the context requires a different construction, be deemed to be references to the Sections of this Agreement. The word “or” as used herein is not exclusive and is deemed to have the meaning “and/or.” All references to “including” shall be construed as meaning “including without limitation.” Unless the context requires otherwise, all references herein to a law, agreement, instrument or other document shall be deemed to refer to such law, agreement, instrument or other document as amended, supplemented, modified and restated from time to time to the extent permitted by the provisions thereof. All references to “dollars” or “$” in this Agreement refer to United States dollars. Whenever the context may require, any pronouns used herein shall include the corresponding masculine, feminine or neuter forms, and the singular form of nouns and pronouns shall include the plural and vice versa. Neither this Agreement nor any uncertainty or ambiguity herein shall be construed or resolved against any party hereto, whether under any rule of construction or otherwise. On the contrary, this Agreement has been reviewed by each of the parties hereto and shall be construed and interpreted according to the ordinary meaning of the words used so as to fairly accomplish the purposes and intentions of the parties hereto.

22.Counterparts. The Grant Notice may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute one instrument. Delivery of an executed counterpart of the Grant Notice by facsimile or portable document format (.pdf) attachment to electronic mail shall be as effective as delivery of a manually executed counterpart of the Grant Notice.

23.Section 409A. This Agreement and the PSUs are intended to comply with, or be exempt from, the applicable requirements of Section 409A of the Code and shall be limited, construed and interpreted in accordance with such intent. Notwithstanding any contrary provision in the Plan or this Agreement, any payment(s) of “nonqualified deferred compensation” (within the meaning of Section 409A of the Code) that are otherwise required to be made under the Plan or this Agreement to a “specified employee” (as defined under Section 409A of the Code) as a result of such employee’s separation from service (other than a payment that is not subject to Section 409A of the Code) shall be delayed for the first six (6) months following such separation from service (or, if earlier, until the date of death of the specified employee) and shall instead be paid (in a manner set forth in this Agreement) upon expiration of such delay period. Notwithstanding the foregoing, neither the Company nor any of its Affiliates makes any representation that the PSUs provided under this Agreement are exempt from, or compliant with, Section 409A of the Code, and in no event shall the Company or any Affiliate be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by the Participant on account of non-compliance with Section 409A of the Code.

[Remainder of Page Intentionally Blank]

A-8

EXHIBIT B

This Exhibit B to the Grant Notice contains the performance requirements and methodology applicable to this Award. Subject to the terms and conditions set forth in the Plan and the Agreement, the portion of the Target PSUs, if any, that become the Earned PSUs, if any, will be determined upon the Committee’s certification of the achievement of the performance criteria in accordance with this Exhibit B, which shall occur as soon as practicable following the end of the Performance Period, but in any event within 60 days following the end of the Performance Period (the “Certification Date”). Capitalized terms used but not defined herein shall have the same meaning as is ascribed thereto in the Grant Notice, the Agreement or the Plan, as applicable.

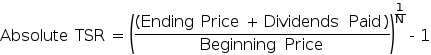

1.Performance Goal. The Performance Goal applicable to this Award shall be the Company’s Absolute TSR (as defined below) during the Performance Period.

2.Determination of Earned PSUs. Subject to the Participant’s continued employment by, or provision of services to, the Company or an Affiliate thereof from the through the Certification Date (except as otherwise provided in Section 2 of the Agreement), the percentage of the Target PSUs that become Earned PSUs will be determined in accordance with table set forth below:

| Performance Level | Absolute TSR (%) |

Earned PSUs

(% of Target PSUs)*

|

||||||

| Maximum | ≥ 15% |

200% | ||||||

| Target | 12% | 100% | ||||||

| Threshold | 10% | 50% | ||||||

| < Threshold | < 10% |

0% | ||||||

*The percentage of the Target PSUs that become the Earned PSUs for performance between the threshold and target achievement levels or between the target and maximum achievement levels will be calculated using linear interpolation. For purposes of clarity, (i) no portion of the Target PSUs will become the Earned PSUs if the Company does not attain at least the threshold level of Absolute TSR for the Performance Period and (ii) in no event shall the number of Earned PSUs exceed 200% of the Target PSUs. Any of the Target PSUs that do not become the Earned PSUs in accordance with the Agreement, including this Exhibit B, and all rights arising from such Target PSUs and from being a holder thereof will terminate automatically on the Certification Date without further action by the Company and will terminate and be forfeited without further notice and at no cost to the Company.

3.Definitions.

“30-Day VWAP” means, as of any date of determination, the volume-weighted average price of one Share, as reported in transactions on the applicable stock exchange or market, during the last 30 consecutive trading days.

B-1

“Absolute TSR” is determined on an annualized basis as follows, the calculation of which shall be adjusted by the Committee to give effect to any stock dividends, stock splits, reverse stock splits and similar transactions:

“Beginning Price” means the Company’s 30-Day VWAP for the period ending on the first day of the Performance Period.

“Dividends Paid” means the total of all cash dividends paid on one Share during the Performance Period.

“Ending Price” means the Company’s 30-Day VWAP for the period ending on the last day of the Performance Period.

“N” means the number of partial and complete calendar years in the Performance Period.

4.Miscellaneous

Consistent with the terms of the Plan, all designations, determinations, interpretations, and other decisions under or with respect to the terms of the Plan or the Agreement, including this Exhibit B, shall be within the sole discretion of the Committee, and shall be final, conclusive, and binding upon all persons.

The Committee may adjust the performance metrics set forth in this Exhibit B to reflect any unusual or non-recurring events and other extraordinary items, impact of charges for restructurings, discontinued operations, and the cumulative effects of accounting or tax changes, each as defined by generally accepted accounting principles or as identified in the Company’s financial statements, notes to the financial statements, management’s discussion and analysis, or other Company public filing.

A-2